Selling pressure mounts as the breadth of indices from 10:30 am onwards starts to favor the downside. The VN-Index breaks below the 1250 mark from around 10:55 am, and the number of declining stocks starts to dominate. Trading on HoSE also increases by over 22% compared to the previous session, confirming a downward price adjustment.

The VN-Index closed the morning session down 4.62 points, or -0.37%, from the reference level. The index still had one, albeit weak, upward move, peaking at 9:45 am, 3.7 points above the reference. Although it broke below the 1250 level (now at 1,247.09) it hasn’t dipped lower than the recent low on September 11th (1,244.79). If the market bounces back positively in the afternoon, this downward move will be considered a test of the support level.

However, it’s undeniable that the market was weak this morning. At its peak, the VN-Index had 197 gainers and 111 losers. As the index turned red at around 10:40 am, 154 stocks were up and 185 were down. By the end of the morning session, HoSE had only 115 gainers and 252 losers, indicating a broad-based decline as the index slid.

The VN30-Index is down 0.33%, with only 6 gainers and 22 losers, including 7 stocks falling by more than 1%. Fortunately, among the top 10 by market cap, only CTG fell by 1.15%, VHM by 1.4%, and GAS by 1.21%. The biggest loser in the VN30 basket was POW, down 1.56%. This stock has officially broken its July low. On the upside, only TCB, up 1.13%, and SSB, up 3.61%, were notable.

On the HoSE, 71 stocks declined by 1% or more, accounting for about 27.6% of the floor’s total matched value. Blue chips dominated liquidity, with MSN down 1.08% and matching 157.1 billion; MWG down 1.19% and matching 140.5 billion; VHM down 1.4% and matching 132.5 billion; and CTG down 1.15% and matching 105.8 billion. Additionally, several mid-cap stocks saw declines, including HCM down 2.23%, VCI down 1.95%, PDR down 1.86%, and FTS down 1.59%…

The selling pressure was also relatively evident among the most liquid stocks. HoSE recorded 13 stocks with matched order values of 100 billion VND or more, with only DPM up 1.27% and TCB up 1.13%, while the rest were in the red. Of course, not all of the remaining 11 stocks fell sharply, but failing to hold above the reference price still indicates weakness, especially when the breadth strongly favors the downside.

On the upside, 115 stocks are still swimming against the tide, but trading is weak. The group of stocks up by 1% or more consists of 32 stocks, accounting for only 10.4% of the floor’s total liquidity, as the majority are illiquid. NAB rose 4.24% on a volume of 70.6 billion; BMP rose 2.59% on a volume of 33.5 billion; DPM rose 1.27% on a volume of 157.1 billion; AAA rose 1.13% on a volume of 11.4 billion; TCB rose 1.13% on a volume of 128.3 billion, and DPG rose 1.12% on a volume of 46.2 billion were the most notable stocks.

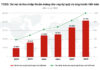

The downward price pressure this morning contributed to a nearly 21% increase in matched order volume on the two exchanges compared to the previous session, reaching VND 5,014 billion. HoSE’s liquidity increased by 22% to VND 4,728 billion. This suggests that the improvement in liquidity was due to sellers taking the initiative, as buyers mostly placed orders at lower prices.

The weak performance and low liquidity are partly due to a lack of catalysts to energize money flow. This week, the market awaits the Fed’s interest rate decision and futures expiration, making supply and demand fragile. At any moment, a slight shift in favor of either side can change price directions.

The Stock Market ‘Anticipates’ Next Week’s Key Event

The market experienced a rather dull trading week, with the last two sessions seeing the lowest liquidity since April 2023. Investor sentiment seems to be heavily impacted by the aftermath of the third storm, which disrupted the business operations of a significant number of enterprises. The market is also awaiting the response of the State Bank of Vietnam following the interest rate cut by the Federal Reserve.

The Stock Market Plunge: NVL, DRH, NRC, and VNZ Take Center Stage as the Market Sheds Over 22 Points

The stock market witnessed a downward trend last week, with the VN-Index shedding over 22 points. Novaland (NVL), DRH Holdings (DRH), and Danh Khoi (NRC) stocks, along with tech “unicorn” VNG (VNZ), saw a surge in trading. Meanwhile, a company’s announcement of a 70% cash dividend caused its stock to soar towards its historical peak.