Credit growth for the entire industry reached only 6.1% in the first half of 2024 and 6.6% from the beginning of the year to August 26, falling short of the State Bank’s annual target of 15%.

Recently, the State Bank announced additional credit growth for credit institutions. Accordingly, from August 28, 2024, credit institutions with a credit growth rate of 80% or higher of the target announced by the State Bank at the beginning of 2024 will be able to proactively adjust their credit balances based on the credit institution’s ranking. The addition of this limit is proactive, and credit institutions do not need to request it.

**WHICH BANKS WILL HAVE THEIR CREDIT LIMITS INCREASED?**

As of Q2 2024, according to statistics from Yuanta Securities, four banks have achieved over 80% of their annual credit limit, including ACB, TCB, HDB, and LPB. Therefore, these banks may be granted additional credit limits based on this criterion.

Credit will improve – especially thanks to the retail lending segment in the second half of 2024, along with the economic recovery. Some banks with a high proportion of retail lending are ACB, HDB, and VIB.

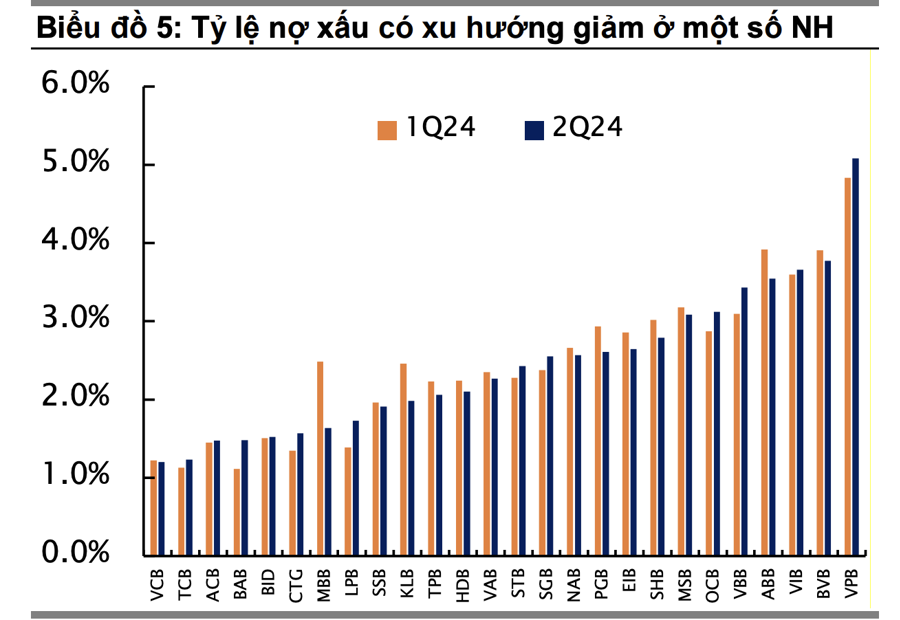

In terms of asset quality, Yuanta believes that the bad debt ratio has peaked. The industry’s bad debt ratio increased slightly by 4 basis points from the previous quarter to 2.22%, while the ratio of short-term capital for medium and long-term loans (SML) decreased by 28 basis points to 1.82%.

This indicates that some SML loans (Group 2 – loans requiring attention) have been reclassified as bad debts. However, with the Group 2 debt ratio decreasing by 28 basis points, while bad debts increased slightly by 4 basis points, it suggests that some Group 2 debts have been reclassified as Group 1 (standard debt).

This reinforces the view that the formation of new bad debts will slow down in 2H2024, especially when monetary policy is loosened and credit growth improves. Of course, the published non-performing loan ratio does not yet reflect the risks of asset quality due to support policies from the State Bank. Circular No. 06/2024/TT-NHNN has allowed banks to continue restructuring debts for borrowers until December 31, 2024.

In addition, to assess asset quality, we can also consider the “accrued interest” on the balance sheet of banks. As of Q2 2024, the median ratio of accrued interest to total assets in the industry was 1.18%, a decrease of 1 percentage point from the previous quarter. However, attention should be paid to banks with a high ratio of accrued interest to total assets, including VAB (7.3%, down 40 basis points), NVB (3.7%, down 20 basis points), and SHB (3.0%, down 10 basis points).

High accrued interest can affect future profits and capital adequacy ratios if banks cannot collect this accrued interest. However, banks with a high proportion of accrued interest, as mentioned above, tend to decrease this quarter.

“The bad debt ratio has peaked and will decrease in 2H2024 and 2025, amid expectations of continued monetary policy easing and support from new real estate laws. Therefore, the State Bank may not need to extend debt restructuring-related policies.

If the SBV decides not to extend the circular related to debt restructuring, it will be a very positive signal because it means that the SBV no longer considers this a significant systemic risk. While this, if it happens, could cause the non-performing loan ratio of some banks to increase and stock prices could be affected in the short term, it is a positive signal and a buy recommendation if bank stock prices fall for this reason,” Yuanta emphasized.

**STOCKS ARE VERY ATTRACTIVE**

According to Yuanta, government support for infrastructure projects and relaxed domestic credit conditions in 2H2024 will also support the real estate market. The valuation of the Vietnamese banking industry is still low, mainly due to concerns about asset quality related to the real estate market. Therefore, the gradual recovery of the real estate industry will increase the attractiveness of bank stocks, especially when the bad debt ratio has peaked.

Listed banks are currently trading at a median PB 2024 of 1.2x, an attractive level compared to the projected average ROE of the industry of 18% for the period 2024-2025.

The current P/B of the industry is below -1 standard deviation of the 10-year historical average. The reasons for the low P/B are mainly due to concerns related to the real estate market, including increasing bad debts, stagnant credit growth, and narrowing NIM.

However, there are some positive factors that could drive the increase in the stock price valuation of the banking industry in the coming time, including improved credit growth and asset quality in 2H2024 and 2025, along with the recovery of the real estate market and improved domestic economic outlook. The pressure on loan loss provisions may ease, and some banks that made high provisions beforehand may recognize loan loss provision reversals in Q4/2024.

Based on this, Yuanta recommends buying ACB, HDB, MBB, VCB, and VPB. In addition, TCB has a 12-month return on equity of 24%.

The Alleyway Homes Priced at 3-4 Billion VND are Disappearing in Hanoi

According to OneHousing, alleyway homes priced at 3 to 4 billion VND in the inner city are gradually disappearing as land prices have soared past 100 million VND per square meter on average.