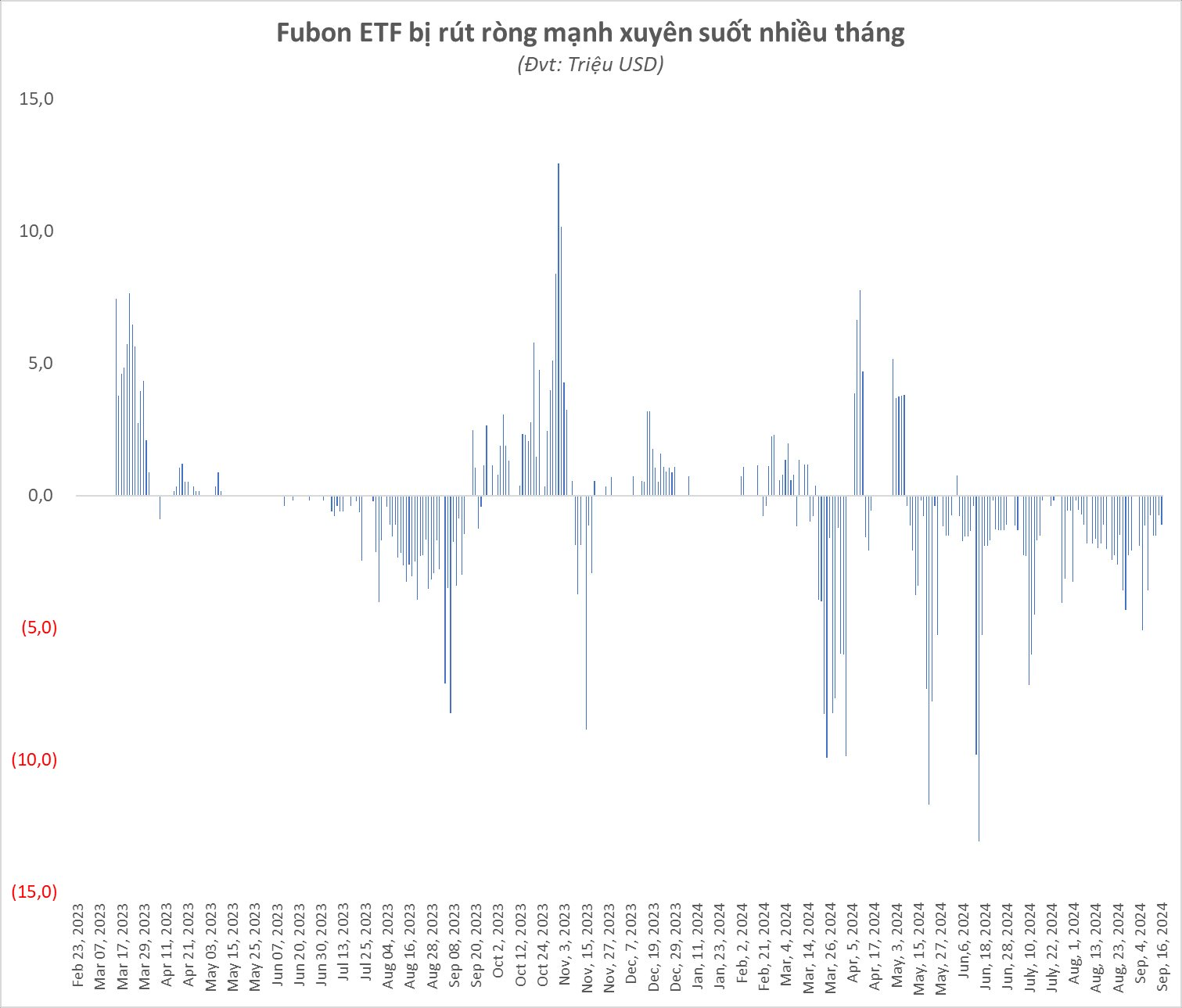

The Fubon FTSE Vietnam ETF, a foreign fund, has been on a consistent selling spree of Vietnamese stocks for over half a year now. The outflow trend has been relentless, with rare occasions of net buying. Just in the first half of September 2024, the ETF experienced consecutive outflows totaling $17 million, equivalent to 433 billion VND worth of Vietnamese stocks sold.

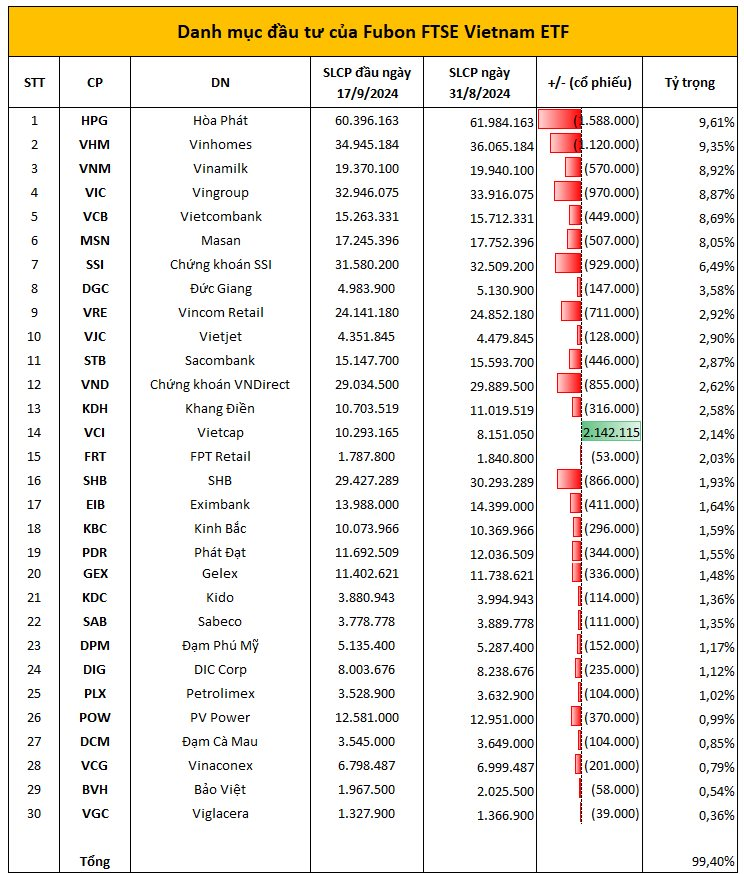

During this period, Fubon ETF sold off most of the stocks in its portfolio, including 1.6 million HPG shares, 1.1 million VHM shares, 970 thousand VIC shares, 929 thousand SSI shares, 866 thousand SHB shares, and 855 thousand VND shares, among others.

In contrast, the ETF surprisingly turned net buyers for VCI shares of Vietcap Securities, purchasing over 2.1 million shares and bringing their total holdings to 10.3 million shares, ranking 14th in the portfolio (2.14% weight).

As of the beginning of the session on September 17, the Fubon FTSE Vietnam ETF’s scale reached 20.2 billion Taiwanese Dollars (approximately $635 million, or 15.6 trillion VND), maintaining its position as the largest ETF in the Vietnamese stock market.

In terms of portfolio composition, HPG remains the stock with the highest weight at 9.6% (holding 60.4 million shares), followed by VHM (34.9 million shares, 9.35%), VNM (19.4 million shares, 8.92%), VIC (32.9 million shares, 8.87%), and VCB (15.3 million shares, 8.69%).

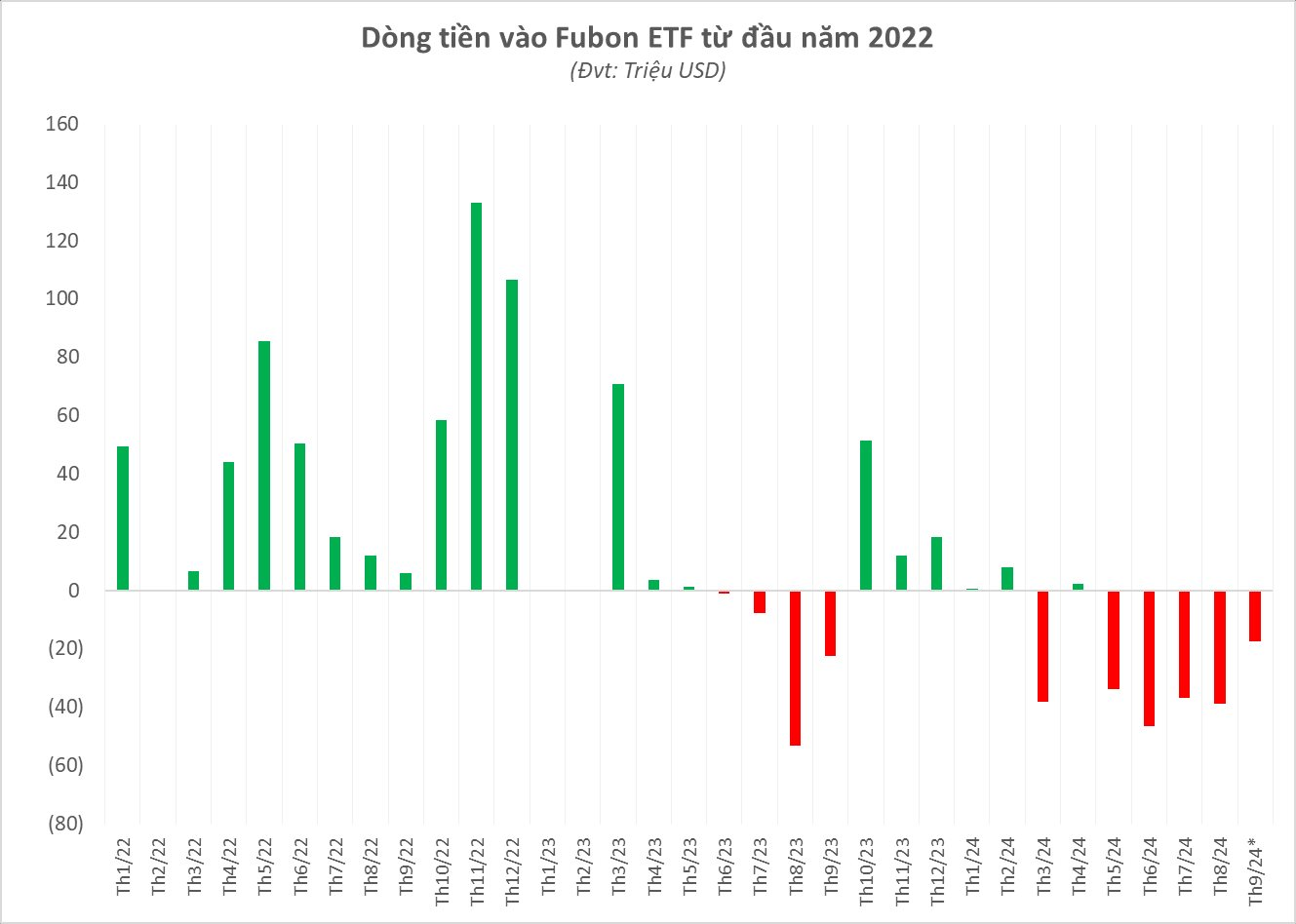

The strong net selling trend has resulted in a record outflow of over $200 million from this ETF since the beginning of 2024, equivalent to approximately 5 trillion VND worth of stocks sold over a period of more than 9 months. This level of net selling is unprecedented since the fund started investing in the Vietnamese market.

The outflow pattern of Fubon ETF aligns with the overall behavior of foreign investors in the Vietnamese stock market. From the beginning of 2024 until now, foreign investors have net sold over 66 trillion VND on the HoSE.

Revolutionizing Transportation: A $150 Billion Investment for a 2-km Road Connecting the Van Phong Transhipment Port

The Khanh Hoa province is set to invest nearly VND 150 billion in constructing a road that will connect to the Van Phong International Transhipment Port (phase 2). With a total length of over 2.4 kilometers, this road boasts an impressive width of 34 meters and is designed for a speed of 80 kilometers per hour.