There are high expectations for personal consumption growth in Vietnam, but there is a lack of domestic retailers offering premium goods. Takashimaya aims to expand its sales opportunities by establishing a system to cater to corporate clients and their needs for gifts and office equipment, as well as taking steps to accommodate orders.

They will begin by solidifying their corporate customer base through out-of-store corporate sales, proactively reaching out to clients to solicit orders. They will also consider offering a similar service to wealthy individuals.

Takashimaya’s shopping center in Ho Chi Minh City has approximately 200 corporate clients, many of whom purchase Mid-Autumn Festival cakes, a type of confectionery that companies gift to corporate clients and individuals during the Mid-Autumn Festival. According to Nikkei Asia, unlike in Japan, where department stores focus on fulfilling all the needs of corporate clients, stores in Vietnam have yet to fully capitalize on their customer networks.

“We want to first understand the needs of the wealthy in the corporate sector and create connections there while thinking about future customer conversion,” said Yuki Hojo, who heads Takashimaya’s subsidiary in Ho Chi Minh City.

The shopping center, which opened in 2016 at the Saigon Center, a commercial complex in the city’s center, was the first Japanese department store to enter Vietnam. It offers cosmetics, children’s clothing, confectionery, and other items. In the first eight months of the year, sales increased by 13% compared to the same period in 2023.

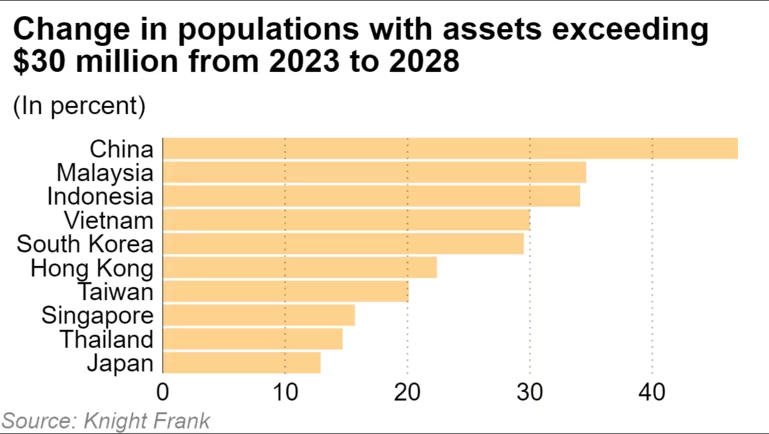

According to Knight Frank, the number of ultra-high-net-worth individuals in Vietnam with assets exceeding $30 million is expected to reach 978 by 2028, a 30% increase from 2023.

“The number of brands that have entered the market [in Vietnam] is still small,” Hojo said, indicating that there is room to tap into the consumption of high-income earners. The shopping center in Ho Chi Minh City aims to stimulate demand by attracting foreign brands that are not yet present in the country.

Vu Hao (According to Nikkei Asia)

Why is Vietnam Spending $1 Billion to Import from Cambodia a Commodity that the Country Exports Top in the World?

In just the first seven months of 2024, Vietnam spent over $1 billion to secure 95% of this commodity from Cambodia.