26 Localities Offered Tax Exemptions, Reductions, and Extensions to Support Individuals, Businesses, and Organizations

Specifically, Official Dispatch No. 4062 states that the Tax Departments in 26 provinces and cities, where organizations, individuals, and businesses have suffered damage due to Typhoon No. 3 and the subsequent floods, will guide taxpayers on implementing regulations related to tax exemptions, reductions, extensions, and policies for those affected by natural disasters.

The list of 26 provinces and cities includes: Quang Ninh, Hai Phong, Thai Binh, Nam Dinh, Hoa Binh, Lao Cai, Yen Bai, Son La, Lai Chau, Dien Bien, Ha Giang, Cao Bang, Bac Kan, Thai Nguyen, Tuyen Quang, Phu Tho, Vinh Phuc, Lang Son, Bac Giang, Bac Ninh, Hai Duong, Hanoi, Hung Yen, Ha Nam, Ninh Binh, and Thanh Hoa.

Various Tax Exemptions, Reductions, and Extensions

According to legal regulations on tax exemptions, reductions, and extensions, taxpayers who have suffered physical damage, directly affecting their production and business operations due to force majeure as specified in Clause 27, Article 3 of the Law on Tax Administration No. 38/2019/QH14, are eligible for an extension on their tax payment deadline.

Specifically, businesses impacted by natural disasters are granted a 1- to 2-year extension on their tax payments, depending on the extent of typhoon-related damage. Businesses can also deduct value-added tax on input goods for production and business activities, and are exempt from late payment fines and administrative violations related to tax management.

Businesses affected by natural disasters are also entitled to a maximum reduction of 30% on their special consumption tax for the year the damage occurred, not exceeding the value of damaged assets after compensation (if any).

Regarding resource tax, businesses are exempt from or receive reductions in this tax for lost resources. If they have already paid the tax, they will be refunded or have the amount deducted from their next resource tax payment. Businesses also receive a 50% reduction in land use tax if their land and premises are damaged.

For individuals and households engaged in business who are affected by natural disasters, there are reductions in personal income tax, special consumption tax, and resource tax. The personal income tax reduction corresponds to the extent of damage but does not exceed the payable tax amount.

The special consumption tax is reduced proportionally to the damage but does not exceed 30% of the payable tax amount. The resource tax is reduced corresponding to the lost resources; if the tax has already been paid, it will be refunded or deducted from the next resource tax payment.

Procedures and Documents for Tax Exemptions, Reductions, and Extensions for Households and Individuals Engaged in Business

For households and individuals engaged in business, according to the Law on Personal Income Tax (PIT); the Law on Special Consumption Tax, and the Law on Resource Tax, those facing difficulties due to natural disasters are eligible for reductions in personal income tax, special consumption tax, and resource tax.

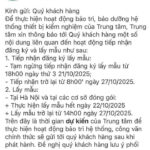

These households and individuals should submit their applications for tax reductions as per the provisions of Articles 53, 54, and 55 of Circular No. 80/2021/TT-BTC dated September 29, 2021, issued by the Ministry of Finance.

Within 30 days (or 40 days in cases requiring on-site inspection) from the receipt of complete documents, the tax authority will decide on tax exemption or reduction or notify in writing the reasons for not granting the reduction.

According to the regulations, households and individuals engaged in production and business activities in the economic sectors and fields specified in Clauses 1, 2, and 3 of Article 3 of Decree No. 64/2024/ND-CP dated June 17, 2024, are allowed to extend the deadline for value-added tax (VAT) and personal income tax payments until December 30, 2024, at the latest.

Households and individuals engaged in business only need to submit a request for extension by September 30, 2024, to benefit from the tax payment extension.

The tax authority will not charge late payment interest on the amount of tax and land rent that is extended within the extended period (including cases where the taxpayer submits the request for extension to the tax authority after filing the tax declaration or where the competent authority inspecting and auditing the taxpayer finds that the taxpayer is eligible for extension and has an additional amount payable for the extended tax periods).

If the tax authority has already charged late payment interest on tax declarations that are eligible for extension under this Decree, the authority shall make adjustments and not charge late payment interest.

For households engaged in business that have suffered physical damage, directly affecting their production and business operations due to natural disasters (floods), they are granted an extension on tax payments for no more than 02 years from the tax payment deadline. Taxpayers are exempt from fines and do not have to pay late payment interest on the tax debt during the extension period.

The Best Just Got Better: Vietnam’s Rice Triumphs Again

Indonesia, the second-largest importer of Vietnamese rice, has just announced a tender for nearly half a million tons of rice, with delivery requested in October and November.