In addition to US dollar loans, some businesses also borrow other foreign currencies, and the depreciation of these currencies against the Vietnamese dong has helped these businesses record exchange rate gains. Photo: REUTERS |

Businesses Affected by Exchange Rates

The profits of most listed companies on the stock exchange have witnessed a positive growth again in the first half of 2024. Accordingly, the market’s profit increased by 27.7%, equivalent to more than VND 124,000 billion, which is slightly lower than the historical peak in 2022. In the context of a solid economic recovery thanks to supportive policies, many businesses are regaining their momentum.

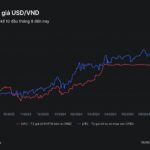

However, there are still many businesses whose financial results have declined, and one of the main factors is the risk of exchange rate fluctuations, especially for those with a large proportion of foreign currency debt, mainly in US dollars. Specifically, with the US dollar/dong exchange rate increasing by nearly 5% in the first half of the year, many businesses borrowing in US dollars have had to record significant exchange rate losses.

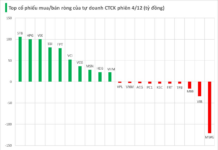

According to a report by BSC Securities Company, as of June 30, Novaland Group (HOSE: NVL) with US dollar loans equivalent to approximately VND 17,927 billion, recorded an exchange rate loss of up to VND 834 billion; Vietnam Airlines Corporation (HOSE: HVN) with US dollar loans equivalent to VND 6,117 billion, lost VND 1,224 billion due to exchange rate fluctuations; Vietnam Oil and Gas Power Corporation (HOSE: POW) with loans of VND 8,002 billion, lost VND 178 billion; Mobile World Investment Joint Stock Company (HOSE: MWG) with loans of VND 6,132 billion, lost VND 146 billion; PC1 Corporation (HOSE: PC1) with loans of VND 3,862 billion, lost VND 112 billion; Hoa Phat Group Joint Stock Company (HOSE: HPG) with loans of VND 747 billion, lost VND 229 billion…

However, some businesses still reported profits thanks to favorable exchange rates. For example, FPT Corporation (HOSE: FPT) recorded a foreign exchange gain of VND 141 billion, 2.5 times higher than the figure for the whole of 2023; Vietnam Oil and Gas Technical Services Corporation (HNX: PVS) made a profit of VND 136 billion; Ca Mau Petroleum Fertilizer Joint Stock Company (HOSE: DCM) earned VND 49 billion; Hoa Sen Group Joint Stock Company (HOSE: HSG) made a profit of VND 231 billion; Nam Kim Steel Joint Stock Company (HOSE: NKG) earned VND 73 billion; Vicostone Joint Stock Company (HOSE: VCS) made a profit of VND 43 billion…

|

In addition to the impact of the US dollar, another notable point is the trend of the Japanese yen. Following Japan’s move to raise interest rates, the yen is being supported to strengthen, with the USD/JPY exchange rate increasing by nearly 12% since the beginning of July. Similarly, the Japanese yen has also appreciated by nearly 12% against the Vietnamese dong during the same period. |

In addition to US dollar loans, some businesses also borrow in other foreign currencies, and the depreciation of these currencies against the dong has helped these businesses record gains from exchange rate differences. For example, FPT Corporation still had outstanding yen-denominated loans of JPY 8.3 billion at the end of Q2/2024, a decrease of JPY 3.4 billion compared to the end of 2023. Meanwhile, the Japanese yen depreciated by more than 10.5% against the dong in the first six months of this year.

Moreover, while businesses borrowing in US dollars will suffer when the dollar appreciates, exporters with revenue in US dollars will benefit. When the US dollar rises, exporters selling goods to foreign partners will receive US dollars, and when converted to dong, they will earn more. This is also the reason for FPT Corporation’s large exchange rate gain in the first half of this year. Similarly, businesses in the seafood, iron and steel, and oil and gas sectors, which have strong export activities and significant US dollar revenue, also benefit.

On the other hand, businesses dependent on importing raw materials, machinery, and inputs and using US dollars for payment will be negatively affected. Therefore, for the textile industry, although the US is the main export market for most garment businesses, most enterprises have to import raw materials from abroad as specified by customers, so the impact of exchange rate fluctuations on their business results is not significant.

Reversal Scenario in the Second Half of the Year?

As the US dollar has been depreciating in the past two months, there is a possibility that the above scenario will reverse in the coming period. In other words, businesses with large US dollar loans may record exchange rate gains again in the second half of the year. As assessed by BSC Securities Company, the factor of lower interest expenses will continue to be a driving force for business results growth in Q3 and Q4/2024, with the context of reduced exchange rate losses as the exchange rate cools down.

VNDirect Securities Company’s experts believe that the exchange rate from now until the end of the year will continue to be supported by many factors: the US Federal Reserve (Fed) starts a cycle of lowering interest rates; inflationary pressure in the country is expected to ease from the second half of Q3; foreign exchange supply continues to be supported by positive foreign direct investment (FDI) disbursement in Vietnam, a sustained trade surplus, and a large amount of remittances in the fourth quarter.

According to data from the General Statistics Office, realized FDI in Vietnam in the first eight months of 2024 is estimated at US$14.15 billion, up 8% over the same period last year. This is the highest realized FDI for the January-August period in the last five years. In terms of trade, the trade surplus in August reached a record of US$4.53 billion, bringing the trade surplus in goods in the first eight months to US$19.07 billion.

The USD/VND exchange rate, after rising sharply in the first six months of this year, has fallen by more than 3% since the beginning of July, as the US dollar has weakened in the international market with expectations that the Fed will soon cut rates again at its September meeting, and thanks to a more abundant foreign exchange supply in the domestic market. However, there are also opinions that the exchange rate is unlikely to fall much further from this level and is likely to fluctuate around the 25,000 VND/USD level, as the year-end is also a peak period for import activities.

In addition to the impact of the US dollar, another notable point is the trend of the Japanese yen, which has been fluctuating since the beginning of Q3. Following Japan’s move to raise interest rates, the yen is being supported to strengthen, with the USD/JPY exchange rate increasing by nearly 12% since the beginning of July. Similarly, the Japanese yen has also appreciated by nearly 12% against the dong during the same period, causing concerns for businesses with large yen-denominated debts.

For example, Vietnam Airports Corporation (ACV), with official development assistance (ODA) loans denominated in Japanese yen equivalent to VND 11,000 billion, will face an exchange rate loss of up to VND 110 billion for every 1% appreciation of the yen against the dong. In Q2/2024, ACV recorded an exchange rate gain of VND 434 billion from this ODA loan when the yen depreciated sharply, but this gain may be erased in the second half of this year if the yen remains high or continues to rise. However, businesses with revenue in Japanese yen will benefit.

Triêu Dương

The Greenback Takes a Tumble: Will the State Bank Step In to Buy?

The recent loosening of monetary policy by the State Bank of Vietnam (SBV) in the context of a sharp decline in exchange rates has led to speculation that the central bank may buy USD at a higher price at the Trading Center to boost foreign exchange reserves. This move is expected to enhance the liquidity of VND in the commercial banking system, ensuring a more stable and robust financial environment.

The Freefall of USD: Buying Rate Drops Below 25,000 VND.

The US dollar weakened significantly on the global market today, and this decline was reflected in the drop in USD rates in the domestic market. The USD exchange rate in the free market has fallen below the 25,000 VND per USD mark for buying.