Khải Hoàn Land’s CEO Acquires 1 Million Shares

Ms. Đinh Thị Nhật Hạnh, CEO of Khải Hoàn Land Corporation (HOSE: KHG), purchased 1 million KHG shares through order matching from August 14 to September 9, 2024.

During this period, KHG share prices fluctuated around the range of 5,200-5,500 VND per share. With an average closing price of approximately 5,375 VND per share, it is estimated that Ms. Hạnh spent 5.4 billion VND to complete the transaction, thereby increasing her ownership from 1.21% to 1.435% (nearly 6.45 million shares). The purpose of the transaction was to increase personal ownership.

Nearly 2.4 Million YTC Shares Change Hands

Sài Gòn 3 Capital Investment Company has reported the sale of nearly 1.9 million shares of Ho Chi Minh City Medical Import-Export Joint Stock Company (UPCoM: YTC) through a negotiated deal, which it held (accounting for 19.83% of capital) from September 5 to 9, for portfolio restructuring purposes.

Also, during the three trading sessions (September 5-9), YTC recorded negotiated transactions totaling nearly 2.4 million shares. The transaction value was nearly VND 112 billion, corresponding to VND 47,137 per share, 22% higher than the average closing price of YTC in the last three sessions.

With the number of shares sold, it is estimated that Sài Gòn 3 Capital Investment has received more than VND 89 billion after no longer being a shareholder of YTC.

Previously, during the same period when Sài Gòn 3 Capital Investment registered to divest from YTC, Thành Công Fund Management and Sài Gòn 3 Development Investment Joint Stock Company (UPCoM: SGI) also registered to trade YTC shares.

Specifically, SGI registered to buy nearly 2.37 million YTC shares from September 5 to October 3, 2024, aiming to invest in finance. If successful, SGI would directly own 24.79% of YTC‘s capital, up from zero shares previously.

Meanwhile, Thành Công Fund Management registered to sell its entire holding of more than 473,000 YTC shares (4.96%).

It can be seen that the transfer of YTC shares to SGI in this transaction is likely from Sài Gòn 3 Capital Investment Company and Thành Công Fund Management, with a total volume matching the 2.37 million shares that SGI intends to purchase.

Late DIC Corp’s Chairman’s Wife to Inherit Nearly 20.8 Million Shares

Ms. Lê Thị Hà Thành will inherit more than 20.75 million shares of Total Construction Investment and Development Joint Stock Company (DIC Corp, HOSE: DIG) from her late husband, Mr. Nguyễn Thiện Tuấn, who was the Chairman of DIC Corp.

After the transaction, Ms. Thành is expected to increase her ownership in DIC Corp from more than 4,900 shares to nearly 20.8 million shares, equivalent to 3.4% of the capital. The transaction is expected to take place from September 17 to October 16, 2024, through a transfer method without going through the trading system at the Stock Exchange.

Based on DIG share price at the close of September 12, 2024, at VND 21,700 per share, a decrease of 35% from the highest peak of the year, the value of shares inherited by Ms. Thành is estimated to be over VND 450 billion.

AAA to Receive Transfer of 11.2 Million NHH Shares from Parent Company

On September 10, 2024, the Board of Directors of An Phat Green Plastic Joint Stock Company (HOSE: AAA) approved the plan to purchase nearly 11.2 million shares of Hanoi Plastic Joint Stock Company (HOSE: NHH) through a negotiated deal, aiming to restructure the ownership structure of the Group. The transaction is expected to take place from September 13 to October 11, 2024.

If successful, AAA will become the parent company of NHH, with its ownership increasing from 47.44% (34.6 million shares) to 62.75% (45.7 million shares).

Currently, the Board of Directors of AAA has not disclosed the specific purchase price but has authorized Mr. Nguyễn Lê Trung, CEO of AAA, to decide the purchase price, which should be suitable for the market price of NHH shares on the transaction date and comply with the regulations of related laws.

At the close of the trading session on September 11, NHH share price stood at VND 13,750 per share, down 22% from the beginning of 2024. Based on this price, the estimated value of the transfer is about VND 153 billion.

Upcoming Large “Handover” of VFS Shares Worth Hundreds of Billions?

In recent days, there have been continuous moves to register for the purchase and sale of large quantities of shares of Nhất Việt Securities Joint Stock Company (HNX: VFS), with a transaction value that could amount to hundreds of billions of VND.

On September 11, Mr. Trần Anh Thắng, Standing Vice Chairman of the Board of Directors and General Director of VFS, registered to sell more than 7.6 million shares from September 18 to October 17, 2024, expecting to reduce his ownership from over 15.6 million shares (13.01%) to 8 million shares (6.67%).

The intention to sell a large number of shares held by the Vice Chairman of VFS was announced just two days after a financial investment organization, Hòa An Financial Investment Company, registered to buy 20.5 million new shares, equivalent to 17.083% of VFS‘s capital.

Regarding the relationship between the two, both VFS and Hòa An Company have the same Chairwoman, Ms. Nghiêm Phương Nhi. It is worth noting that Ms. Nhi has only recently become the Chairwoman of VFS since April 2024. In addition, she also holds the position of Chairwoman of Amber Fund Management Joint Stock Company, another member of the Amber ecosystem.

Returning to Hòa An Company, the organization stated that the purpose of the purchase is to increase its ownership, expected to be carried out from September 16 to October 15, 2024. Based on the closing price of VFS shares in the latest session on September 13 at VND 13,500 per share, Hòa An Company is estimated to spend nearly VND 277 billion to complete this deal. On the other hand, Mr. Trần Anh Thắng could earn nearly VND 103 billion if he sells all the registered shares.

|

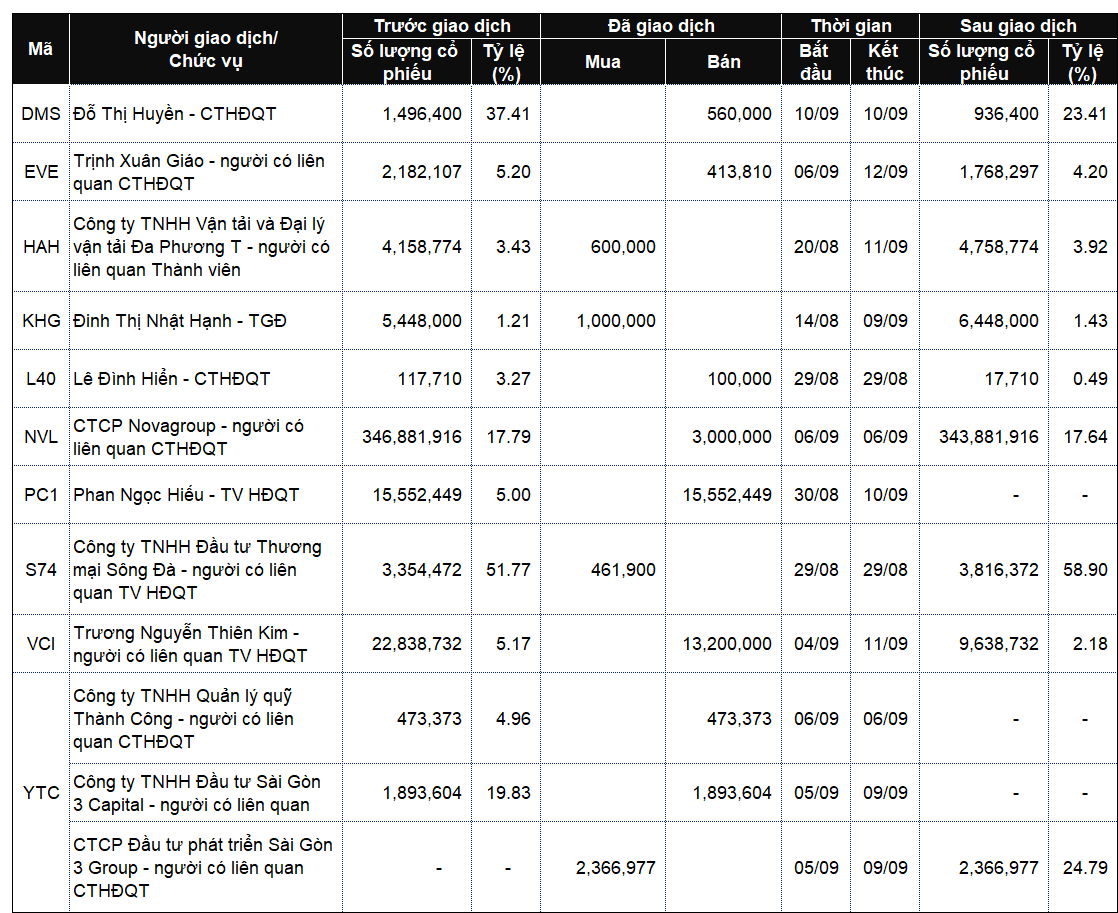

List of company leaders and relatives trading from September 9 to 13, 2024

Source: VietstockFinance

|

|

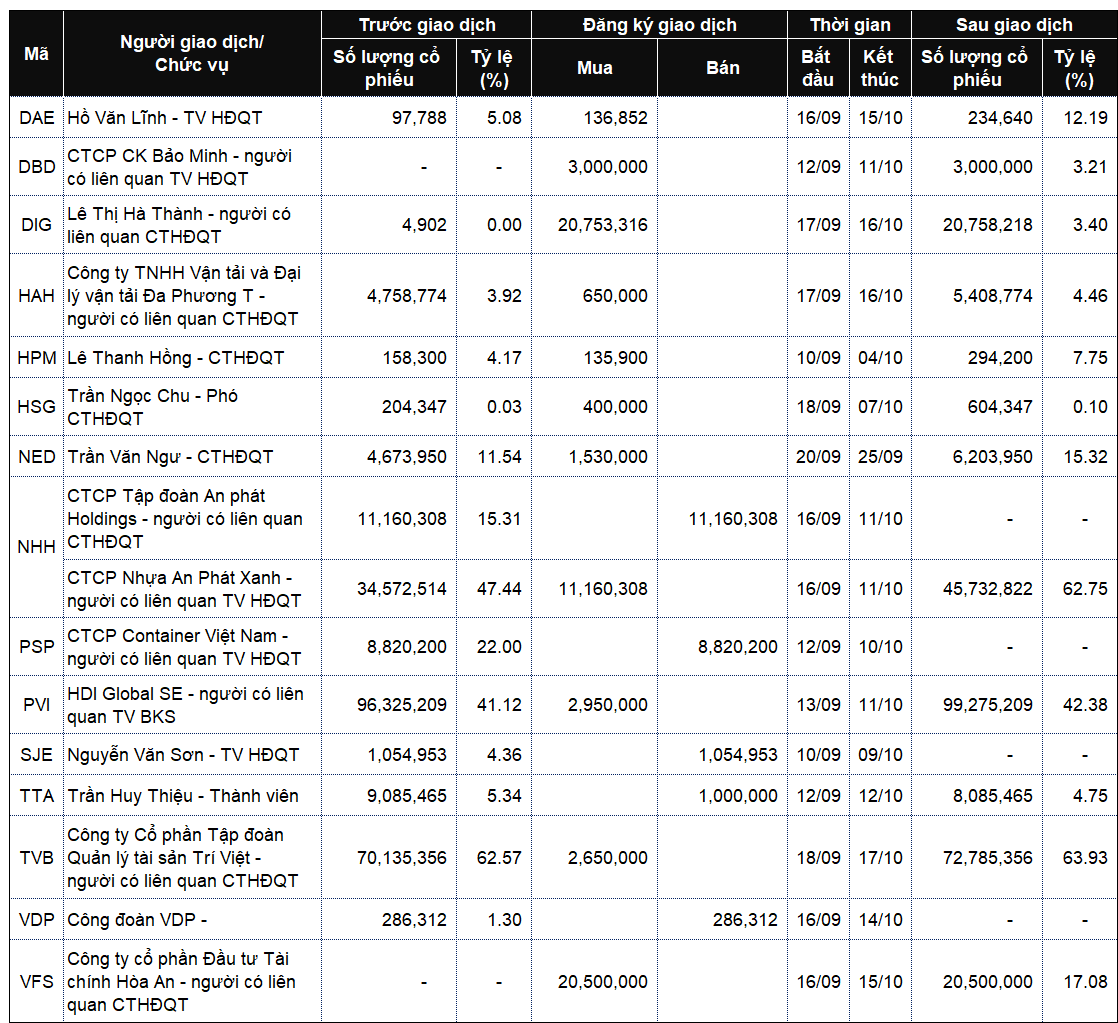

List of company leaders and relatives registering for trading from September 9 to 13, 2024

Source: VietstockFinance

|

Deputy Prime Minister: Comprehensive Environmental Impact Assessment of the Can Gio ‘Mega Port’

As the Can Gio port project is associated with Vietnam’s first-ever World Biosphere Reserve, it holds immense value and significance for Ho Chi Minh City and the region. Due to its potential environmental implications, Deputy Prime Minister Tran Hong Ha has emphasized the need for a thorough and comprehensive assessment of its environmental impact.