Previously, issues regarding the going concern of HVS were also emphasized by the auditing unit in the reviewed financial statements for the first half of 2024. The SSC is considering approval of changes to its head office and charter capital increase, leading to doubts about the going concern of HVS. However, as of the date of the mid-term financial statements, there was no reason for the Board of Directors and Executive Board of HVS to believe that the Company would not be approved by the SSC to continue operating. Therefore, the financial statements were still prepared assuming that HVS will continue to operate.

In addition, HVS is awaiting SSC approval for changes to its head office and charter capital increase, leading to HVS only generating revenue from interest on held-to-maturity investments.

HVS has submitted a proposal to the SSC to increase capital by offering shares to existing shareholders and issuing shares to meet the foreign ownership ratio approved by the Board of Directors’ resolutions, to increase the charter capital from 50.2 billion VND to 300.2 billion VND. Accordingly, the expected amount of capital to be raised is 250 billion VND.

In reality, HVS Securities has been paralyzed for a long time.

Specifically, in August 2018, the SSC withdrew the brokerage business of HVS. Subsequently, in September 2018 and November 2018, the Ho Chi Minh City Stock Exchange and the Hanoi Stock Exchange, respectively, terminated the membership of the Company.

Furthermore, on December 3, 2018, the Vietnam Securities Depository Center (now Vietnam Securities Depository and Settlement Corporation) revoked the Company’s depository membership certificate.

For the first six months of 2024, HVS generated over 201 million VND in operating revenue, all of which was from fixed-term deposit interest, a 51% decrease compared to the same period last year. After expenses, HVS incurred a net loss of nearly 266 million VND, while in the same period last year, it made a profit of over 203 million VND.

HVS‘s total assets as of June 30, 2021, were nearly 11 billion VND, almost entirely in the form of a 10 billion VND, three-month term deposit with a 3% interest rate at the Joint Stock Commercial Bank for Prosperity and Development (UPCoM: PGB).

Another notable point is that HVS‘s accumulated loss has exceeded 39 billion VND and eroded equity.

| HVS with long-standing accumulated losses |

Changes in Senior Management

Following the conclusion of the first extraordinary general meeting of shareholders held in early August 2024, significant changes occurred in the senior management of HVS with the dismissal of three members of the Board of Directors, including Ms. Truong Thi Hong Nga (Chairwoman), Mr. Ngo Van Do, and Mr. Thai Dinh Sy, as well as three members of the Supervisory Board, namely Ms. Nguyen Thi Tuyet (Head of the Supervisory Board), Ms. Chu Hoang Mai, and Ms. Dinh Hoai Huong.

In contrast, the general meeting of shareholders approved the election of three new members to the Board of Directors: Ms. Van Le Hang, Ms. Nguyen Thi Thuy, and Mr. Trinh Binh Long, along with three new members of the Supervisory Board: Ms. Mai Ngoc Anh, Mr. Du Ba Phuoc, and Ms. Ngo Thi Hong Nhung. Subsequently, Ms. Van Le Hang was elected as Chairwoman of the Board of Directors, while Ms. Mai Ngoc Anh became the Head of the Supervisory Board.

At the time of the meeting, Ms. Van Le Hang (born in 1993) was introduced as a business executive at TCG Land Company Limited. Ms. Nguyen Thi Thuy (born in 1982) serves as the secretary and assistant at Thanh Cong Group Joint Stock Company. Ms. Thuy previously held the position of Deputy Head of Import-Export Department at Thanh Cong Vietnam Automobile Joint Stock Company from 2011 to 2019 and was an import-export business executive at Thanh Cong Mechanical Company Limited from August 2005 to 2011.

Mr. Trinh Binh Long (born in 1975) has held important positions in various companies, notably Thanh Cong Group Joint Stock Company, Hyundai Lam Kinh, Vnsteel, and the Coma-Cotana Joint Venture. He currently serves as the General Secretary to the General Director at Thanh Cong Group Joint Stock Company.

It is noteworthy that all the newly elected members of the Supervisory Board held positions at DSC Securities Joint Stock Company at the time of the general meeting of shareholders. Specifically, Mr. Du Ba Phuoc (born in 1997) was a legal specialist at DSC, Ms. Mai Ngoc Anh (born in 1989) was a specialist in the Risk Management and Internal Control Department at DSC, and Ms. Ngo Thi Hong Nhung (born in 1994) was an accounting specialist at DSC.

The general meeting also approved the change in the position of General Director from Ms. Pham Thi Giang to Mr. Tien Quoc Viet, a very young individual born in 1999.

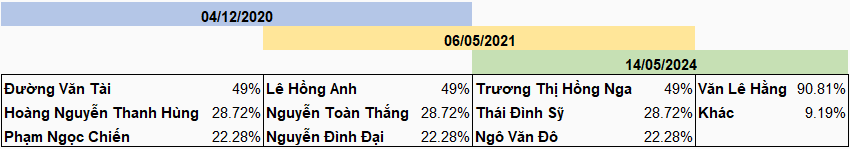

Prior to this, on May 14, there was a significant change in the shareholder structure of HVS when Ms. Truong Thi Hong Nga, Mr. Ngo Van Do, and Mr. Thai Dinh Sy – the dismissed members of the Board of Directors – sold their entire holdings.

On the other hand, Ms. Van Le Hang became a major shareholder by acquiring nearly 4.6 million shares (90.81% ownership), corresponding to the majority of the shares sold by the aforementioned individuals.

|

Shareholding structure of HVS Securities

Source: Author’s compilation

|