Vietnam’s retail industry is experiencing robust growth, as indicated by the recently released socio-economic report from the General Statistics Office. In the first eight months of the year, retail revenue is estimated to have reached VND 3,199.7 thousand billion, reflecting a notable 7.3% increase compared to the same period last year. The most significant growth was observed in several provinces, including Quang Ninh, Hai Phong, Can Tho, Da Nang, Ho Chi Minh City, and Hanoi.

The report also revealed an encouraging rebound in international visitor arrivals to Vietnam over the past eight months, even surpassing pre-COVID-19 levels from 2019 by a slight 1%. The country welcomed over 11.4 million international visitors, marking a substantial 45.8% increase compared to the same period in 2023.

Commenting on this trend, Tran Pham Phuong Quyen, Senior Manager of Retail Leasing at Savills Ho Chi Minh City, attributed the industry’s momentum to favorable demographic factors and widespread urbanization across provinces. This, in turn, stimulates economic growth.

A study by KPMG Vietnam forecasts that from 2020 to 2030, Vietnam will witness the addition of approximately 23.2 million people to its middle class, achieving an impressive annual growth rate of 5.5%. This places the country among the top fastest-growing middle-class populations in Southeast Asia.

The study also highlights that as of October 2023, Vietnam’s urbanization rate stood at 42.6%. The Vietnamese government has set ambitious targets, aiming for an urbanization rate of at least 45% by 2025 and surpassing 50% by 2030.

“The rise of the middle class, the tourism sector’s robust recovery, and the continuous emergence of new brands have collectively painted a vibrant and dynamic picture of modern retail in Vietnam,” explained Ms. Phuong Quyen. “As a result, shopping malls have become sought-after destinations for entertainment and leisure among consumers.”

According to the recently published Prime Benchmark report by Savills Asia-Pacific, Hanoi and Ho Chi Minh City are among the markets with actively performing retail real estate sectors in the first seven months of the year.

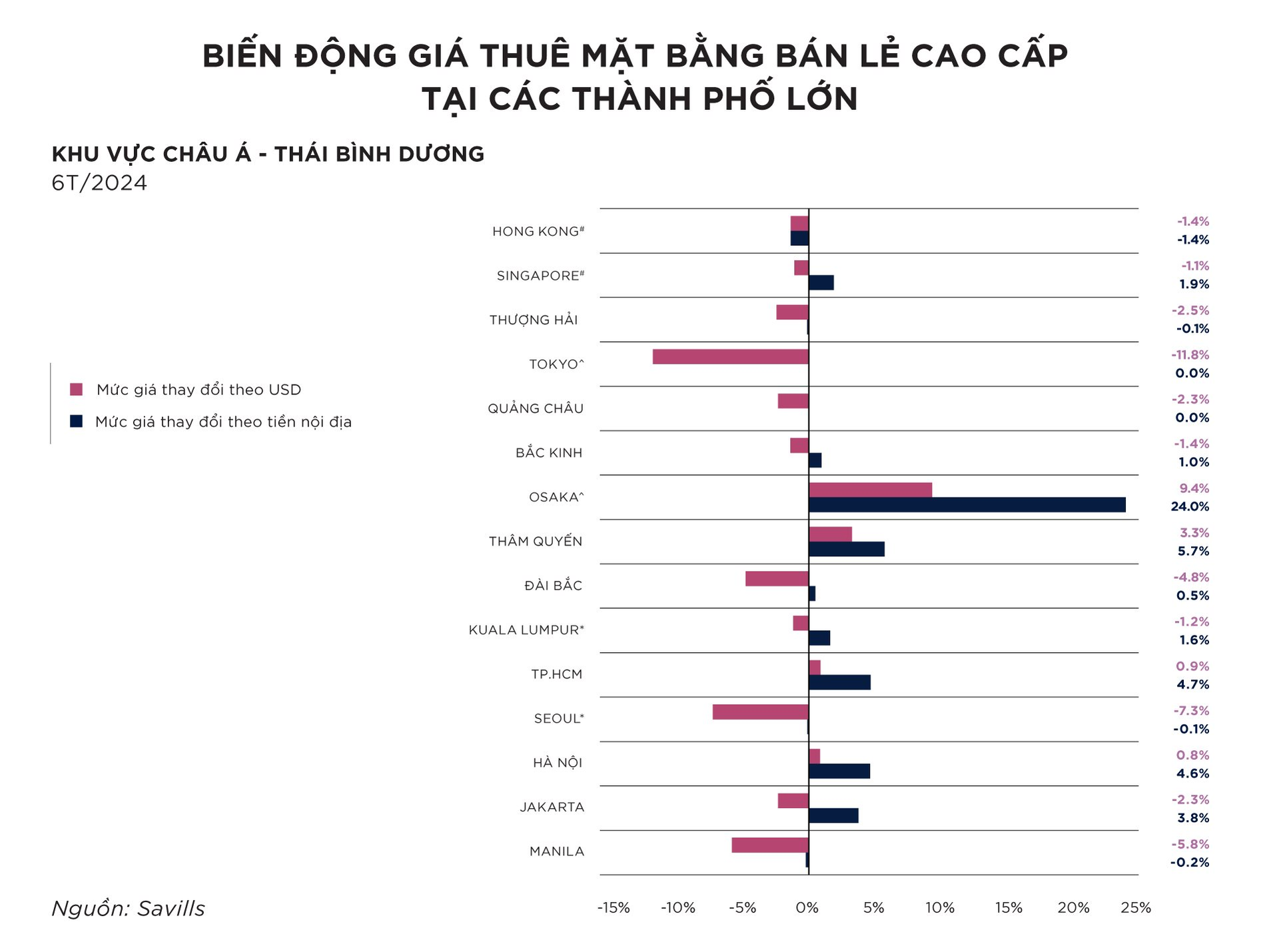

Specifically, rental prices for premium retail spaces in Osaka, Japan, witnessed a significant surge in the first half of the year, increasing by 24% year-on-year. This growth is expected to persist, fueled by the weak yen and the allure of Japan’s tourism offerings.

According to a survey conducted in Japan, three emerging Southeast Asian markets—Ho Chi Minh City, Hanoi, and Jakarta—have also experienced significant improvements in rental prices, increasing by 4.7%, 4.6%, and 3.8%, respectively. Analysts attribute these results to the expanding middle class and the tourism industry’s recovery.

Rental rates for premium spaces in Hanoi’s central area stand at USD 96.4 per square meter, while in Ho Chi Minh City, they reach USD 151 per square meter. In comparison, Kuala Lumpur’s rates are USD 158.6 per square meter, Singapore commands USD 399.7, and Beijing offers USD 289.5 per square meter.

Changes in premium retail rental prices in major cities. Source: Savills Prime BenchMark.

“The rental costs of premium retail spaces in Hanoi and Ho Chi Minh City remain competitive compared to many other regional markets,” assessed Do Thi Thu Hang, Senior Director of Consulting and Research at Savills Hanoi.

“The outlook for rental prices in this segment in Hanoi is positive, with a tendency towards stability or slight increases due to limited new supply. This means that existing projects in prime locations will likely maintain high occupancy rates and may even raise rental rates,” she added.

In contrast, other cities in the region face abundant retail space options, creating intense competition among landlords, leading to adjustments in rental prices to attract customers.

According to Savills’ research team, Ho Chi Minh City currently offers approximately 1.52 million square meters of retail space for lease, with an impressive occupancy rate of 94%. Elaborating on this market, Ms. Phuong Quyen noted that the limited supply of premium retail options in the city has fostered intense competition among shopping malls vying for prime locations.

“However, premium spaces in Ho Chi Minh City are predominantly concentrated in the city center or developed districts like District 7. Moving forward, we anticipate an expansion into peripheral areas. Additionally, in 2024, the appreciation of the US dollar has significantly contributed to higher rental rates when converted into the local currency,” she further explained.

“The “New Commerce” Model: Unveiling the Billion-Dollar Company Blueprint in India and its Relevance for Vietnamese Retailers”

The Vietnamese modern retail market is projected to reach a staggering $20 billion in the next decade, according to Euromonitor. WinCommerce, a pioneer in the New Commerce model, has been reaping sustainable profits, thereby enhancing its intrinsic value.

Retail’s Resilience: How the WinMart Chain Turned a Profit

WinMart, a prominent retail chain, has turned a new leaf. As of June 2024, the company has embarked on a journey of transformation, overhauling its store systems and implementing innovative solutions. This strategic revamp has led to a remarkable turnaround, with the chain now boasting positive profits and a bright future ahead.

3 New Real Estate Laws: A Timely Opportunity for Developers to Seize the Initiative

With the advent of the Land Law, Housing Law, and Real Estate Business Law, a myriad of enterprises have embarked on a strategic journey, harnessing the newfound legal provisions to their advantage.