As is customary, the chorus of profit mismatches on self-prepared and audited financial statements rang out during the 2024 semi-annual report season.

According to data from VietstockFinance, as of September 13, 2024, a total of 271 enterprises on the HOSE, HNX, and UPCoM exchanges published audited financial statements that differed from their self-prepared ones.

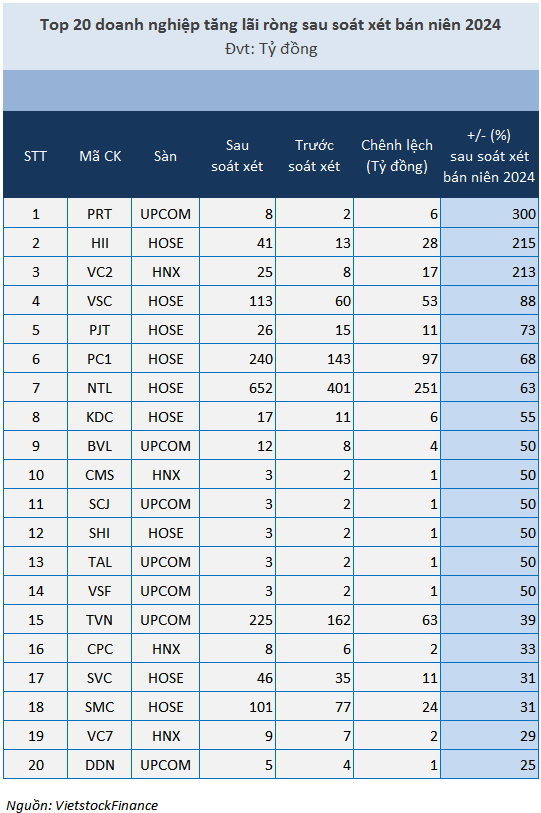

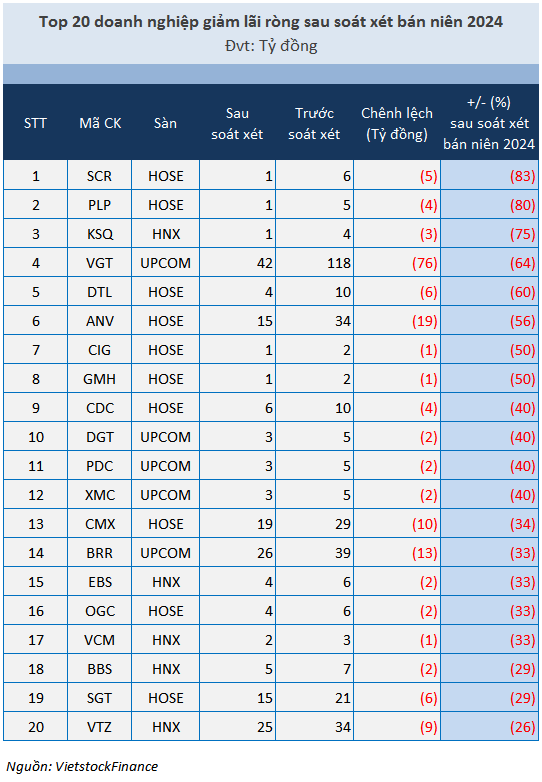

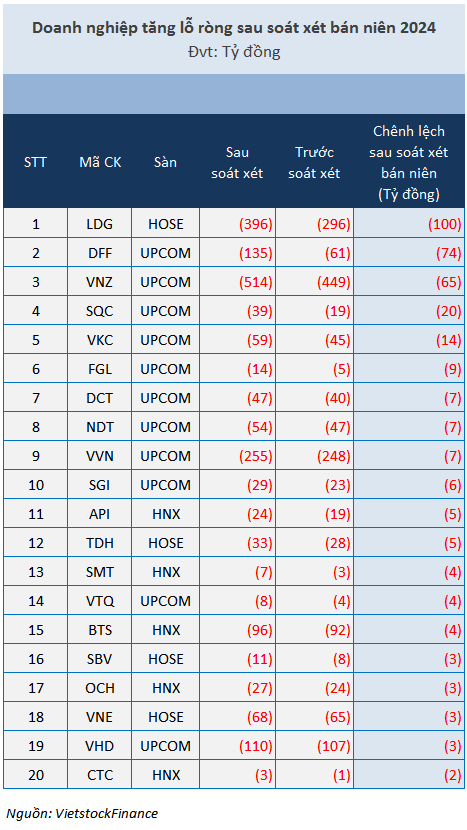

Of these, 125 enterprises reported reduced profits, 37 reported increased losses, and 9 turned from profitable to loss-making. On the other hand, 86 enterprises reported increased profits, 12 reduced losses, and only 2 turned from losses to profits.

Hundreds of billions added in profit after the audit

Among the enterprises that gained additional profits after the audit, it is worth mentioning the case of Urban Development and Construction Corporation – Tu Liem (HOSE: NTL), with a significant increase of hundreds of billions of dong in half-yearly net profit. This was also the highest absolute value profit difference among enterprises with profit mismatches after the audit.

Specifically, compared to the self-prepared report, NTL’s net profit for the first half of 2024 increased by VND 251 billion, reaching VND 652 billion after the audit; a 63% increase. This result was achieved due to a VND 538 billion (61% increase) rise in revenue and a nearly VND 196 billion (55% increase) rise in cost of goods sold compared to the self-prepared figures.

According to NTL, the auditing firm added revenue and cost of goods sold regarding the land area sold to customers of the Bãi Muối Urban Area project (belonging to Cao Thắng, Hà Khánh, and Hà Lầm wards in Hạ Long city, Quảng Ninh province) – even though there were still outstanding payments as of June 30, 2024, but it was determined that the conditions for recognizing revenue in the first half of 2024 had been met.

NTL’s net profit for the first half of this year was also significantly higher than the previous year (145.2 times higher) in the self-prepared report. With the audited results, NTL’s net profit was more than 236 times higher than the previous year. Furthermore, NTL also exceeded its 2024 profit plan, reaching nearly 164% instead of just 57% in the previous self-prepared report.

In terms of growth rate, Binh Duong Production – Import Export Corporation (UPCoM: PRT) led the increase in half-yearly profit after the audit, with a 300% growth rate, equivalent to a VND 6 billion increase, reaching nearly VND 8 billion. The reason was the reversal of financial investment provisions of subsidiaries, joint ventures, and associates when re-evaluated according to the audited reports of these units.

Another case of a significant increase in net profit after the 2024 semi-annual audit was An Tien Industries Joint Stock Company (HOSE: HII) with an additional nearly VND 28 billion, 3.2 times higher than the self-prepared report. According to HII, this change was mainly due to a reduction in financial expenses and an increase in profit from associated companies.

“Shrinking” net profit through the lens of the audit

In absolute terms, Vietnam National Textile and Garment Group (UPCoM: VGT) experienced the most significant reduction in net profit, with a 64% decrease, equivalent to VND 76 billion, compared to the self-prepared report.

In its explanation, VGT stated that the Group currently has 34 subsidiaries, 31 associated companies, and numerous other financial investments. The audited semi-annual consolidated financial statements of the Group were based on the financial statements of its subsidiaries and associated companies. During the audit, the auditing firm adjusted the figures according to the audited financial statements of these subsidiaries and associated companies, which affected the consolidated financial results of the Group.

In terms of the rate of “evaporation” of net profit, Saigon Thuong Tin Real Estate Joint Stock Company (HOSE: SCR) topped the list with an 83% decrease, a difference of about VND 5 billion, due to differences in tax calculation between the Company and the auditing firm.

Another case is CNC Capital Vietnam Joint Stock Company (HNX: KSQ) – with a 75% decrease in net profit because the Company adjusted financial revenue down by more than VND 3 billion. The reason is that in 2024 and the coming time, the Company’s management has decided to expand and transform its field of business, so the Company is evaluating and recovering unviable investments to concentrate financial resources on more sustainable business activities and has decided to terminate old business cooperation contracts ahead of schedule. Therefore, the Company did not recognize the interest income from capital contribution activities from the date of signing the contract termination minutes up to June 30, 2024.

Mounting losses

When it comes to more “tragic” situations after the audit, we cannot fail to mention the case of LDG Investment Joint Stock Company (HOSE: LDG), which incurred an additional loss of VND 100 billion, bringing the net loss to nearly VND 400 billion. The main reason was that the auditing firm adjusted the additional provision for doubtful accounts receivable.

Similarly, Fat Racing Group Joint Stock Company (UPCoM: DFF) saw its net loss increase by VND 74 billion compared to the self-prepared report – from VND 61 billion to VND 135 billion after the audit, as the Company had to provision for interest expenses payable arising during the period for loans from the Vietnam Bank for Agriculture and Rural Development (Agribank) and Saigon – Hanoi Commercial Joint Stock Bank (SHB)… amounting to VND 76 billion.

Meanwhile, Saigon – Quy Nhon Minerals Joint Stock Company (UPCoM: SQC) also incurred an additional loss of VND 20 billion compared to the self-prepared report, due to increased provisions for impairment of investment losses.

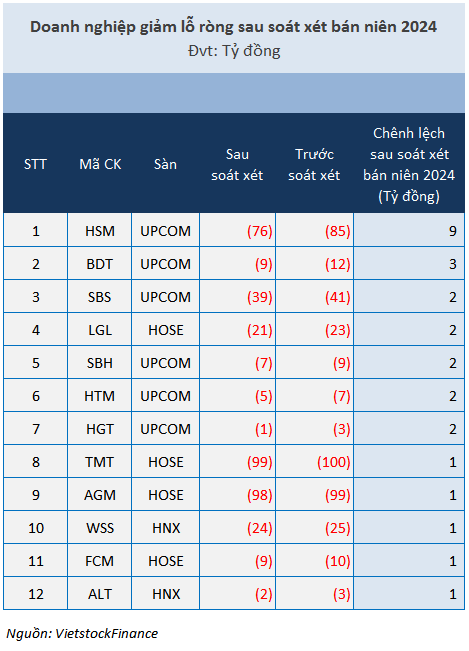

Small reduction in losses after the audit

While some enterprises suffered significant increases in losses after the audit, others saw small reductions in losses, ranging from VND 1-9 billion.

Hanoi Textile and Garment Joint Stock Corporation (UPCoM: HSM) narrowed its loss from VND 85 billion to VND 76 billion after the audit, equivalent to a VND 9 billion reduction.

This discrepancy was due to the recognition of profit from financial activities in the audited consolidated financial statements, which included the entire amount of capital withdrawal from its subsidiary, Halotexco Garment Joint Stock Company.

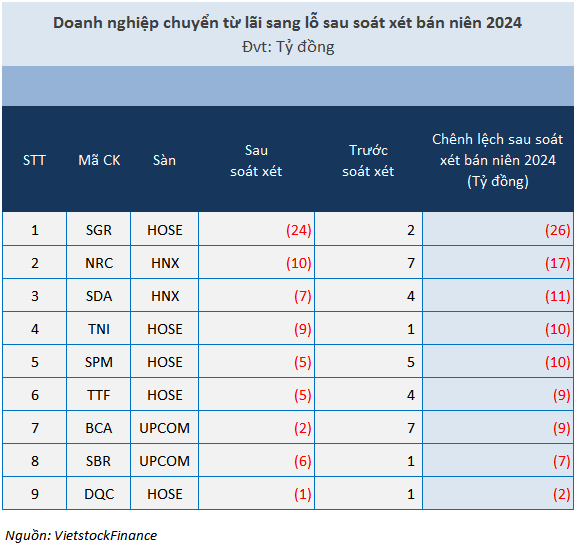

Profit turns into loss

More unfortunate than incurring additional losses is that the net profits of many units in the self-prepared reports have “vanished into thin air,” turning into losses like SGR, TNI, and SBR…

Specifically, due to a reduction in revenue from real estate transfers (this revenue will be transferred to the next period when the recognition conditions are met) and an increase in selling expenses after the audit due to the provision for doubtful accounts as proposed by the auditing firm, Saigon Real Estate Corporation (HOSE: SGR) incurred a net loss of VND 24 billion instead of a profit of VND 2 billion as in the self-prepared report.

Meanwhile, Thanh Nam Group Joint Stock Company (HOSE: TNI) turned from a profit of VND 1 billion to a net loss of VND 9 billion after the audit because the Company had not made provisions for inventory and part of the uncollectible debt that was recognized as other income.

Real profit, fake loss

Two ironic cases of “fake loss, real profit” were Dak Lak Rubber Joint Stock Company (UPCoM: DRG) and Vietnam Water and Environment Investment Corporation (UPCoM: VIW).

Accordingly, DRG turned from a loss of VND 3 billion to a profit of VND 5 billion after the audit. This discrepancy arose because when Daklak-Mondulkri Rubber Development Limited Company (a subsidiary of DRG in Cambodia) prepared its financial statements, it recorded the expenses for the period incorrectly, which were adjusted according to the audit (the business results of the subsidiary in the self-prepared report were a loss of VND 0.89 billion, and after the audit, it turned into a profit of nearly VND 7 billion), which then affected the consolidated financial statements of the parent company.

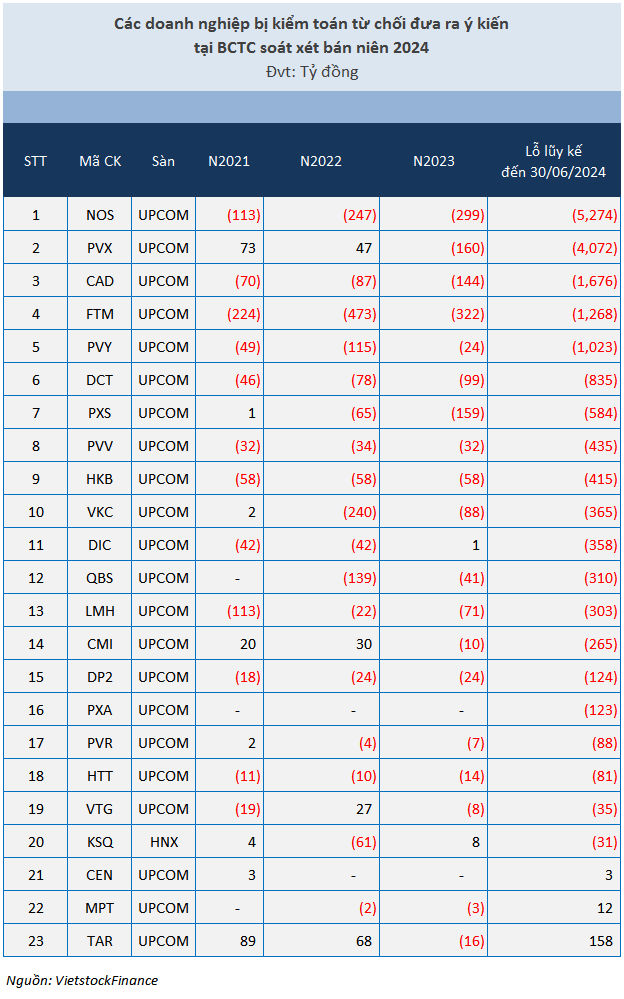

Auditors “refuse to understand”

Most of the enterprises that received a refusal of opinion from the auditing firms reported cumulative losses as of June 30, 2024. Among them, PVX is an all-too-familiar name.

After being delisted from the exchange and moved to UPCoM in mid-2020 due to continuous losses and a series of refusals of opinion from the auditing firms, Vietnam Oil and Gas Construction Joint Stock Corporation (UPCoM: PVX) once again received a refusal of opinion from the auditing firm for its 2024 semi-annual audited financial statements. This is also the sixth consecutive year that PVX has been refused an opinion by the auditing firm, with cumulative losses exceeding VND 4,000 billion.

Regarding Phuong Dong Sea Transport and Trading Joint Stock Company (UPCoM: NOS), although its cumulative losses amounted to nearly VND 5,300 billion as of June 30, 2024, this is the first time NOS has been refused an opinion by the auditing firm.

According to the auditing firm, at the time of issuing the audit report for the six-month period ending June 30, 2024, they had not received confirmation of the balances of accounts receivable and investments.

“Due to the significance of the above matters, we were unable to obtain sufficient appropriate audit evidence to form a basis for an audit conclusion. Therefore, we cannot express an opinion on the financial statements for the period from January 1, 2024, to June 30, 2024,” the auditing firm stated.

Khang Di

The Billion-Dollar Company’s Shares Halted as All Auditors Refuse to Review

The ITA stock is currently restricted and only tradable during the afternoon session from July 16th onwards.