The market unexpectedly dropped quite significantly today despite no new adverse information. The risk from global stocks may have caused anxiety to spread…

US stocks have just gone through a V-shaped recovery similar to VNI, and the stagnant development around the peak is nothing new. Last night’s sharp decline was a normal reaction, which happened to occur when the domestic information flow was calm. Attention has now shifted abroad until new domestic factors emerge.

The schedule for releasing monthly macroeconomic information has been moved to the beginning of the following month, and this Friday will feature data from August. The data is expected to continue to show improvement, and it is hoped that the impact of volatility in global stock markets will soon be reduced. In reality, the domestic stock market is progressing much more slowly than international markets, only keeping pace during August.

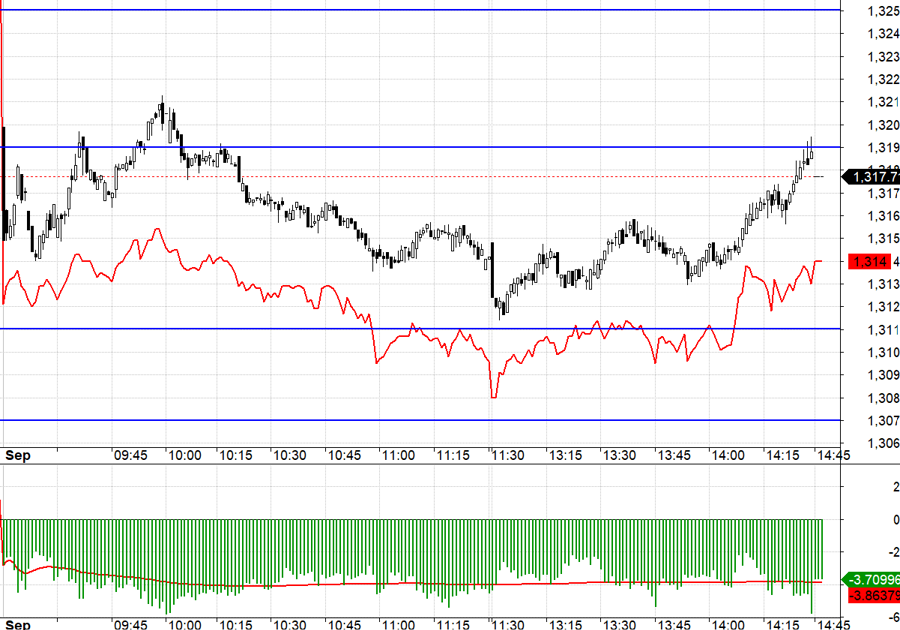

Today, the impact of the blue-chip stock group put quite a lot of pressure on the market, with VN30 falling sharply by 1.04%, and many stocks in the basket falling by 1%-3%. The stagnant development before the holiday was due to the rotation phenomenon among the main stocks, and today, despite VHM, GAS, and CTG trying their best, they could not make up for the large number of other stocks in the basket that declined. The fragile balance of the VNI quickly disappeared.

The unexpected expansion of the price range today pushed liquidity up, with the two exchanges matching 14.7k billion, the highest in the last three sessions. While this number is not necessarily high, it is an improvement. The change in the selling side’s state has led to more supply and demand meetings. Although the downward trend was blocked in the afternoon, the degree of price recovery was not yet clear. The buying side is still mostly passive, simply because holding cash has a psychological advantage at the moment: if the market adjusts, it’s even better, easier to buy, and if it goes up, it will still only return to a stagnant state within the old peak range. A breakthrough will be needed before any new calculations are required.

I still believe that a balanced portfolio ratio should be maintained to handle all scenarios. As the market is mainly influenced by external factors, even if it adjusts according to the world, there will be no large ranges. The decline is an opportunity to cover the sold portfolio again. In addition, as September also has many new information events, the probability is high that if a correction occurs, it will create a higher bottom than the August bottom.

Today, the basis of the derivatives market shifted very early, perhaps reflecting the concern that US stocks failed to break through the peak successfully and instead formed a double-top reduction pattern. After the first drop, VN30 fluctuated within the range of 1311.xx to 1319.xx. However, due to the discounted basis, when VN30 turned and broke through 1319.xx, Short’s profits were limited. The decline to 1311.xx did not have high inertia because most of the stocks in the basket had already fallen sharply at the beginning of the session and started to encounter thick buy-stops. However, the Long point was better, with a basis advantage. Although the basis expanded in the afternoon session during VN30’s recovery, and profits were also limited, it was clear that the safety was much higher.

Bottom-fishing money appeared today but was quite passive. If global stock markets stabilize, the opportunity for VNI to recover and return to the old accumulation range remains. The index is not that important and is not directly related to the buying and selling of stocks at the moment, but it does have a psychological impact. A VNI recovery will reduce selling pressure and stimulate new buying demand. The strategy is flexible Long/Short.

VN30 closed today at 1317.71. The nearest resistance levels for tomorrow are 1318; 1325; 1333; 1339; 1345; 1350. Support levels are 1306; 1320; 1297; 1290; 1279.

“Blog Securities” is personal and does not represent the opinions of VnEconomy. The views and evaluations are those of individual investors, and VnEconomy respects the author’s point of view and writing style. VnEconomy and the author are not responsible for any issues arising from the published investment evaluations and opinions.

Tomorrow’s Stock Market Outlook: Which Three Sectors Should Investors Consider for Profit-Taking?

The stock market witnessed another volatile session on September 9th. Despite the fluctuations, the emergence of buying interest indicates that investor sentiment is not overly pessimistic. The presence of buyers suggests a hopeful outlook for a potential rebound.