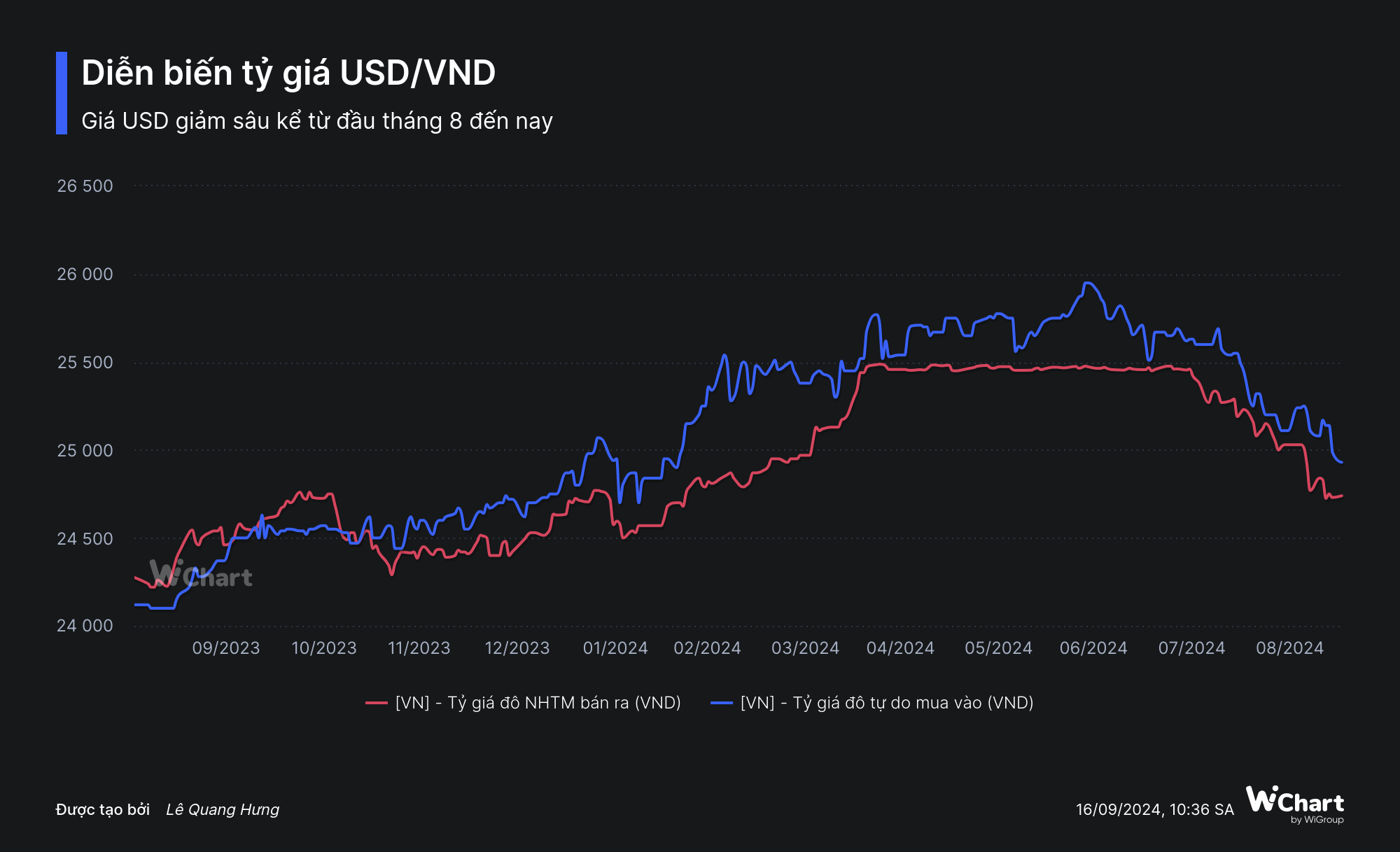

In recent weeks, interbank USD exchange rates, as well as rates quoted at commercial banks and on the black market, have seen a significant drop.

On the interbank market, the USD exchange rate fell to 24,543 VND/USD last week, a decrease of 47 VND compared to the previous week’s closing. This represents a 2.8% decline since the end of July.

USD rates quoted by domestic banks have also been on a downward spiral. As of last week, the selling rate was mostly between 24,730 and 24,750 VND/USD, while the buying rate stood at 24,360–24,400 VND/USD.

Specifically, Vietcombank, the system’s largest foreign currency trader, currently quotes a rate of 24,360 – 24,730 VND/USD. Since the beginning of August, the USD rate at this bank has dropped by approximately 700 VND, equivalent to a 2.7% decrease. This has narrowed the devaluation of the VND against the USD since the beginning of the year to 1.3%, down from a peak of 4.3% in June and July.

On the black market, USD rates are being traded at 24,930 VND/USD for buying and 25,030 VND/USD for selling. Compared to the peak of nearly 26,000 VND in late June, the black market rate is now nearly 1,000 VND lower, equivalent to a 3.8% decrease.

Source: Wichart

As exchange rates cooled down, the State Bank of Vietnam (SBV) implemented a series of accommodative policies. Specifically, the central bank announced that from August 28, credit institutions with a credit growth rate of 80% of the allocated quota for 2024 would be allowed to proactively adjust their credit growth limit based on their ranking.

In the open market operations, the SBV also proactively stopped issuing bills and reduced the interest rate on the refinancing channel (OMO) to 4.25% to support the banking system’s liquidity. This interest rate cut reversed the trend of rate hikes in the first half of 2024, when both OMO and bill rates were increased to 4.5% from 4.0% and 3.9%, respectively, at the beginning of the year.

Following a series of accommodative moves by the SBV and the sharp drop in exchange rates, analysts do not rule out the possibility that the central bank will increase the USD buying rate at the Trading Center to replenish foreign exchange reserves (as in late 2022). Previously, in the second quarter and early third quarter, the SBV sold a large amount of foreign currency (estimated at about $6 billion, equivalent to the amount of foreign currency purchased in 2023) to counter the pressure on exchange rates.

At the online seminar “Data Talk September 2024: Recession, Fed, and Investment Strategies at the 1,300 Threshold” held on September 13 by VietnamBiz and Wigroup, Ms. Nguyen Thi My Lien, Head of Analysis Department of Phu Hung Securities Company, said that in the early months of the year, the SBV was under great pressure as exchange rates continued to rise rapidly.

However, in recent times, the SBV has made moves such as reducing OMO and bill interest rates and stopping bill issuance as soon as the exchange rate cooled down.

“The exchange rate reduction is very positive, enabling the SBV to be more proactive in implementing support policies. However, it cannot be affirmed that the central bank will reduce the policy interest rate when the current deposit interest rate is still low,” said the Head of Analysis of Phu Hung Securities, adding, “The SBV will have to consider the context of the Fed’s interest rate cut this year, which will not be large enough to make VND interest rates more attractive than USD interest rates. Therefore, lowering interest rates may put pressure on the exchange rate.”

Ms. Lien also said that the market expects the SBV to resume buying foreign currency, thereby increasing VND liquidity in the market. Forecasting the next moves, the expert said that the SBV would keep interest rates stable, especially after the Yagi storm.

“In suitable conditions, the SBV may return to buying foreign currency, but the exchange rate needs to drop deep enough. In general, the exchange rate reduction and the possibility of the SBV buying foreign currency again are very positive factors, helping to increase the market’s liquidity,” the expert from Phu Hung Securities said.

In the context of the sharp drop in exchange rates and positive foreign currency supply, VNDirect Securities also believes that the central bank will have more policy space to support the market’s liquidity through the open market operation channel and create conditions to supplement foreign exchange reserves in the last months of this year.

The Great Liquidity Conundrum: Are Investors Fed Up with Stocks or Merely Biding Their Time?

SGI Capital anticipates a challenging landscape for liquidity and cash flow in the coming months, with potential risks amplified by volatile global market conditions. The firm believes that navigating this period will require a nuanced approach to managing finances and mitigating risks effectively. With a keen eye on market dynamics, SGI Capital is poised to help clients weather the storm and emerge resilient.

The Calming Forex Rates and “Breathable” Interest Rates

The U.S. dollar plummeted, prompting the State Bank to purchase this foreign currency to boost its reserves. This strategic move helped to temper the exchange rate and provided more room for interest rate stability on loans, offering a much-needed reprieve to borrowers.