By the end of this year, residents of Tứ Hạ in Hương Trà town, Thừa Thiên – Huế province, and its surrounding areas may no longer need to drive for half an hour to shop at Co.opmart or GO! supermarkets in the center of Huế city.

Next to the town’s cultural center, which is currently under construction, a small-scale supermarket of Central Retail Vietnam (CRCV) is also being built at a rapid pace. This location is part of the mini go! supermarket chain – developed by the Thailand-based retail group since 2021 – targeting consumers in suburban areas.

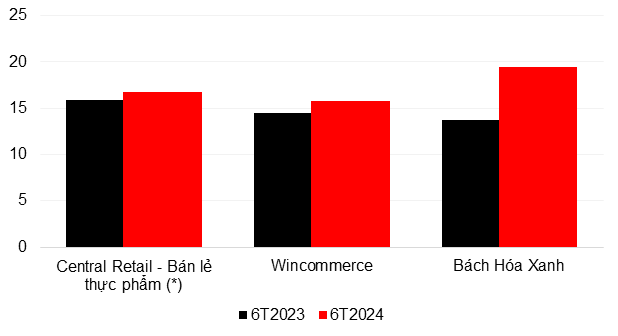

The consecutive openings of mini go! supermarkets have boosted Central Retail’s food retail sales by 5.6% in the first half of this year.

Starting in Vietnam in 2012 with just a few fashion stores, Central Retail – a branch of Thailand’s fourth-richest family, Chirathivat – quickly expanded its presence through prominent M&A deals, including the acquisition of Nguyễn Kim electronics stores and the Lan Chi Mart and BigC supermarket chains.

The GO! brand in Vietnam today is the result of a familiar strategy practiced by Thai businesses, consisting of two steps: acquisition and restructuring of the target business, in this case, BigC. However, unlike industries approaching saturation – such as plastics and beer, which have also seen Thai acquisitions – the food retail sector remains a vast ocean of growth potential.

According to an analysis report published by FPTS Research in late June, modern retail channels, despite their rapid growth in recent years, account for only approximately 12% of retail revenue in Vietnam’s grocery sector, as of 2023.

|

Comparison

The modern food retail throne is a competition among the four giants (**) Unit: Thousands of billions of VND

– (*) Revenue converted at the rate of 1 Baht to 730 VND. According to the financial statements of Central Retail Corporation (CRC, the parent company of CRCV), the food retail segment in Vietnam generated 23 billion Baht in revenue in the first half of 2024, a 5.6% increase compared to the same period last year.

– (**) Also among the leaders in the modern food retail market in Vietnam, Saigon Co.op – which owns the Co.opmart and Co.op Food chains – does not disclose semi-annual financial data. According to the author’s understanding, this enterprise achieved nearly 30,000 billion VND in revenue for the full year 2023.

– Data source: Compiled by Vietstock

|

With ambitions to be the leading multi-channel retailer in the food industry and despite having investment plans of up to $1.45 billion – according to a statement made in early 2023, Central Retail’s operators have shown that they are not in a hurry to spend money to conquer the market but have their own preferences.

Instead of infiltrating the centers of large cities, which are already densely occupied by thousands of Co.op Food, Bach Hoa Xanh, and Winmart+ (owned by Wincommerce) stores, Central Retail pursues a supermarket model with a scale of 1,000 square meters or more and is paying more attention to less bustling suburban areas.

“We need stores that are large enough to provide a good customer experience and thus be profitable, as well as to implement commercial tactics,” said Olivier Langlet, CEO of Central Retail Vietnam, in an interview with Forbes in February 2023.

According to data from a report by Central Retail Corporation (CRC – the parent company of Central Retail Vietnam in Thailand), in the fast-moving consumer goods (FMCG) sector alone, Central Retail accounted for 24.3% of the market share in modern retail channels in Vietnam in Q1/2024. If we consider only hypermarkets, excluding Winmart and Mega Market, their market share rises to 41.5%.

The Thai retail giant – with 81 food supermarkets and hypermarkets in operation as of the end of June 2024 – is expected to continue to increase its presence in the second half of the year with new business locations currently under construction.

Mr. Olivier Langlet, CEO of Central Retail Vietnam, stands in front of a GO! hypermarket. As of mid-2024, the Group from Thailand operates 43 small-scale supermarkets, including mini go!, Tops Market, and Lan Chi Mart, along with 34 GO! hypermarkets and 4 BigC hypermarkets – expected to be soon converted to the GO! brand – Photo: Forbes Vietnam

|

GO! Hypermarket

On August 15, Central Retail inaugurated a hypermarket in the newly opened GO! shopping center in the city of Phủ Lý, Hà Nam province. This is one of three GO! hypermarkets – along with locations in Ninh Thuận and Bạc Liêu provinces – included in the group’s plan to open by the end of this year, bringing the total number of hypermarkets to 41.

After taking over BigC in a 2016 acquisition deal, the new owners launched a campaign to reposition the supermarket chain under the GO! brand starting in 2019. Currently, only four hypermarkets still use the BigC brand. According to plans, Central Retail will renovate two more BigC locations, Thăng Long in Hanoi and Đồng Nai in Biên Hòa, in the latter part of this year, in preparation for the upcoming Lunar New Year holiday.

Tops Market Supermarket in City Centers

The Tops Market supermarket, converted from BigC, is located in the Thao Dien Pearl building, 12 Quoc Huong, Thu Duc City (formerly District 2), Ho Chi Minh City – Photo: Central Retail Vietnam

|

Meanwhile, BigC supermarkets with an area of less than 3,000 square meters, usually located in apartment buildings, have been converted to the Tops Market brand since 2021.

Earlier this year, Central Retail also opened its ninth Tops Market supermarket, with an area of 1,800 square meters, in the Park City urban area of Ha Dong District, Hanoi. This is the first new Tops Market model – featuring self-service checkout counters and exclusive imported products – to be operated in the capital.

Currently, there are five Tops Market supermarkets in Hanoi and four in Ho Chi Minh City.

2 Suburban Supermarket Chains: Lan Chi Mart and mini go!

The mini go! supermarket, which opened in October 2023, is located in Hòa Thành Town, Tây Ninh Province – Photo: Central Retail Vietnam

|

While the acquired Lan Chi Mart chain has maintained 24 stores (in the northern provinces) in recent years, mini go!, developed by Central Retail itself, has been the growth driver for the food business.

The retail giant introduced mini go! as a small-scale integrated supermarket model, targeting consumers in medium and small provinces and cities, offering a shopping mall-like experience with a supermarket, entertainment area, and dining outlets.

The mini go! chain has been prioritized for expansion since 2023 – when Central Retail announced plans to invest over $1 billion in Vietnam – with the opening of six new stores. By early 2024, another supermarket was inaugurated in Đồng Tháp, becoming the 10th mini go! nationwide.

CRC’s business update report states that mini go!’s sales and profitability have exceeded expectations, and there is still room to expand this model to many more suburban areas. By the end of this year, four more mini go! supermarkets are expected to open.

Source: Central Retail Corporation (CRC) Business Update Report, published on August 19, 2024

|

|

In addition to food retail, Central Retail operates in various sectors in Vietnam, including amusement parks, fashion, and furniture. However, it is best known for its Nguyễn Kim electronics stores and SuperSport sports equipment chain. In the first half of this year, the food segment was the growth driver for Central Retail, while other segments declined due to the continued subdued demand for non-essential products. The Thai conglomerate is also considered a major real estate player in Vietnam, operating and leasing retail spaces in shopping centers bearing the GO! brand – which also house the group’s hypermarkets. As of mid-August 2024, information from CRC indicates that GO! has over 1,060 business tenants. Revenue from this segment in the first half of the year increased by 7% compared to the same period last year. |

Thừa Vân

“Hòa Phát: Forging Ahead as Vietnam’s 16th Most Valuable Brand”

Brand Finance, the renowned brand valuation consultancy, has unveiled its latest report on Vietnam’s Top 100 Most Valuable Brands for 2024. Hoa Phat, a prominent Vietnamese brand, has secured the 16th rank in this prestigious listing, marking its 9th consecutive year of inclusion in this esteemed ranking.

The Asian Funds Alliance: A $35 Billion Promise for Vietnam’s Future

A newly formed investment alliance, the Vietnam Private Capital Agency (VPCA), has set its sights on attracting $35 billion in investment to Vietnam over the next decade.