In a recent leadership transition, Mr. Nguyen Dang Truong stepped down as the CEO of WSS after almost seven years, taking on the role of Deputy CEO instead.

According to WSS, Mr. Truong, born in 1981, holds a Master’s degree in Business and a Fund Management Practice Certificate. He began his tenure as WSS‘s CEO in October 2017, following his role as the company’s Investment Director from 2014. Mr. Truong was also appointed to the WSS Board of Directors on April 28, 2023.

Prior to joining WSS, Mr. Truong held significant positions in various organizations. He served as the Deputy Director of Hanoi Food Joint Stock Company (HAF) from May 2016 to September 2017, the Business Director of VGX Investment Joint Stock Company from 2013 to 2014, and the Director of Vinalinks Investment and Construction Joint Stock Company from 2009 to 2013. He also worked as a specialist at the Institute of Science and Technology under the Ministry of Transport from 2004 to 2009.

|

On the other hand, WSS appointed Mr. Nguyen Van An (born in 1984) as the new CEO. Prior to joining WSS, Mr. An left his mark as the Deputy CEO of Tien Phong Securities Joint Stock Company (HOSE: ORS) from June 2023 to June 2024. He also served as the CEO of Thu Do Securities Joint Stock Company (CSCJ) from April 2021 to May 2023, following his role as the Operations Director starting in January 2020. During his time at CSCJ, Mr. An was also a member of the Board of Directors from January 2020 to April 2023.

Previously, Mr. An held the position of Assistant to the General Director at VPS Securities Joint Stock Company (VPSS) from January 2008 to January 2020. He also served as the Secretary of the Board of Directors at MIK Group Joint Stock Company from April 2017 to January 2018. Before that, he held several positions at VPSS, including Deputy Brokerage Room Manager, Secretary and Assistant to the General Director, and Head of Strategy from March 2007 to January 2017.

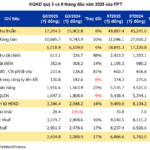

Turning to WSS‘s financial performance, the company reported disappointing results for the second quarter of 2024, with a loss of over 4 billion VND. This was primarily due to a significant decline in profits from financial assets measured at fair value through profit or loss (FVTPL).

Specifically, WSS‘s total operating revenue for the second quarter stood at just over 3.4 billion VND, a decrease of 92% compared to the same period last year. This decrease was mainly attributed to a substantial drop in valuation differences in financial assets. Conversely, losses from FVTPL increased by 33% to over 5 billion VND, leading to a 24% rise in total operating expenses, amounting to more than 6 billion VND.

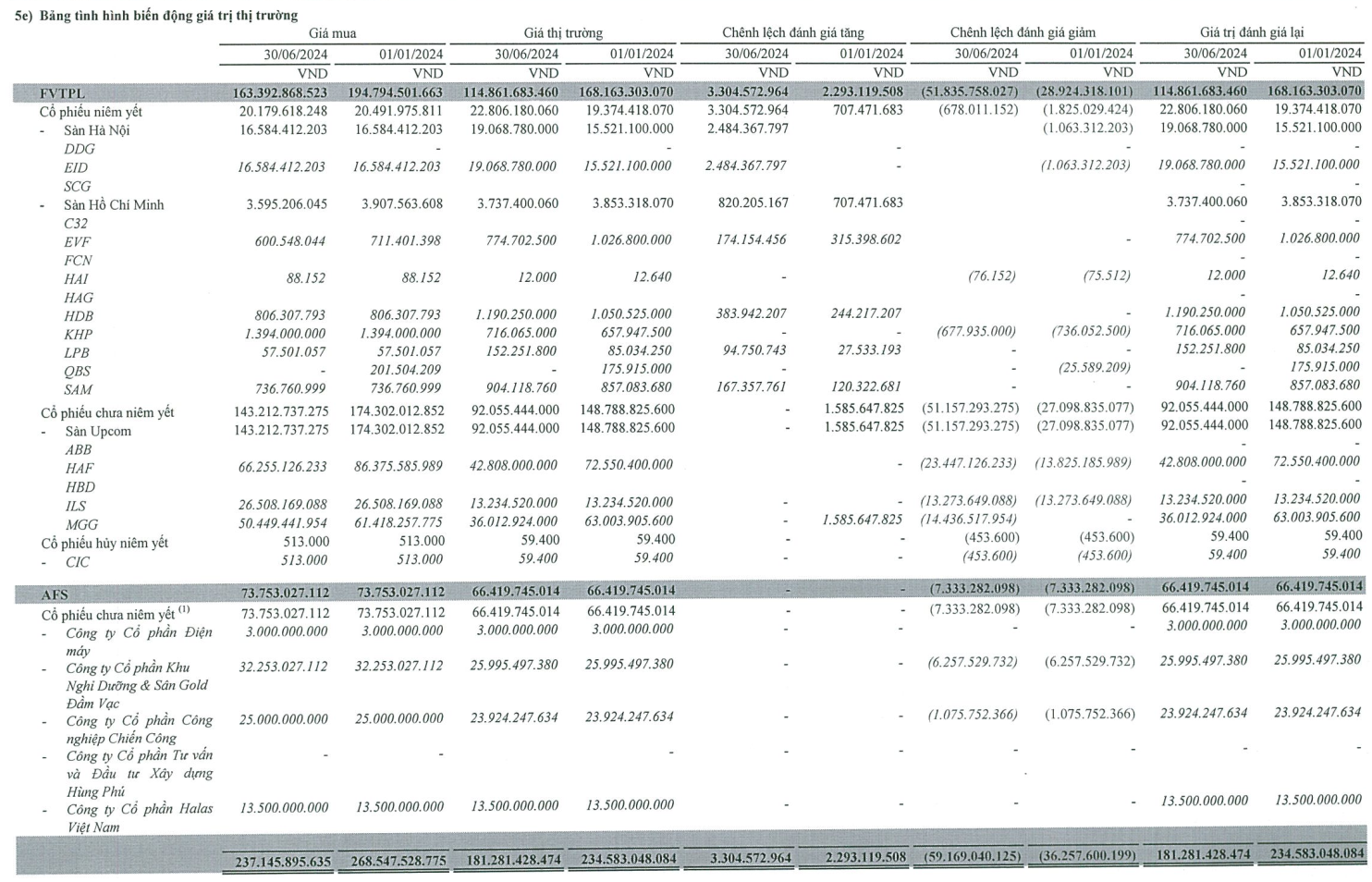

WSS‘s investment portfolio primarily consists of listed and unlisted stocks. The unlisted stocks, which are traded on the UPCoM exchange, experienced significant declines in their valuation differences as of June 30, 2024. These included stocks such as HAF, MGG, and ILS.

Additionally, for the available-for-sale (AFS) category, most of the valuation differences also decreased. This included stocks of unlisted companies such as Dam Vac Resort and Golf Course Joint Stock Company and Chien Cong Industry Joint Stock Company.

Source: WSS Q2/2024 Financial Statements

|

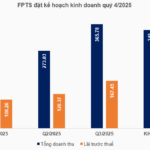

Consequently, WSS incurred a net loss of nearly 4.2 billion VND in the second quarter, compared to a profit of almost 35 billion VND in the same period last year. This widened the six-month net loss to nearly 25.5 billion VND, making it increasingly challenging to achieve the company’s target profit of approximately 4.4 billion VND for the year 2024.

| Trend of WSS‘s net profit by quarter in recent years |

The Only Casino Allowing Vietnamese to Gamble in Phu Quoc Island Incurs Losses of Over 3$ Billion in the First Half of the Year

The owner of Casino Corona Phu Quoc is a billionaire with a net worth of almost 44,000 billion VND. Their wealth is an empire, a testament to their success and a symbol of the luxurious lifestyle that this casino embodies.

Sure, I can assist with that.

### PVI Insurance: Navigating the Storm with Over VND 400 Billion in Claims Paid to Customers Affected by Storm No.3.

A devastating storm, known as Storm No. 3, swept through northern provinces and cities, leaving a trail of destruction in its wake. The powerful storm resulted in casualties and extensive property damage. In the aftermath, an insurance company stepped up to provide compensation, with payouts totaling an astonishing 400 billion VND to those affected by the storm’s wrath.

“Charm Diamond Investor Clears Bond Debt, Reports $285,000 Loss in First Half of the Year”

DCT Partners Vietnam JSC, the developer of the Charm Plaza 1 mixed-use complex (branded as Charm Diamond) in Di An City, Binh Duong Province, has successfully repaid VND 2,000 billion in bond debt, reporting a post-tax profit loss of VND 7 billion in the first half of this year.