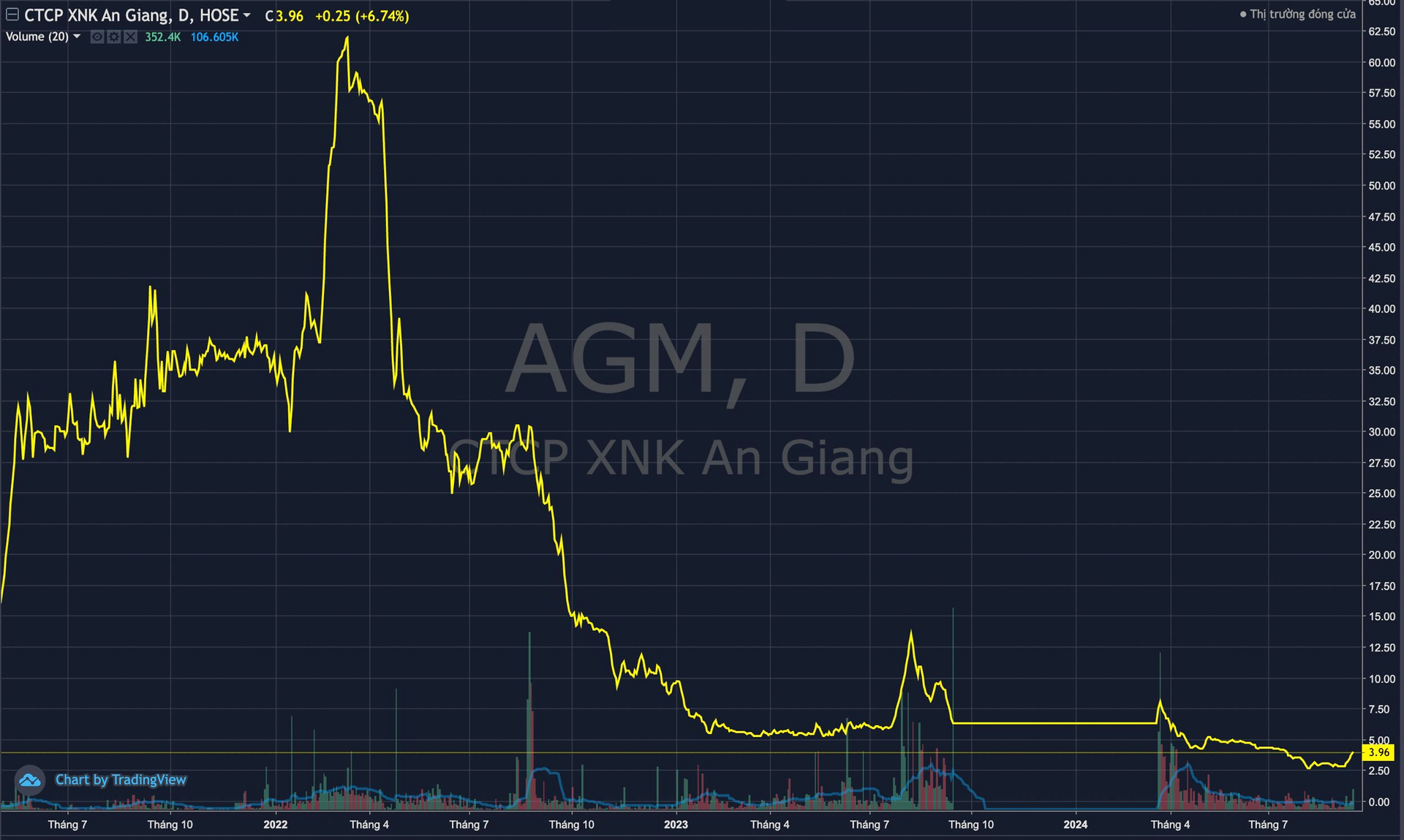

Amid a gloomy broader market, shares of AGM of An Giang Import-Export Joint Stock Company (Angimex) unexpectedly surged with five consecutive sessions of reaching the ceiling price from September 10 to September 16. As a result, the market price soared over 40% to 3,960 VND per share. Trading in this stock was also quite vibrant, with hundreds of thousands of matching orders per session, several times higher than in the previous period.

However, compared to the price range back in March of this year, the AGM price has “halved”. Looking further back from the historical peak in March 2022 (around 60,000 VND per share), the current stock price is only about 1/20.

In a clarification on the price movement, Angimex stated that the export rice market of Vietnam remains favorable due to increased demand from traditional customers. A factor of uncertainty stems from India’s consideration of relaxing its rice export policy.

Additionally, Super Typhoon Yagi caused severe damage, leading to food shortages and subsequent price hikes domestically. This may have heightened investors’ expectations for the company.

Angimex affirmed that the stock price increase resulted from supply and demand dynamics in the stock market, and investors’ decisions are beyond the company’s control. Angimex has no influence over the trading price of its shares.

Involvement in price manipulation and plummeting business performance

Angimex was once known as a leading rice exporter in Vietnam and was part of the Louis Holdings ecosystem of Mr. Do Thanh Nhan. Troubles emerged in 2022 when the Louis group encountered setbacks as Mr. Do Thanh Nhan was prosecuted for stock market manipulation.

Following this incident, AGM’s business performance continuously plummeted. In 2022 and 2023, Angimex incurred consecutive losses of hundreds of billions of VND, pushing the accumulated loss higher than the charter capital, leading to the risk of mandatory delisting.

In 2024, despite Angimex adjusting its profit-before-tax plan to 5 billion VND, 81% lower than the previous plan, the company has not turned a profit so far. In the first half, revenue plunged 53% to 151 billion VND, completing less than 9% of the set plan. Consequently, Angimex reported a pre-tax loss of 98 billion VND. As of June 30, 2024, the company’s owner’s equity was negative 82 billion VND, including a cumulative loss of over 264 billion VND.

The plummeting business performance, coupled with violations of information disclosure regulations on the stock market, has frequently landed AGM stock on the HoSE’s “watch list.” In September 2023, the stock was even temporarily suspended from trading and was only allowed to resume trading in March 2024.

Currently, AGM remains under HoSE’s control. Regarding measures and timelines to address this situation, Angimex plans to intensify the implementation of solutions to rectify the situation of accumulated losses exceeding the paid-up capital in the last months of 2024.

Specifically, the company is actively carrying out a comprehensive restructuring by optimizing its management apparatus, streamlining personnel, enhancing labor productivity and business efficiency, intensifying the collection of difficult debts and disposal of assets, and gradually restructuring debts to generate profits to reduce accumulated losses.

Concurrently, the company will continue seeking professional securities investors to proceed with private placement to increase the owner’s equity, thereby supplementing working capital for production and business activities and addressing the issue of accumulated losses exceeding the paid-up capital.

Another proposed plan is to conduct a private placement to swap bond debts for shares with bondholders, as per the resolution of the Extraordinary General Meeting of Shareholders in November 2023, thereby increasing charter capital and improving the financial situation.

At the same time, the company commits to providing quarterly explanations, reporting on the progress of addressing the controlled securities situation, and disclosing information in compliance with stock market regulations.

The Power of Persuasive Writing: Crafting a Compelling Headline

“Securities Success Leader Explains Reason for Pausing Capital Increase Plan”

On June 17, TCSC, a leading securities company listed on the Ho Chi Minh Stock Exchange (HOSE) under the ticker symbol ‘TCI’, held its 2024 Annual General Meeting of Shareholders in a hybrid format, combining physical and online attendance. A key item on the agenda was the proposal to discontinue the implementation of the plan to offer shares to existing shareholders and the employee stock ownership plan (ESOP) scheme, which had been approved for 2023.