The Ministry of Finance is drafting amendments and supplements to the Securities Law, which propose heightened qualifications for professional investors.

Specifically, for individuals, the new requirements include: (i) a minimum of two years of experience in securities investment with a minimum of ten transactions per quarter in the last four quarters; and (ii) an annual income of at least VND 1 billion in the last two years.

While these conditions aim to mitigate risks for investors, they may also restrict market participation. The income requirement, in particular, is challenging for most Vietnamese citizens to meet. According to the World Bank, Vietnam’s per capita income in 2023 was nearly $4,400 (approximately VND 110 million). As a result, many potential professional investors will be excluded due to this criterion.

Additionally, the requirement of a minimum of ten transactions per quarter in the last four quarters has sparked concerns among investors. Some view this frequency as relatively high, especially for those adopting a long-term investment approach. Essentially, the “professional” standard encourages short-term “trading” rather than long-term investment strategies.

A senior executive from a leading securities company once shared that “90% of market transactions result in losses.” This highlights the high level of risk in the securities market, especially for investors with a high frequency of transactions. Therefore, the transaction frequency condition could impact investors’ performance, especially during unfavorable market conditions.

Overall, the proposed qualifications will significantly reduce the number of professional investors. Moreover, these conditions will limit the types of assets accessible to non-professional individual investors, such as corporate bonds. This may hinder legitimate investment needs for individuals.

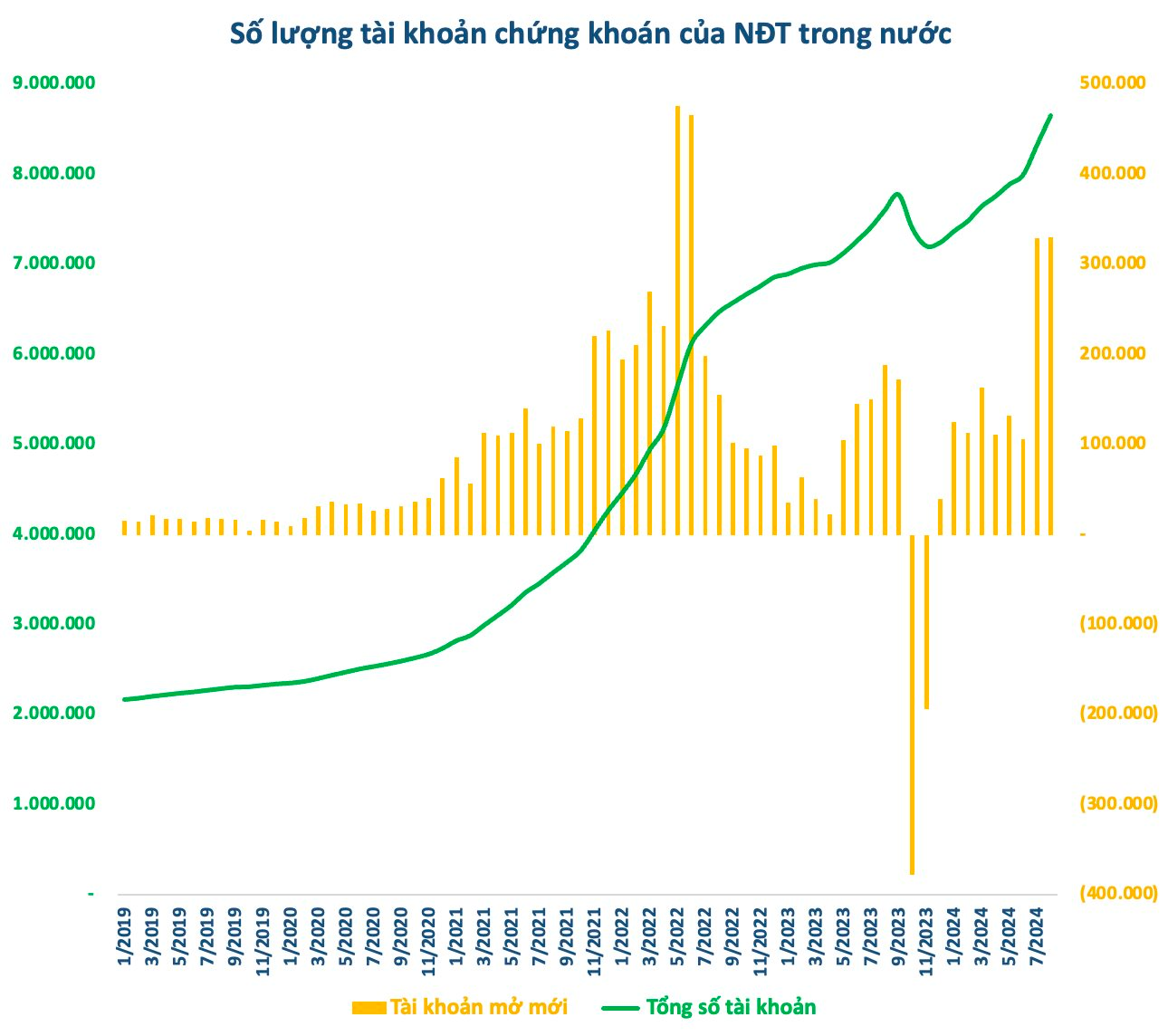

According to the recently approved Vietnam Securities Market Development Strategy for 2030, the country aims to reach 9 million securities trading accounts by 2025 and 11 million by 2030. As of the end of August, there were over 8.6 million individual investor accounts, equivalent to approximately 8.6% of the population.

The CEO of VIS Rating: Most Individuals Holding Key Financial Positions Are Not Professionals.

“It’s clear that the majority of private investors currently holding corporate bonds are not professional investors, and this is an anomaly in the context of market development,” says Tran Le Minh, CEO of Vietnam Investment and Rating Joint Stock Company (VIS Rating).