Illustrative Image

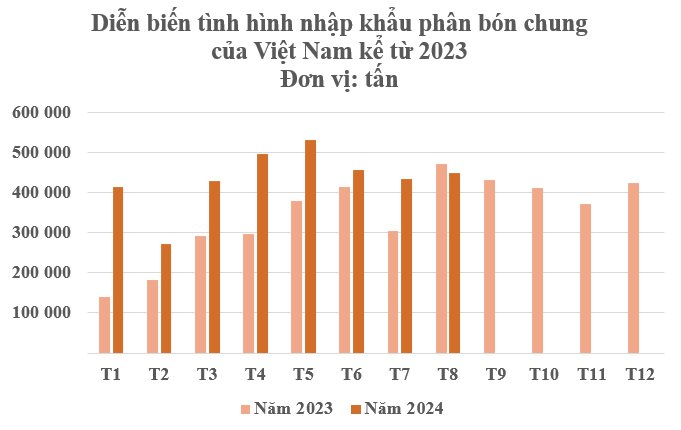

According to preliminary statistics from the General Department of Vietnam Customs, fertilizer imports to Vietnam in August reached over 448,000 tons, valued at more than $157 million, up 5.8% in volume and 14.9% in value compared to the previous month.

In the first eight months of the year, the country spent over $1.1 billion on importing nearly 3.5 million tons of fertilizer, a significant increase of 43.6% in volume and 36.9% in value year-on-year.

The average import price was $324 per ton, a decrease of 4.6% from the same period last year.

In terms of market share, China remained Vietnam’s largest fertilizer supplier in the first eight months, with over 1.4 million tons, equivalent to over $439 million, up 17% in both volume and value compared to the same period last year. The import price was $307 per ton, unchanged from the previous year.

Towards the end of 2023, China requested some businesses to temporarily suspend urea exports after domestic prices surged. The moves by the world’s leading fertilizer producer pushed up global urea prices and also impacted Vietnam’s fertilizer exports, which have increased sharply in recent times.

Russia ranked second, with over 434,000 tons, worth more than $187 million, up 133% in volume and 112% in value year-on-year. The average price was $432 per ton, a decrease of 9%.

Laos maintained its position as Vietnam’s third-largest fertilizer supplier, with over 240,000 tons, valued at more than $240 million, up 27% in volume but down 5.7% in value compared to the same period in 2023.

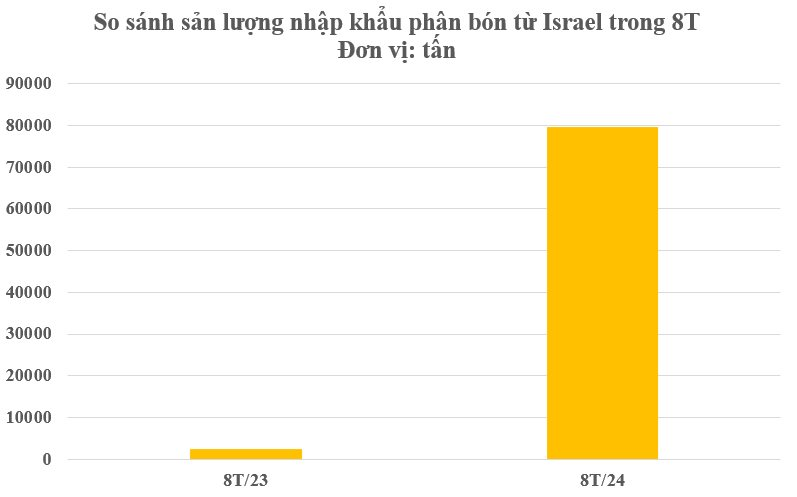

Notably, Israel has been aggressively increasing its fertilizer exports to Vietnam, with a four-digit growth rate. Specifically, in the first eight months, Vietnam imported over 79,000 tons of fertilizer from this market, worth over $30 million, a significant increase of 3,028% in volume and 711% in value compared to the same period in 2023.

While the volume increased sharply, import prices witnessed a significant decrease. On average, fertilizer imported from Israel in the first eight months cost $379 per ton, while in the same period last year, it was as high as $1,462 per ton, equivalent to a nearly fourfold decrease.

Israel accounts for about 6% of global potash production and is the world’s fourth-largest potash exporter, after Canada, Russia, and Belarus, supplying about 8% of total global exports in 2022. Israel’s Ashdod Port, just north of the Gaza Strip, is a crucial potash export hub for the country.

Regarding global demand in 2024, the International Fertilizer Association (IFA) forecasts that fertilizer consumption worldwide will increase by 4% compared to 2023, reaching 192.5 million tons. Factors such as geopolitical instability and extreme weather conditions have kept key commodity prices, including rice, wheat, and corn, high compared to the ten-year average.

Currently, Vietnam’s fertilizer consumption is approximately 11 million tons per year, while the domestic industrial fertilizer production capacity is nearly 8 million tons per year.

According to experts, there is a mismatch between fertilizer production and consumption. While there is a surplus of urea and phosphate fertilizers, other types of fertilizers, such as potash, micronutrients, and organic fertilizers, are still in short supply, leading to Vietnam’s continued reliance on imports for about 40% of DAP and all potash requirements to meet domestic demands.

Three out of the 12 loss-making projects turn profitable due to a 2.45% reduction in interest rates and penalty interest being waived by VDB.

The Chairman of the Chemical Corporation stated that Ammonia Hai Bac, Ammonia Ninh Binh, and DAP Lao Cai are operating steadily and profitable thanks to the Vietnam Development Bank (VDB) reducing interest rates from 11% to 8.55% and waiving penalties for late payment of interest.