This was the insight shared by Tran Hoang Son, Market Strategy Director of VPBank Securities JSC (VPBankS), during the “Matching Orders on 16/09: New Cycle?” livestream session.

Mr. Tran Hoang Son, VPBankS’ Market Strategy Director

|

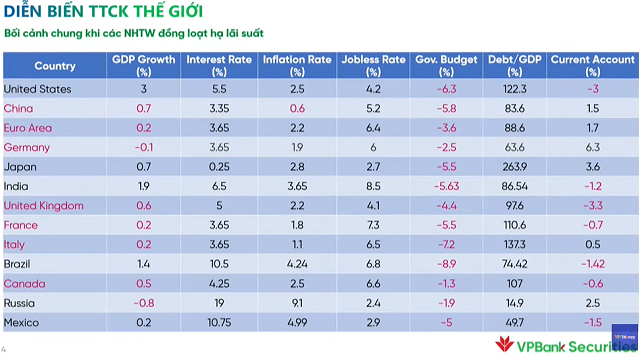

The wave of interest rate cuts indicates a weakening global economy.

Mr. Son assessed that the recent wave of interest rate cuts reflects a global economy fraught with issues, with a particular focus on growth as the primary concern for central banks and nations at this juncture, rather than inflation. The current economic landscape gives rise to worries and the possibility of a recession if central banks do not take action to cut interest rates.

Inflation is also on a downward trend globally and, in some cases, declining rapidly. Experts believe that without reasonable interest rate adjustments, inflation may fall short of central banks’ expectations, given that interest rates are at their highest in a decade. Even with rate cuts now, it would take 3-6 months for the full impact to be felt in the economy.

Source: VTV Money

|

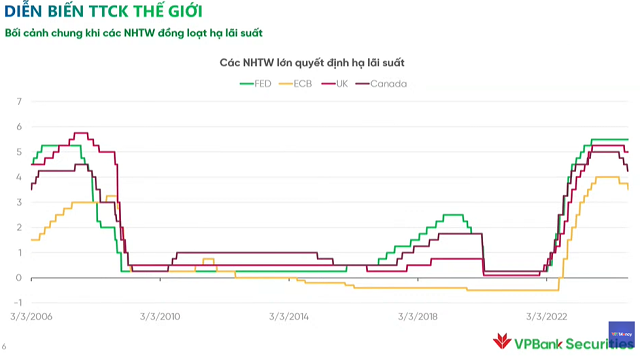

Over time, central banks in Europe (ECB), England (BoE), and Canada (BoC) have been quick to lower their rates. Notably, the ECB cut rates for the second time in a row last week (September 9-13, 2024), reducing the deposit rate by 25 basis points while slashing the refinancing rate by 60 basis points. This move underscores their concern about economic growth and the fragility of the economic landscape.

Source: VTV Money

|

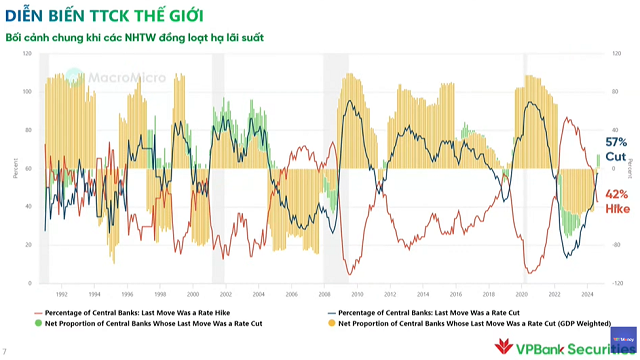

According to statistics, up to 57% of central banks globally are expected to cut interest rates, while only about 42% have recently raised rates. The trend indicates that most central banks will lean towards lowering rates in the coming months. Looking further ahead, lower interest rates will provide much-needed relief for manufacturing, business, and real estate enterprises.

Source: VTV Money

|

Catalyst for capital inflows back into Vietnam in the near future

Mr. Son pointed out that a Fed rate cut does not always bode well for the stock market, as there have been instances of recessions following such moves.

Historical data from 1974 onwards suggests that, generally, rate cuts over the medium to long term have a positive impact on both the economy and the stock market, regardless of whether a recession occurs. Typically, six months after a Fed rate cut, the stock market experiences significant growth, which continues to strengthen over the following year. However, there may be short-term dips, and these can be quite deep during this transitional phase.

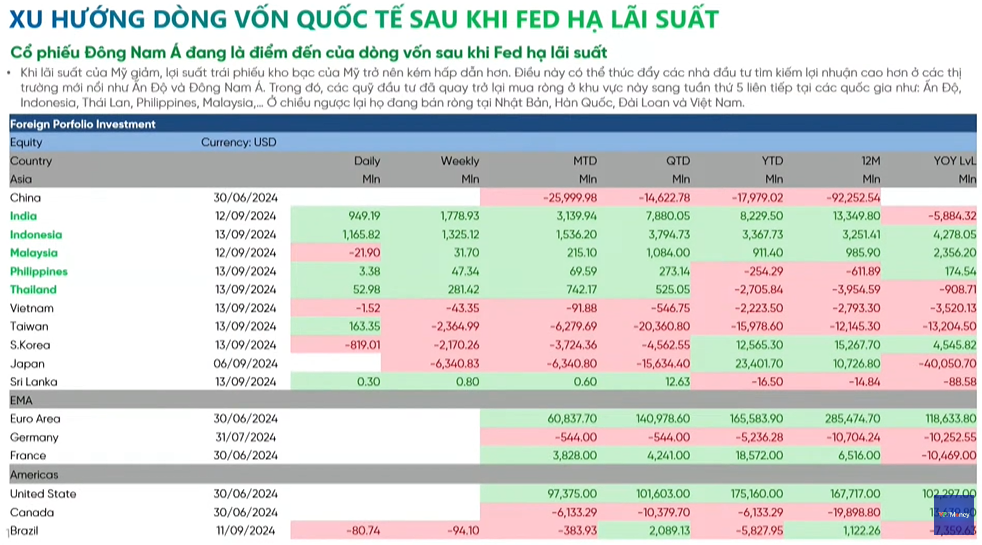

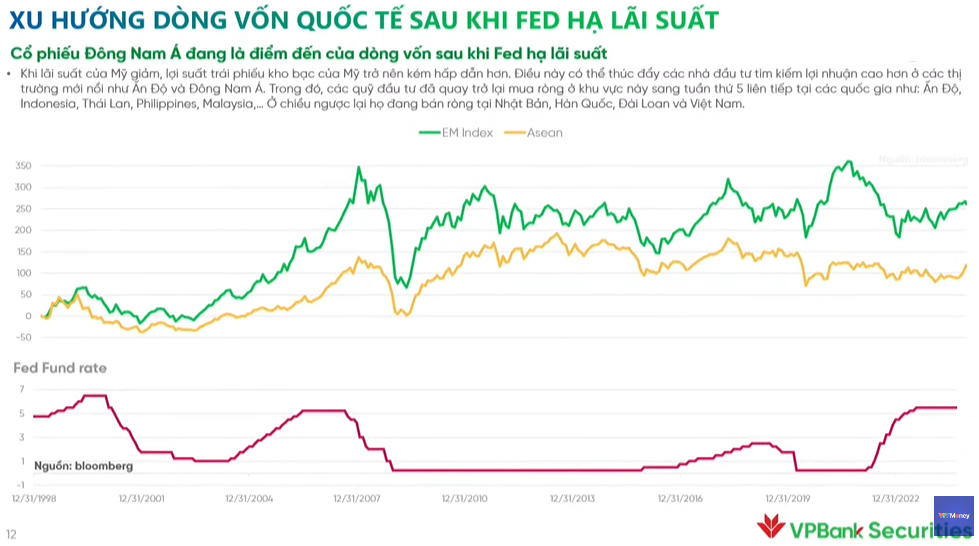

Regarding capital flow trends, after a Fed rate cut, money tends to move from overheated markets to those with higher growth expectations. Recently, Southeast Asian and Asian markets have successfully attracted substantial capital, with notable examples including Thailand, the Philippines, Malaysia, Indonesia, and India. In contrast, strong sell-offs have occurred in Japan, South Korea, and Taiwan, leading to a divergence between index groups.

The capital flow signals in the Southeast Asian region will create a catalyst for capital to return to Vietnam in the near future, possibly towards the end of 2024 or early 2025. Vietnam also has a compelling story to tell for foreign investors, including its recent upgrade and its high-growth, export-oriented, diversified economy.

Comparing the performance of indexes in Southeast Asia and emerging markets more broadly, rate cuts have typically led to relatively weak performance, as recessions have occurred in at least three out of the most recent instances. However, when the Fed cuts rates to a sufficiently low level, these markets tend to perform very well.

Therefore, Mr. Son predicted that capital would flow into Southeast Asian and emerging markets, but not immediately. He anticipated that this shift would occur in 1-2 years, once interest rates reach a sufficiently attractive level.

Source: VTV Money

|

Source: VTV Money

|

Another factor to consider is the significant inflows of capital related to the US stock market, which continue to pour into the money market. During this period of high-interest rates, money market fund assets have reached record levels (over $6 trillion) and may continue to grow. While interest rates are expected to fall in the future, they will likely remain relatively high, allowing money market funds to continue attracting investment. These funds offer three key advantages: stable income and low risk, high liquidity, and returns that outperform bank interest rates.

According to Mr. Son, after a period of rate cuts that bring rates to a certain level, money will start flowing out of these money market funds and back into the market, positively impacting the medium- and long-term performance of the stock market.

Additionally, after the upcoming Fed rate cut, we will enter the US election season. Historical data suggests that the market tends to be weak in the one to two months leading up to the election, often finding a bottom around the election period and then rebounding afterward.

Positive impact of interest rate cuts on the stock market trend

Lower interest rates will provide a boost to the Vietnamese economy, primarily by easing pressure on exchange rates, which is a concern not only for importers and exporters but also for the government.

Secondly, Vietnam’s monetary policy will have more room to maneuver, and the recent challenges posed by Typhoon Yagi will create additional opportunities to cut interest rates. This will provide much-needed support to struggling businesses through concessional loans for post-disaster reconstruction. It also presents an excellent opportunity to introduce favorable credit packages and fiscal support initiatives, such as public investment programs.

Mr. Son predicted that the economy would benefit from these favorable conditions, positively impacting the stock market trend.

Lower interest rates will particularly benefit highly leveraged businesses, creating significant leeway and motivation for their recovery. Typical beneficiaries include real estate, manufacturing, and export sectors.

For banks, while lower interest rates will lead to reduced lending rates, a deeper look reveals a shift towards a more service-oriented structure, gradually reducing the reliance on net interest income. Additionally, the recovery of businesses will help banks reduce bad debts and lower provisioning costs, potentially improving their financial health.