Ho Chi Minh City Stock Exchange (HoSE) has notified Tan Tao Investment and Industry Corporation (code: ITA) of the suspension of trading in ITA shares based on the provisions of Point c, Clause 1, Article 41 of the Listing and Trading Rules of Listed Securities issued under Decision No.17/QD-HĐTV dated March 31, 2022, of the Vietnam Stock Exchange.

According to HoSE, ITA shares are currently restricted from trading due to the company’s delay in submitting its 2023 audited financial statements (AFS) by more than 45 days from the prescribed deadline. This falls under the scope of Point a, Clause 1, Article 39 of the Listing and Trading Rules of Listed Securities issued under Decision No.17/QD-HĐTV dated March 31, 2022, of the Vietnam Stock Exchange.

On August 27, ITA sent Official Letter No. 260/CV-ITACO-24 to the State Securities Commission of Vietnam and HoSE, requesting a temporary postponement of the publication of its 2023 AFS, 2023 Annual Report, and 2024 Semi-annual Reviewed Financial Statements due to force majeure. Previously, in June, the State Securities Commission had responded to the company’s request for a temporary postponement of information disclosure.

On September 4, HoSE issued Official Letter No. 1368/SGDHCM-NY reminding the company of its delayed disclosure of the 2024 Semi-Annual Reviewed Financial Statements. As of now, the company has yet to publish its 2024 Semi-Annual Reviewed Financial Statements.

ITA has affirmed that it has provided detailed explanations for the force majeure event that has persisted for several months. Specifically, despite the company’s best efforts to contact and persuade all auditing firms (30 auditing firms approved to audit public interest entities in the securities sector in 2023), all of them have refused.

The main reason for the refusals, according to ITA, is the suspension of four auditors by the State Securities Commission of Vietnam. These auditors had conducted audits for Tan Tao’s 2021 and 2022 AFS and the 2023 Semi-annual Reviewed Financial Statements.

In the past, ITA was one of the leading industrial real estate developers in Vietnam. Founded in 1993, the company was chaired by Ms. Dang Thi Hoang Yen, who was born in 1959 and graduated from the University of Economics Ho Chi Minh City. She was a well-known businesswoman and ranked among the top 10 richest people in the Vietnamese stock market for three consecutive years from 2008 to 2010.

However, in 2012, ITA faced significant challenges due to economic factors, causing the share price to drop to one-tenth of its value at the time of listing in 2006. Since then, Ms. Yen has been notably absent from the company’s annual general meetings, each time citing different reasons.

After an eight-year absence, Ms. Yen suddenly reappeared at the 2020 Annual General Meeting of Tan Tao via an online format. Following this, she became more involved and later changed her name to Maya Dangelas.

2021 also marked the year when the Chairman declared that Tan Tao would return to its golden age, with a primary focus on boosting business in the United States. Nevertheless, according to the 2022 audited financial statements, Tan Tao incurred a substantial loss of over VND 260 billion.

Currently, ITA has a charter capital of nearly VND 9,400 billion, corresponding to more than 938 million circulating shares. However, its market capitalization has dwindled to around VND 3,000 billion due to a steep decline in share prices. ITA shares are currently only traded in the afternoon session since July 16 due to trading restrictions.

The Stock Market Update: Trading Preview for September 16th

Recently, listed companies have been in communication with the Ho Chi Minh City Stock Exchange (HoSE) and the Hanoi Stock Exchange (HNX) to disclose information as per regulations.

Will MWG Stock Return to the Nearly VND 13,000 Billion ETF Portfolio with the VNDiamond 3.0 Update?

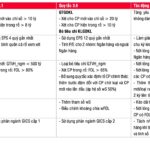

SSI Research has reported that the VNDiamond Index’s rules have been revised to tighten liquidity conditions for stocks while relaxing FOL conditions. The new rules also amend the P/E filter criteria, introduce a formal stock basket determination rule, and add a wS parameter to curb volatility in the index.