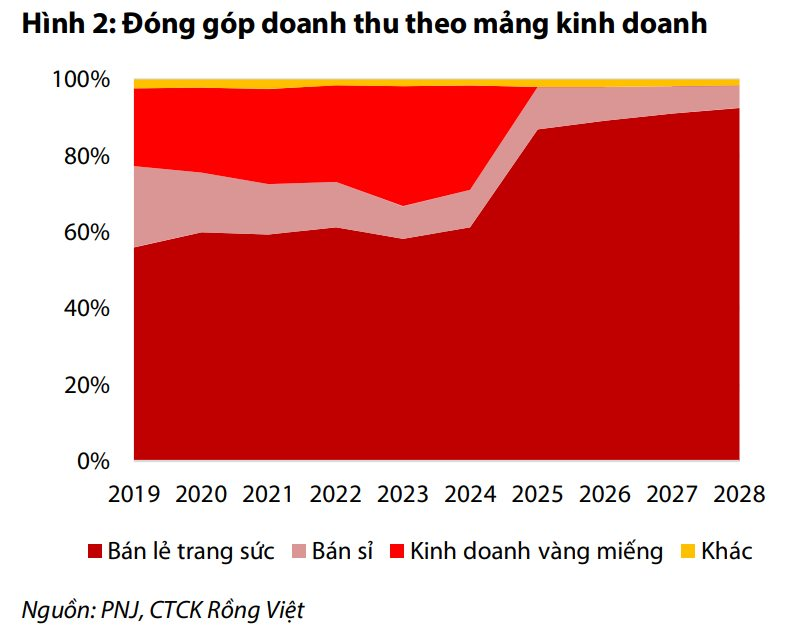

According to Vietcap’s recent analytical report on PNJ, the gold bar business segment is expected to significantly narrow from the second half of 2024 due to tight policies in this market. In the base case scenario, Vietcap projects that this business segment will no longer contribute significantly to revenue.

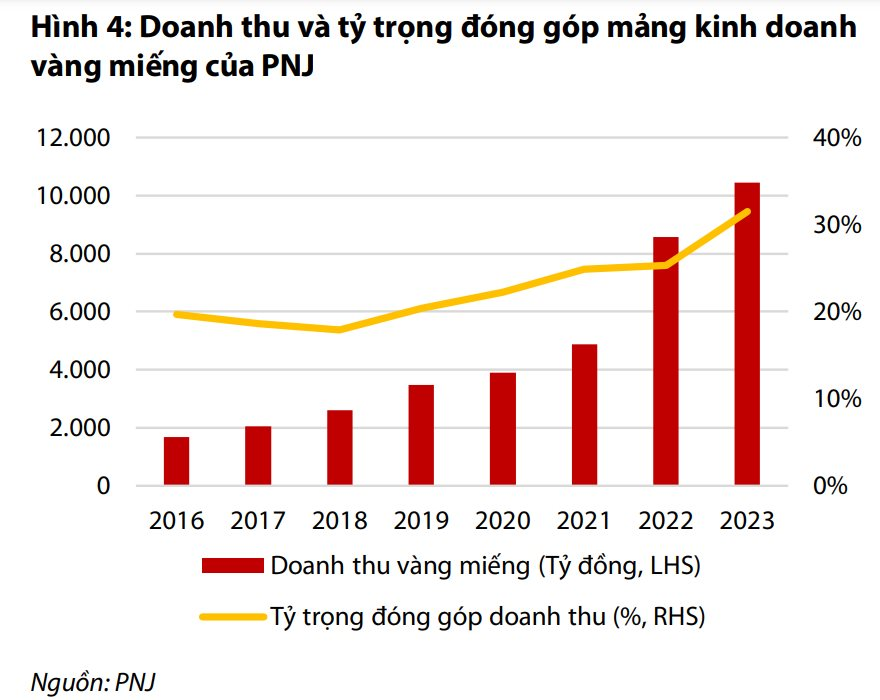

The gold bar business is the second-highest revenue contributor for PNJ, accounting for 31.5% in 2023. However, the gross profit margin for this segment is very low, at approximately 1.0%. PNJ retains this segment as it is a basic need for Vietnamese people and a gateway to generating demand for the company’s other products, such as jewelry and watches.

The contribution ratio of this segment has gradually increased over the years since 2019, following the upward trend in domestic SJC gold prices, stimulating people’s investment demand for gold bars.

According to Vietcap, due to soaring gold prices and the state’s tight management of gold trading activities, especially since the beginning of this year, there has been a lack of gold bar trading activities (or very rare) across the PNJ system from Q3 2024 due to supply shortages. People mostly buy gold bars, with little or no resale.

Vietcap does not anticipate a change in this tight management approach from the authorities as the overarching management goal remains consistent. Therefore, the company projects that the supply shortage for gold bars will persist in the coming years. As a result, PNJ’s revenue from the gold bar segment is expected to cease from 2025 onwards.

In reality, the gold bar business is just a secondary segment for PNJ, which they maintain to attract customers to their core jewelry retail segment. Therefore, PNJ will prioritize gold raw materials for jewelry production rather than focusing on gold bar trading.

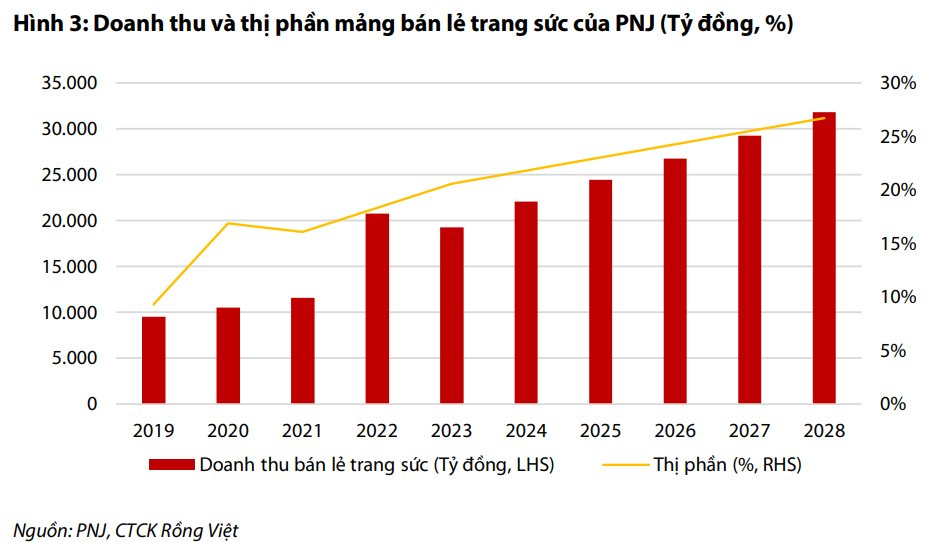

The company’s strategy is to focus on the jewelry retail segment due to its significantly higher profit margin. The retail jewelry segment is the highest revenue contributor, accounting for 58.2% in 2023. During 2018-2023, PNJ’s jewelry retail revenue grew at a rate of 18.6% per year.

Although PNJ focuses on developing the jewelry retail segment, its proportion did not change significantly during 2019-2023 due to the rise in domestic gold prices since mid-2019, stimulating investment demand for gold bars.

According to Vietcap’s estimates, PNJ has continuously increased its market share from 7% in 2018 to 21% in 2023, becoming the leading jewelry enterprise in Vietnam. Vietcap projects that PNJ’s market share will continue to rise from 21% in 2023 to 27% in 2028. As a result, the revenue of the retail jewelry segment is expected to grow at a rate of 10.5%/year for the period 2023-2028 (higher than the market growth rate of 4.9%/year).

In the wholesale segment, the revenue contribution ratio decreased steadily from 29.2% in 2016 to 8.6% in 2023 due to PNJ’s strategic decision to reduce focus on this segment.

In 2023, due to the decline in jewelry retail sales stemming from weak demand, PNJ strengthened its wholesale segment by: diversifying its wholesale product portfolio to align with customer needs based on data analysis; reinforcing the PNJP brand in the wholesale market; and investing in technology and innovation to enhance production capacity.