Should private corporate bonds be reserved for ‘professional players’?

These are Mr. Minh’s insights shared with the press regarding the new regulations on professional securities investors being proposed in the amended Securities Law draft.

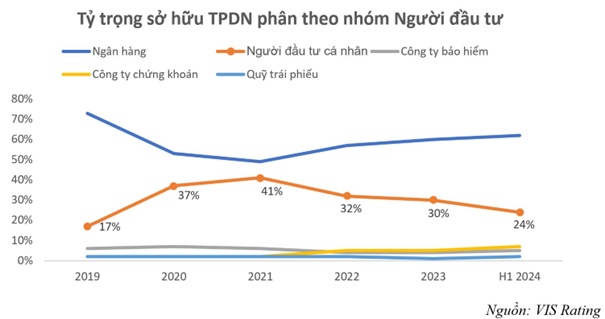

Mr. Minh stated that individual investors currently hold the second-largest proportion of corporate bonds, only after banks, and significantly more than other organized investor groups (insurance companies and investment funds). In 2021, individual investors accounted for the highest proportion, holding 41% of the total market size, while banks held 49%. “Recently, this proportion has gradually decreased to 24% as of June 2024, but the position remains unchanged,” he said.

Mr. Tran Le Minh – General Director of VIS Rating

|

However, it is noteworthy that most of these investors are small retail investors, not professional groups. “Many cases of investing in bonds as an alternative to savings deposits assume that this product is highly safe. This is unreasonable and stems from the market’s reality and needs adjustment,” he added.

According to Mr. Minh, the new draft notably adds regulations specifying that professional securities investors participating in purchasing, trading, and transferring private corporate bonds are organizations. This implies that privately issued corporate bonds are only to be issued and traded among professional institutional investors.

“The drafting committee has also provided detailed explanations for this opinion based on the market’s actual developments and characteristics, as well as the practices and experiences of other countries in the region. I believe that market participants agree with the view that the privately issued corporate bond market is intended for professional investors,” he shared.

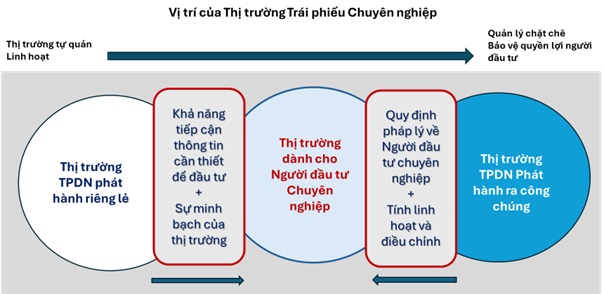

“Given the nature of the privately issued corporate bond market, the disclosure of information related to bonds and issuing organizations is significantly less, state management is relaxed, and the market’s self-regulation is enhanced. Moreover, the diversity in negotiating bond terms and conditions has made this type of corporate bond a complex product requiring in-depth knowledge to invest and unsuitable for retail investors.”

Countries have specific regulations for the corporate bond market

Sharing insights on other markets, Mr. Minh stated that the ASEAN +3 countries (China, South Korea, and Japan) have specific legal regulations for privately issued corporate bond markets and investor qualifications. A common thread is that privately placed corporate bonds are not intended for the public. Investors must meet certain conditions to participate in this market.

“Currently, the regulations related to professional investors only mention asset and transaction requirements and do not quantify experience and knowledge prerequisites. The regulations concerning individual professional investors in all the aforementioned countries are stipulated in the highest legal documents, such as laws or decrees,” said Mr. Minh.

Source: ASEAN+3 Bond Market Forum

|

Additionally, Mr. Minh noted that global markets consider privately placed corporate bonds as “exempted securities,” falling outside the scope of the Securities Law. When issuing such bonds, organizations are exempt from registration and the management of the countries’ Securities Commissions.

The practical shortcomings of the corporate bond market exposed in the past have been addressed through the issuance of Decree No. 65/2022/ND-CP. Moreover, the amendments related to the publicly issued corporate bond market and professional securities investors in the new draft, with a streamlined process, underscore the urgency of the issue, according to Mr. Minh.

“To achieve the goal of expanding the corporate bond market to reach 25% of GDP by 2030, the market needs a rapid recovery phase. Observable data to assess the market’s recovery includes the total value of outstanding bonds in the market reaching the peak of 2022 again and the value of newly issued bonds exceeding the issuance value of 2021. While it is crucial to create a suitable legal framework to promote rapid recovery, we must not compromise stability for growth.

Therefore, I believe that the objective of the current Securities Law amendment is to establish a stable and long-term development phase, aligning with market dynamics and creating a foundation for a more transparent market recovery, without repeating the unreasonable aspects or risks that occurred in the private corporate bond market in the past,” he added.

“Tightening” Corporate Bond Issuance: Considering Market Development

The new regulations have sparked concerns within the industry that they may constrict the private bond market. The fear is that the dual impact of reduced capital-raising opportunities for businesses and a decrease in individual investor participation could shrink this market.