The VN-Index closed at 1,239.26 points on September 16, 2024, a decrease of 0.99% from the previous trading session.

The total trading value on the three exchanges reached VND14,768.0 billion, an increase of 20.4% compared to the previous session. Of this, the matched order trading value reached VND11,618.4 billion, up 14.5% from the previous session but down -2.9% and -24.2% compared to the 5-day and 20-day averages, respectively.

In terms of sector performance, liquidity increased notably in Chemicals, Banks, and Construction, while it decreased in Securities, Information Technology, and Retail. Regarding price movements, the Construction, Rubber & Plastics, Forestry & Wood Processing sectors gained, while the remaining sectors lost ground.

Foreign investors recorded a net buy position of VND 252.4 billion, with a net buy position of VND 208.5 billion in matched orders.

The main sectors that foreign investors net bought on the matched orders were Banks and Information Technology. The top stocks that foreign investors net bought on the matched orders included TCB, NAB, VNM, FPT, CTG, VHM, TPB, KDH, DPM, and BMP.

On the selling side, foreign investors net sold Basic Materials stocks on matched orders. The top stocks that foreign investors net sold on matched orders included HSG, MWG, VCI, PDR, HPG, DCM, GMD, KBC, and NKG.

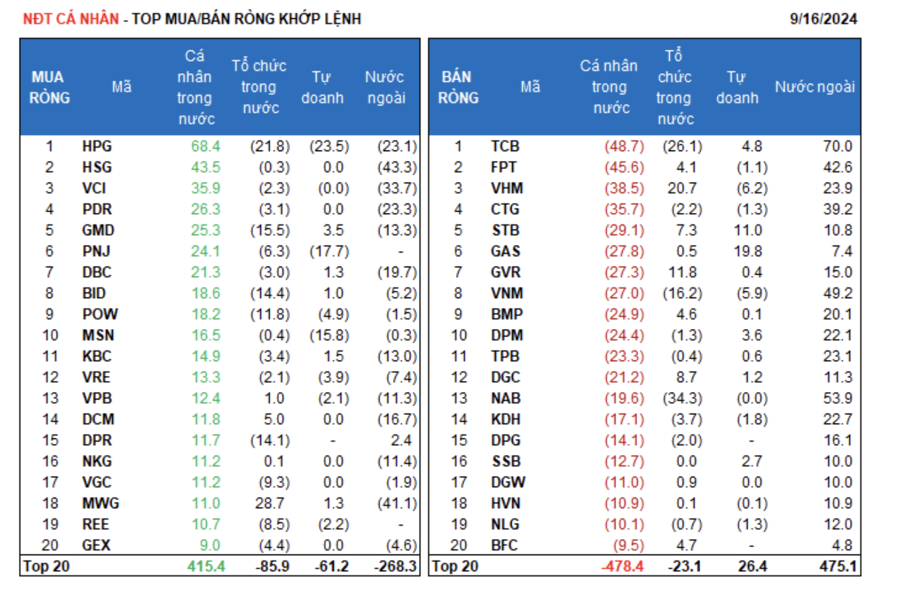

Individual investors recorded a net buy position of VND 22.8 billion, with a net sell position of VND 46.7 billion in matched orders. In terms of matched orders, they net bought 10 out of 18 sectors, mainly Basic Materials. The top stocks that individual investors net bought included HPG, HSG, VCI, PDR, GMD, PNJ, DBC, BID, POW, and MSN.

On the selling side, they net sold 8 out of 18 sectors on matched orders, mainly Banks and Chemicals. The top stocks that individual investors net sold included TCB, FPT, VHM, CTG, STB, GAS, VNM, BMP, and DPM.

Proprietary trading recorded a net buy position of VND 41.1 billion and a net sell position of VND 69.5 billion in matched orders.

In terms of matched orders, proprietary trading net bought 6 out of 18 sectors, with the main sectors being Banks, Electricity, Water & Gas. The top stocks that proprietary trading net bought on matched orders included GAS, VCB, STB, TCB, VIB, DPM, GMD, SSB, BAF, and HDB. On the selling side, they focused on Basic Materials stocks. The top stocks that proprietary trading net sold included HPG, PNJ, MSN, SSI, MBB, TLG, VHM, VNM, POW, and SAB.

Domestic institutional investors recorded a net sell position of VND 281.8 billion, with a net sell position of VND 92.3 billion in matched orders.

In terms of matched orders, domestic institutions net sold 10 out of 18 sectors, with the largest value being in Banks. The top stocks that domestic institutions net sold included NAB, TCB, HPG, VNM, GMD, BID, DPR, POW, VGC, and REE. On the buying side, they focused on the Retail sector. The top stocks that domestic institutions net bought included MWG, VHM, MBB, HCM, GVR, FUEVFVND, DGC, NVL, STB, and PAN.

Negotiated trading value today reached VND 3,149.5 billion, an increase of +48.5% compared to the previous session and contributed 21.3% of the total trading value.

Notable negotiated trades were observed in SSB, with over 30 million units equivalent to VND 426 billion traded between domestic institutions and individual investors. Additionally, negotiated trades involving all investor groups were recorded in VIX.

Individual investors continued to be active in the Banking sector (SHB, HDB, TPB, EIB, TCB) and large-cap stocks (VIC, VHM, MWG).

The allocation of money flow increased in Banks, Construction, Chemicals, Warehousing, Logistics & Maintenance, Textiles, and Rubber & Plastics, while it decreased in Real Estate, Securities, Agricultural & Seafood Farming, Food, Retail, Software, and Oil & Gas Production & Services.

In terms of matched orders, the allocation of money flow increased in small-cap stocks (VNSML) and decreased in large-cap (VN30) and mid-cap (VNMID) stocks.

The Capital City Adjusts its Blueprint: Adding Basement Floors to Residential Areas

The Hanoi People’s Committee has approved adjustments to the planning of a residential area serving a land clearance project and a land auction for land use rights in Long Bien district. The notable change is the addition of an extra basement level, increasing the total number of basement floors from two to three.

“The Big Four Banks: Tehcombank, OceanBank, Bac A Bank, and OCB Raise Savings Rates This Week”

This week, we witnessed four banks raise their savings interest rates. Notably, one bank increased its interest rate to above 6% per annum, offering a more attractive option for customers.