The VN-Index closed at 1,239 points on September 16, a decrease of 12 points (-1%) from the previous day’s trading.

Investors remained cautious and tentative as they entered the trading session on September 16. The market witnessed a recovery attempt from the 1,250-point region, but the upward momentum during the morning session was modest and subsequently reversed.

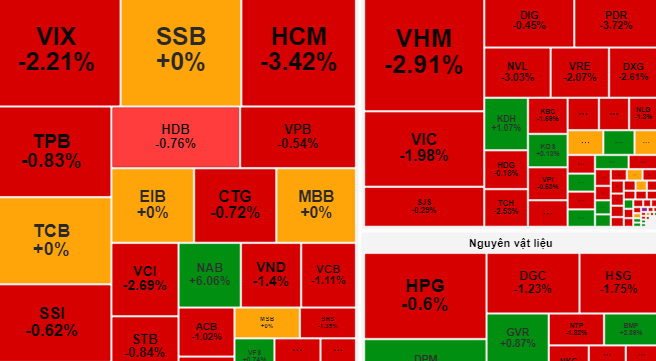

In the afternoon session, investors increased selling pressure on low-priced stocks, causing most sectors of large-cap stocks to trade in negative territory. Notably, out of the 30 large-cap stocks, 25 recorded significant losses: POW (-3.9%), VHM (-2.9%), GAS (-2.3%), VRE (-2.1%), and VIC (-2%).

Against this backdrop, foreign investors stepped up their buying activity. As a result, net foreign buying on the HoSE exceeded VND 218 billion.

At the close, the VN-Index fell by 12 points (-1%) to finish at 1,239 points. Trading liquidity increased, with 453.6 million shares changing hands on the HoSE.

According to the Vietnam Dragon Securities Company (VDSC), the higher trading volume compared to the previous session indicates a resurgence in supply. This signal is exerting psychological pressure on investors. Additionally, the downward momentum from the September 16 session could lead to further market declines in the next trading day.

“Therefore, investors should maintain a reasonable stock proportion in their portfolios and avoid being overly invested,” VDSC advised. “Consider taking advantage of rebound periods to restructure your portfolio in a way that minimizes risks.”

Meanwhile, the Vietnam Foreign Trade Securities Company (VCBS) noted that the recent corrective periods suggest that the market is awaiting the emergence of leading capital flows. This has impacted investor sentiment, resulting in somewhat subdued trading activity.

“Investors should maintain their stock proportions as in previous sessions and closely monitor market movements to ensure timely trading decisions that safeguard profits,” said Mr. Nguyen Quoc Bao, a senior analyst at VCBS.