If the supply of shophouses and villas in Ho Chi Minh City remains scarce and prices stay high, Dong Nai and Binh Duong provinces emerge as attractive alternative options. Notably, for two consecutive months (July and August 2024), Dong Nai has taken the lead in terms of primary supply across the entire market adjacent to Ho Chi Minh City.

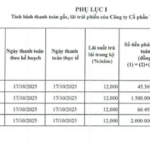

Specifically, in August 2024, there was a slight decrease in the primary supply of Ho Chi Minh City and its four surrounding areas, an 8% drop compared to the previous month. Nearly 40% of this supply was attributed to Dong Nai, with Ho Chi Minh City contributing over 35%.

Data from DKRA Group on shophouses and villas in Ho Chi Minh City and its peripheral areas for August 2024.

According to DKRA Group, most transactions occurred in the price range of below VND 10 billion per unit, with reputable developers in the market ensuring legal compliance and construction progress. Primary price levels remained stable compared to the beginning of the year, and market stimulation policies, as well as financial support, were widely applied by developers to boost liquidity.

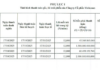

Previously, in July 2024, the supply of new shophouses and villas in Ho Chi Minh City and its peripheral areas witnessed a significant improvement compared to the same period in 2023, an increase of about 14% from the previous month. Dong Nai and Ho Chi Minh City accounted for 85% of the new supply weight, with Dong Nai alone contributing 58% of the total market supply. Ba Ria – Vung Tau province made up the remaining 15%.

Data for July 2024

In July, the market liquidity for shophouses and villas was moderate, with consumption reaching approximately 50% of the new supply for the month, a 17% decrease from the previous month. A slight increase of about 1% was observed in primary price levels compared to the previous launch. Market stimulation policies continued to be implemented to enhance liquidity.

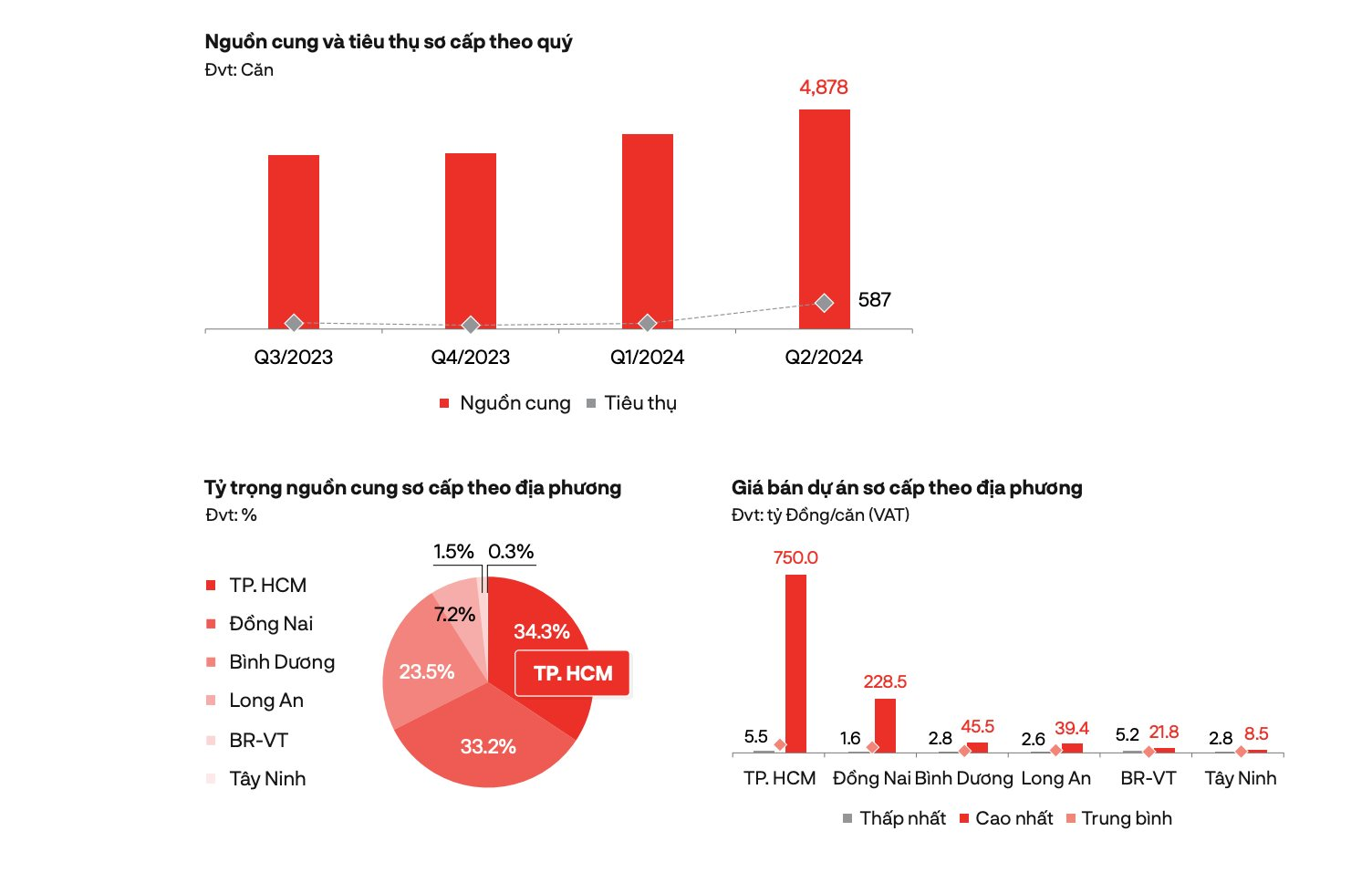

In Q2 2024, DKRA also pointed out that the primary supply of shophouses and villas increased by 12% compared to the previous quarter, mainly distributed in three areas: Ho Chi Minh City, Dong Nai, and Binh Duong, accounting for approximately 91% of the total primary supply in the market.

Data for Q2 2024.

According to DKRA Group, the new supply showed significant improvement, increasing by about 4.3 times compared to the same period last year, and accounting for approximately 13.6% of the primary supply. At the same time, market demand improved, with consumption increasing significantly compared to the previous quarter. Most transactions involved products with completed infrastructure and legal compliance, developed by reputable companies in the market.

Sharing the same perspective on this segment, Ms. Giang Huynh, Director of Research and Consultancy at Savills Vietnam, stated that land prices in Ho Chi Minh City have tripled in the primary market and doubled in the secondary market over the past five years. The high prices have pushed buyers seeking residential purposes to neighboring provinces for more suitable options.

Dong Nai and Binh Duong, in particular, have benefited from improved infrastructure and have become direct competitors to Ho Chi Minh City, offering prices that are 79% lower and a primary supply that is 31% higher.

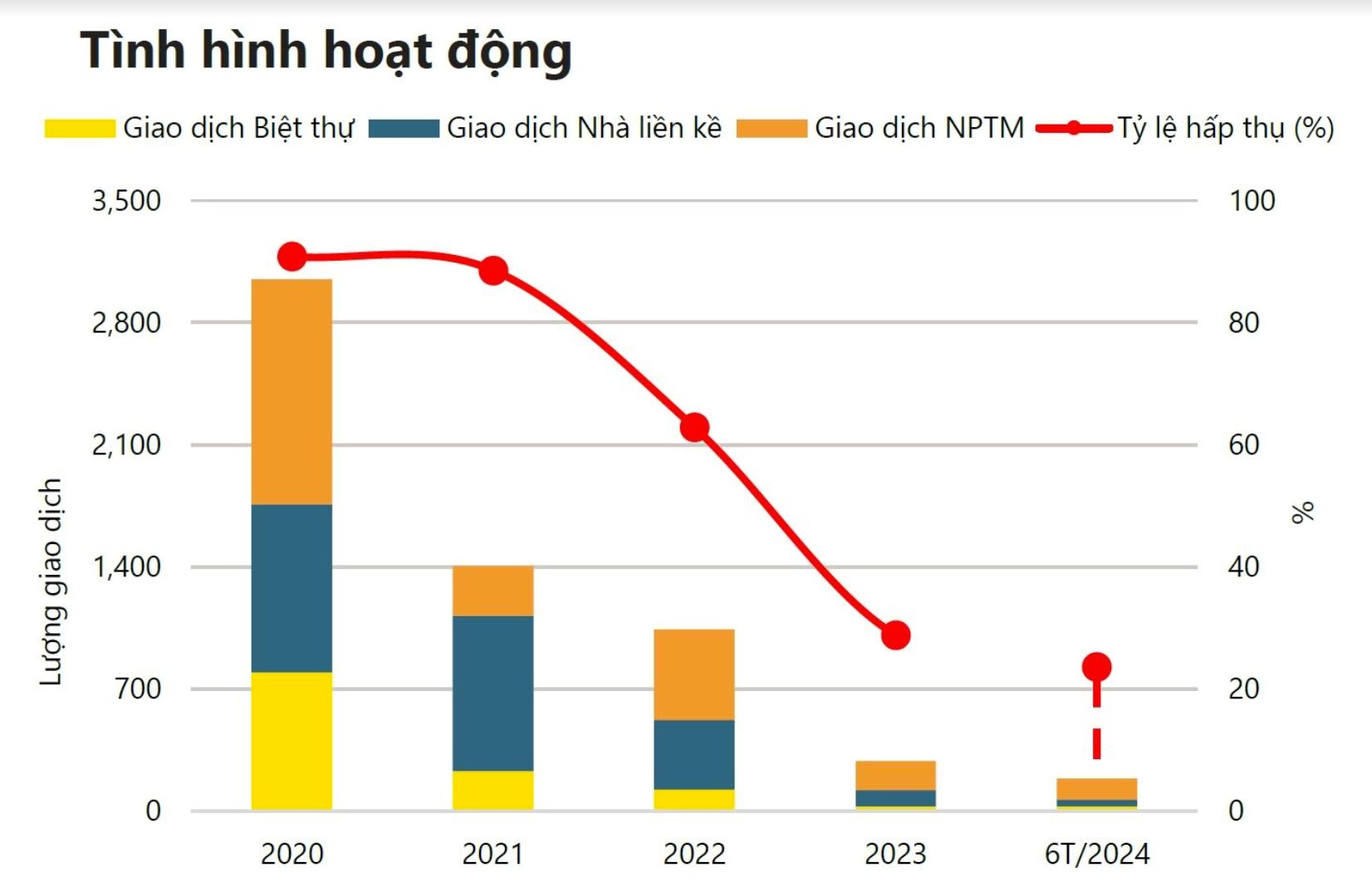

According to Savills, the supply and demand for shophouses and villas in Ho Chi Minh City are facing challenges due to direct competition from peripheral areas such as Dong Nai and Binh Duong. Data source: Savills.

Observations indicate that in Dong Nai province, shophouses priced between VND 6-8 billion per unit are in high demand. For instance, in Bien Hoa city (Dong Nai), the shophouse and villa products within the Izumi City urban area, developed by Nam Long and Hankyu Hanshin Properties (Japan), have experienced positive liquidity. The project, spanning 170 hectares along a 5.5-kilometer frontage of the Dong Nai River, is located at the intersection of Huong Lo 2 and Nam Cao streets. Phase 1 of the project comprises 275 diverse units, including commercial shophouses, garden shophouses, and twin villas, all of which are completed and equipped with meticulous amenities, welcoming residents to move in. This existing eco-urban area east of Ho Chi Minh City, boasting a diverse range of entertainment, educational, and working facilities, has garnered significant market interest.

Ms. Giang further noted that in Ho Chi Minh City, during Q2 2024, only 42 new shophouse and villa units were introduced to the market. The limited supply, persisting for three years due to legal obstacles, has constrained the development of new projects. The current primary supply in the market stands at 762 units, with properties priced above VND 30 billion per unit accounting for 76% of the market share. Notably, 85% of the primary supply is concentrated in Thu Duc City. In contrast, the areas bordering Thu Duc City, such as Dong Nai, offer more affordable options with well-planned infrastructure, fueling the demand for relocation to these satellite cities.

According to Savills’ forecast, by 2026, Ho Chi Minh City will no longer have any low-rise products priced below VND 5 billion per unit, and only 10% of the primary supply will be below VND 10 billion per unit. In contrast, 85% of the supply in Binh Duong and 55% in Dong Nai will fall within this price range.

In the last few months of 2024, Ho Chi Minh City is expected to release 883 low-rise units to the market, mainly from subsequent phases of existing projects. Properties priced above VND 20 billion per unit will account for 80% of the future supply.

‘The $5 Billion Mega Port’ – Unlocking the Gateway to Ho Chi Minh City: A Project of Epic Proportions

Recently, the Government Office issued Notification No. 418/TB-VPCP, dated September 13, 2024, regarding the conclusion of Deputy Prime Minister Tran Hong Ha at the meeting on the Investment Policy Dossier for the Saigon Gateway International Transshipment Port Project (officially named the Can Gio International Transshipment Port in the master plan).

The Cement Company’s New Toll Road Project

The Ha Tien Cement Joint Stock Company has announced road usage charges to recoup investment in the build-operate-transfer (BOT) project for the road connecting Nguyen Duy Trinh Street to Phu Huu Industrial Park in Thu Duc City, Ho Chi Minh City. The project is slated to begin toll collection from September 17 onwards.

The Ultimate Mid-Autumn Treat: Indulge in Our Exquisite Mooncakes, Priced at Almost 300,000 VND Each, But Buy One and Get… 3 for Free!

With an array of enticing promotions such as “buy one, get three or four” and competitive pricing, mooncake sellers at markets and sidewalks in Ho Chi Minh City are pulling out all the stops to attract customers. Despite their efforts, many of these businesses are still struggling with low sales and empty stalls.