On September 30, JSC Saigon Port Loading and Services (Sasteco – code SAC) will finalize the list of registered shareholders to receive 2023 dividends in cash at a ratio of 70.65% (1 share receives VND 7,065). The expected payment date is October 15, 2024.

With 3.95 million circulating shares, Sasteco plans to spend nearly VND 28 billion on this dividend payout. This constitutes the company’s entire undistributed post-tax profit accumulated over several years up to December 31, 2023.

In Sasteco’s shareholder structure, JSC Saigon Port (code SGP) is the dominant parent company with a 51.43% stake and is expected to receive approximately VND 14.4 billion from this dividend payout. Saigon Port is currently a subsidiary of Vietnam Maritime Corporation (VIMC – code MVN). VIMC is a state-owned enterprise, with the State Capital Management Committee in Enterprises holding nearly 99.5% of its capital.

In addition, Sasteco has another major shareholder, Agricultural Supplies Joint Stock Company, holding 5% of its charter capital. Thus, this enterprise is expected to receive about VND 1.4 billion from Sasteco’s dividend payout. In terms of relationships, Mr. Nguyen Tien Dung, a member of Sasteco’s Board of Directors, is currently the Chairman of the Board of Directors of Agricultural Supplies.

Sasteco, formerly known as Saigon Port Loading and Services Enterprise, was established on August 1, 2008, by merging cargo handling teams, cargo receivers, mechanics, and specialized departments from Saigon Port’s former loading companies. The enterprise was a dependent accounting unit of Saigon Port JSC. Since October 1, 2010, the enterprise has been transformed into JSC Saigon Port Loading and Services, with Saigon Port JSC (now JSC Saigon Port) holding a controlling stake of over 51%.

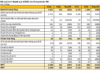

Since its listing on the stock exchange in 2016, Sasteco has consistently paid cash dividends to its shareholders. However, the dividend ratio has been decreasing, from 12% in 2016 to 10% during 2017-2019, and further down to 8% in 2020-2022. The ratio of 70.65% for 2023 is a record-high dividend ratio for Sasteco shareholders.

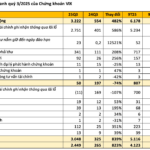

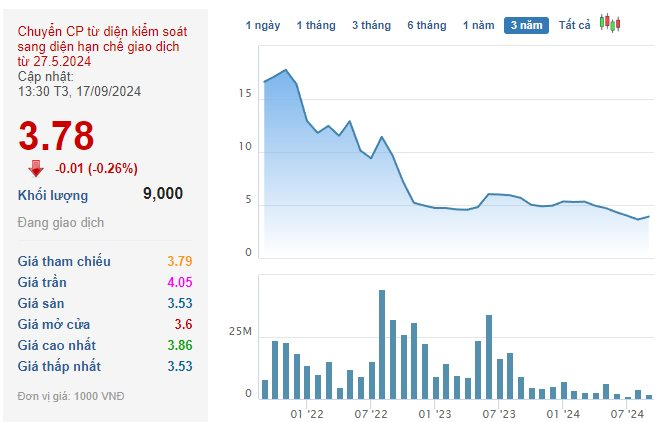

In terms of business results, after the record profit of VND 21 billion in 2017, Sasteco’s net profit has declined to below VND 10 billion in recent years. This is mainly due to the lower-than-expected cargo volume handled by the company. In 2023, Sasteco’s net profit increased by 37% compared to 2022 but only reached nearly VND 3.8 billion.

On the market, SAC shares are trading near their all-time high, around VND 29,000/share, three times higher than at the beginning of the year. The corresponding market capitalization is approximately VND 115 billion.