PLX: Target price of VND 48,000/share

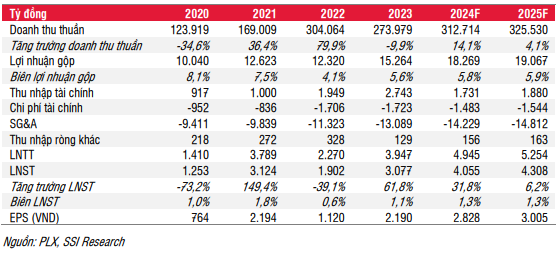

SSI Research assessed that Vietnam Petroleum Group (HOSE: PLX)’s Q2 2024 pre-tax profit increased by 41.3% year-on-year and 4.3% quarter-on-quarter, reaching VND 1.5 trillion. This was mainly due to higher oil prices and improved profit margins following the adjustment of regulations on gasoline prices in 2023.

PLX‘s domestic gasoline consumption maintained at 2.65 million m3/ton, a 0.6% increase year-on-year, slowing down from the 3.9% growth in 2023 due to the high base effect. However, retail sales volume increased at a faster pace of 4% year-on-year and 2.8% quarter-on-quarter, reaching 1.85 million tons. PLX opened 60 new stations in the first seven months, expanding its network by 2% since the beginning of the year. Additionally, the profit margin in Q2 2024 was supported by Decree 80, which took effect in November 2023. This decree shortened the cycle for gasoline price adjustments from 10 days to 7 days and adjusted other components in the retail price formula more frequently and in closer alignment with the actual costs of enterprises.

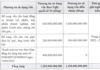

Given the better-than-expected Q2 2024 performance, SSI Research upwardly adjusted its full-year 2024 pre-tax profit estimate for PLX by 12%, reaching VND 4.95 trillion, a 25% increase year-on-year, mainly due to improved profit margins. SSI Research maintained its forecast for domestic gasoline consumption at 10.76 million tons (up 4.1%) and retail sales volume at 7.3 million tons (up 4.5%).

For 2025, SSI Research expects a 6% increase in pre-tax profit to VND 5.25 trillion, driven by a 4.1% growth in gasoline sales volume.

|

PLX’s Projected Business Results for 2025

|

Based on these assessments, SSI Research maintains a neutral recommendation for PLX shares with a target price of VND 48,000/share for the next 12 months due to increased profit estimates and a shift in the valuation base to 2025. However, they caution that the 9% decline in gasoline prices in July and August may put pressure on both profits and share prices in Q3 2024 for PLX.

Read more here

DHC: Optimistic outlook with a target price of VND 42,100/share

According to Vietcap Securities, paper prices reached VND 9,500/kg (up 8% since the beginning of the year) as of September 2024, increasing from VND 8,800/kg in January. This increase was lower than expected, and Vietcap Securities attributed it to FDI companies continuing to sell at dumping prices in the Vietnamese market amid weak consumption in China.

Looking ahead, Vietcap Securities forecasts a slight increase in selling prices, driven by the recovery in commercial activities and domestic consumption in Vietnam, especially during festive seasons (such as the Mid-Autumn Festival and Tet Holiday). Additionally, the securities firm expects prices for old corrugated cartons (OCC) to decrease, supported by a lower USD/VND exchange rate and reduced transportation costs – factors that will contribute to improving DHC‘s profit margins.

Vietcap Securities has increased its operational efficiency forecast for carton factories to 70%, up from the previous assumption of 65%. This level of efficiency is equivalent to DHC‘s performance in Q2 2024 and is supported by the strong recovery in Vietnam’s export activities, particularly for fruits like durian and bananas. The management expects the current two carton factories to reach maximum capacity within the next 2 to 3 years. Additionally, the third carton factory project is expected to commence construction in 2025, with an estimated investment value of VND 250 billion.

The Giao Long 3 (GL3) project – the capital contribution phase has been completed, and it is now awaiting investment approval. Regulations require the investor of GL3, Giao Long Paper Joint Stock Company, to ensure 20% of the total project value is in equity, equivalent to VND 360 billion. As of Q2 2024, DHC has contributed this full amount and approved a plan to issue purchase rights to raise additional capital. The company is currently awaiting investment approval, which is expected to be granted in early Q4 2024. GL3 will focus on producing kraftliner and testliner instead of products that are currently in oversupply.

Vietcap Securities forecasts a core gross profit margin of 13.3% for DHC in 2024, compared to a total gross profit margin of 12.7%, in the scenario that DHC continues its steel trading business.

Based on these assessments, Vietcap Securities maintains a positive recommendation for DHC shares with a target price of VND 42,100/share.

Read more here

Buy SAB with a target price of VND 68,900/share

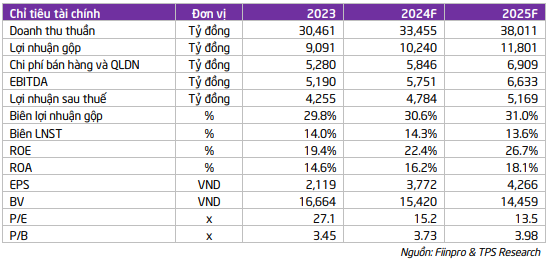

According to Tien Phong Securities (TPS), although Saigon Beer, Alcohol and Beverage Joint Stock Corporation (HOSE: SAB)’s post-tax profit for the first six months of 2024 recovered from the low base in 2023, revenue growth remained in the single digits due to the impact of Decree 100. Decree 100, issued by the government on December 30, 2019, and Decree 24, issued on February 24, 2020, have affected the operations and prospects of alcoholic beverage businesses, including SAB.

However, SAB is expected to achieve a 9.8% revenue growth and an 11.9% profit growth in 2024, thanks to economic recovery and enhanced distribution through e-commerce channels.

In the long term, beer producers, including SAB, still have significant growth potential due to: (1) Beer remains the preferred choice among consumers of alcoholic beverages in Vietnam. In 2023, the scale of Vietnam’s alcoholic beverage market exceeded 5.41 billion liters. Beer was the most important segment, with a market size of about 5.34 billion liters in Vietnam in 2023, up 10.4%, and accounted for 98.7% of the total scale of the alcoholic beverage market in Vietnam. The scale of Vietnam’s alcoholic beverage industry is projected to reach about 14,563 billion liters in 2033, equivalent to a compound growth rate of 10.4% in the period of 2024 – 2033, (2) Vietnam is the country with the fastest-growing alcohol consumption in the world in the period of 2010 – 2017. According to WHO forecasts, by 2025, Vietnam will be the country with the highest per capita alcohol consumption in Asia, about 11.4 liters/person/year, ranking 25th in the world, (3) The golden population structure and rapidly increasing income will drive the consumption of beer products in the coming time.

|

SAB’s Projected Business Results for 2025

|

Combining the DCF method with P/E and P/B ratios, TPS gives a recommendation for SAB with a target price of VND 68,900/share.

Read more here

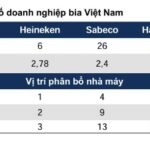

Can Sabeco Overtake Heineken in Vietnam with Control of Sabibeco?

With the acquisition of an additional six breweries from Sabibeco, Sabeco would boost its total brewing capacity to an impressive 3.01 billion liters of beer per year. This strategic move would solidify Sabeco’s position as Vietnam’s largest beer producer, dominating the market with an unparalleled scale of operations.

“Mid-Term Support MA200 Remains Intact, Portfolio Allocation Advised: Insights from VFS Securities Experts.”

The VFS Securities Joint Stock Company believes that after touching MA200, the VN-Index is rebounding nicely with the return of cash flow. The primary trend is a broad sideways movement between 1,190 and 1,300. There has been a significant differentiation among stock groups, so investors should prioritize stock selection and allocate their portfolios rationally to maximize profits while effectively managing risks.