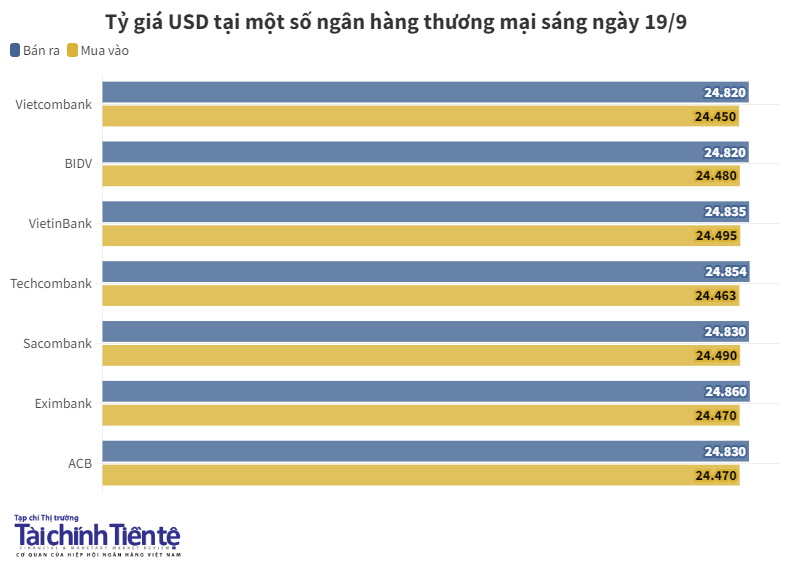

Vietnam Commercial Joint Stock Bank (BVBank) has just increased savings interest rates for terms of 1-6 months.

According to the current online savings interest rate table, the savings interest rate for terms of 1-2 months has increased by 0.1% per year, listed at 3.8% and 3.85% per year, respectively.

Savings interest rates for terms of 3-5 months have all increased by 0.2% per year, with 3-month, 4-month, and 5-month terms now at 4.0%, 4.05%, and 4.1% per year, respectively.

The 6-month term bank interest rate increased by 0.1% per year to 5.2% per year.

For other terms, the savings interest rates remain unchanged. Specifically, the savings interest rates for 7-month, 8-month, 9-month, and 10-month terms are 5.2%, 5.3%, 5.5%, and 5.5% per year, respectively. The 11-month and 12-month terms are offered at 5.6% and 5.8% per year, respectively, while the 15-month term is at 5.9%. The bank also offers a competitive rate of 6.0% per year for long-term savings accounts of 24-36 months.

BVBank’s latest savings interest rates for online deposits.

More than two months ago, BVBank also increased savings interest rates across all terms by an average of 0.2-0.3% per year, effective July 12.

Following today’s adjustment on September 17, BVBank remains among the top banks in the market in terms of savings interest rates, offering rates of 6.0% per year and above.

Recently, many banks have been raising their savings interest rates for both short- and long-term deposits. Even the “giant” Agribank has joined the race and is now one of the best-paying banks among the Big 4.

Across the entire banking system, NCB currently offers the highest interest rate of 6.15% for a 24-month term. Cake by VPBank provides a competitive rate of 6.1% for a 12-month term, while OceanBank and Bac A Bank offer 6.1% and 6.05% for 24-month terms, respectively. VRB and Dong A Bank both provide an interest rate of 6.0% for 24-month terms, and SaigonBank offers an attractive rate of 6.0% for 13, 18, and 24-month terms, with an even higher rate of 6.1% for 36-month deposits.

4 Banks Offering Over 7% Interest on Savings Accounts in September

To earn an interest rate of over 7% per annum, a minimum deposit of 200 billion VND is required by the banks.