A glance at CTP’s price chart at this point would surprise many. The stock price was stagnant until mid-Q2, surged strongly until the end of July, and then skyrocketed from the beginning of August 2024. As of September 13, CTP’s price continued to rise, closing at 42,700 VND/share.

| CTP has been on a steep upward trajectory since the beginning of August 2024 |

This level is more than five times higher than the price of 8,200 VND/share at the beginning of August and nearly 9.5 times higher than the price of 4,500 VND/share at the beginning of the year.

So, what caused the CTP stock price to surge so drastically?

Lackluster Business Performance

Behind the shocking increase in a stock’s price, there is usually positive information, such as impressive business results, growth plans, or positive changes in shareholder structure…

In the case of CTP, it is unlikely to be a story of business performance. From 2019 and prior, the company generated revenue in the hundreds of billions of VND with profits ranging from 6 to 19 billion VND annually. From 2020 to 2023, while revenue remained in the billions, profits declined miserably to just a few hundred million.

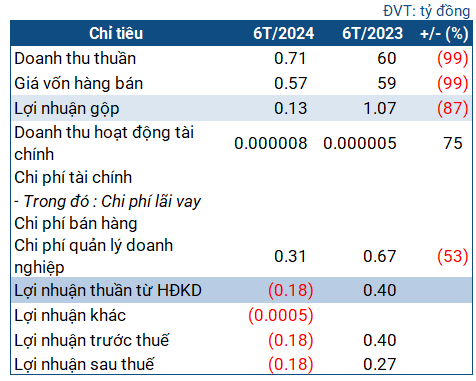

Notably, in the reviewed semi-annual financial statements for the first half of 2024, CTP reported a loss of 178 million VND. Compared to the plan approved by the 2024 Annual General Meeting of Shareholders, which targeted 300 billion VND in revenue and 16 billion VND in pre-tax profits, CTP has yet to make significant progress towards these goals.

|

CTP’s business targets for the first half of 2024

Source: VietstockFinance

|

It is known that CTP, formerly known as Commercial Trading Public Joint Stock Company, was established in 2010 with a charter capital of 3 billion VND. Despite starting as a company in the agricultural sector, specializing in coffee production, CTP mainly operates in the fields of construction materials and real estate, according to its 2023 annual report.

CTP explained that the real estate market faced numerous challenges and difficulties in the first two quarters, directly impacting the company’s primary business. Regarding the additional loss, it was due to an additional expense of 49 million VND for office rent in the first six months and a portion of late payment penalties to the state budget (over 456 thousand VND).

As of June 30, 2024, CTP’s total assets amounted to 153 billion VND, a 21% decrease from the beginning of the year. The company held nearly 3.5 billion VND in cash (compared to nearly 290 million VND at the beginning of the year). Notably, the company had almost no long-term assets, including fixed assets.

| CTP’s business performance from 2015 to the present |

Leadership Changes: Out and Then Back In?

Amid the lackluster business performance, CTP’s management also faced issues. On May 30, 2024, all eight members of CTP’s management board simultaneously submitted their resignations. This included the Board of Directors for the 2023-2028 term, comprising Chairman Nguyen Tuan Thanh, Vice Chairman Le Minh Tuan, Independent Member Nguyen Thi Thao Nhi, and two Board members, Phan Mai Anh Tai and Khau Minh Quan, who cited “personal reasons” for their inability to continue their roles.

For the same reason, the members of CTP’s Supervisory Board also resigned, including Chairman Le Thi Bich Ngoc, along with two members, Nguyen Thi Thanh Phuong and Nguyen Thi Ngoc My. Ms. Ngoc submitted her resignation on May 29, while the other two did so on May 30.

Around the same time, the Chairman and Vice Chairman of CTP registered to sell all their shares between May 16 and June 10. Mr. Thanh intended to sell 1.54 million shares, while Mr. Tuan planned to sell 231,300 shares. This transaction was unsuccessful, prompting the two leaders to re-register to sell their shares. This time, Mr. Thanh sold 741,600 shares, and Mr. Tuan sold 31,000 shares from June 21 to July 19. They then registered to sell the remaining shares but have not been successful so far.

|

CTCP Mingcha’s initial shareholders included CTCP Dau Tu Landmarks (holding 24%) and Mrs. Khau Thi Minh Phuong (wife of CTP’s Chairman, Nguyen Tuan Thanh), who held 25%. Mrs. Phuong also served as the company’s Director and legal representative. By 2022, Mr. Nguyen Le Viet Hung took over as General Director and legal representative. At this point, Mrs. Phuong held 99% of the capital. |

The resignations of the management team were approved at the 2024 Annual General Meeting of Shareholders, held on June 29. Interestingly, almost all of them were re-elected to their positions at the same meeting. Only three people actually left: Mr. Pham Mai Anh Tai and Khau Minh Quan from the Board of Directors, and Ms. Nguyen Thi Thanh Phuong from the Supervisory Board. They were replaced by Mr. Tran Cong Thanh, who later became the Vice Chairman of the Board of Directors, Mr. Duong Van Tinh, who joined the Board, and Mr. Tran Manh Linh, who assumed the role of Supervisory Board member.

Prior to this, in November 2023, CTP’s shareholder structure underwent significant changes. Major shareholders like CTCP Mingcha and CTCP Dau Tu Landmarks, followed by Mr. Nguyen Le Viet Hung, the General Director and legal representative of Mingcha, successively divested their holdings. Notably, these major shareholders were all related to the company’s leadership.

New Plans

Despite the lackluster business performance and internal turmoil, CTP has not been devoid of positive news.

Recently, CTP announced that it had signed a contract to undertake the construction of a project for the Takara Hoa Binh Resort, owned by the Hoa Binh Tourism and Eco-Tourism Development Joint Stock Company. Additionally, CTP plans to invest in and co-develop this project, which spans 60 hectares and has a total investment of nearly 500 billion VND. The company estimates that the project will generate thousands of billions of VND in revenue.

|

Hoa Binh Tourism and Eco-Tourism Development Joint Stock Company was established in 2018, headquartered in Hanoi, specializing in eco-tourism and amusement services. The company currently has a charter capital of 300 billion VND, with Ms. Pham Kim Oanh holding 99% and Ms. Tran Thi Thuy holding 1%. On the other hand, O.C.D International Trading and Service Group Joint Stock Company, formerly known as O.C.D International Trading and Service Joint Stock Company, was established in 2009. With a charter capital of 100 billion VND, Ms. Le Thi Kha serves as its Director. The company’s primary business line is pawnshop services. On its website, O.C.D presents itself as a company with over 15 years of experience in five key areas: real estate, construction, financial investment, commercial services, and entertainment. |

Moreover, CTP intends to collaborate with O.C.D International Trading and Service Group Joint Stock Company, the owner of the OCD building located in a “golden land” area in O Cho Dua Ward, Dong Da District, Hanoi. O.C.D is also the owner of a mixed-use service complex, an 18-hole golf course, an eco-tourism and resort project in Thung Nai (Hoa Binh, with an investment of about 1,300 billion VND), and an eco-tourism film studio project in Luong Son (Hoa Binh, with an investment of 500 billion VND). Additionally, they own a pig farm project in Son La province.

In the opposite direction, O.C.D is expected to become a major shareholder of Minh Khang Capital in the near future.

CTP believes that these plans are promising and are expected to mark a strong transformation after years of lackluster business performance. Could this be the reason for the surge in CTP’s stock price over the past month?

|

Did CTP engage in price manipulation? On December 2, 2020, the State Securities Commission (SSC) announced sanctions against Mr. Le Van Hoan for price manipulation. Based on the investigation results of the public security agency and the monitoring and inspection of the SSC, Mr. Hoan used 29 trading accounts to continuously buy and sell, creating artificial supply and demand, and manipulating the stock price of Commercial Trading Public Joint Stock Company, now known as Minh Khang Capital Trading Public Joint Stock Company (HNX: CTP). The SSC stated that “there was no illegal profit from Mr. Le Van Hoan’s violation.” For this violation, Mr. Hoan was fined 600 million VND. |