In a recent disclosure to the State Securities Commission (SSC), CDP admitted to an oversight in their reporting. They revealed that they had issued resolutions by their Board of Directors regarding the determination of the starting price for the transfer of a 93.7% stake in the Codupha – Laos joint venture. They also disclosed the auction notices and results conducted by Van Thanh An Partnership Auction Company, but “due to an oversight, they had not publicly disclosed this information.”

Prior to this, on July 16, CDP’s leadership decided to publicly auction all their shares in their subsidiary, Codupha Laos Pharmaceutical Company, with a starting price of approximately 11.9 billion VND (10.6 billion Kip, exchange rate: 1 Kip = 1.122 VND).

After the registration deadline for the auction passed twice, on August 12 and September 9, the auction organizer, Van Thanh An, stated that there were no interested customers despite following all the procedures according to the Law on Asset Auction and related regulations. The starting price for the second auction was reduced to approximately 10.1 billion VND. This auction was conducted in a direct, oral format, using the ascending price method.

The auction winner is obliged to inherit the rights and obligations of CDP in the Codupha – Laos joint venture. CDP committed that the assets put up for auction are legally owned and used by the company, and they assume all responsibilities for legal matters related to the auctioned assets.

Codupha Laos was established under the Laws of Laos and is certified by the Lao Ministry of Planning and Investment as of May 31, 2004. Its primary business is pharmaceutical production and trading. The subsidiary’s headquarters are located in Saysetta District, Vientiane Capital, Laos.

CDP’s investment in Codupha Laos as of the end of 2017 was approximately 843,000 USD, equivalent to 21 billion VND (exchange rate: 25,000 VND/USD).

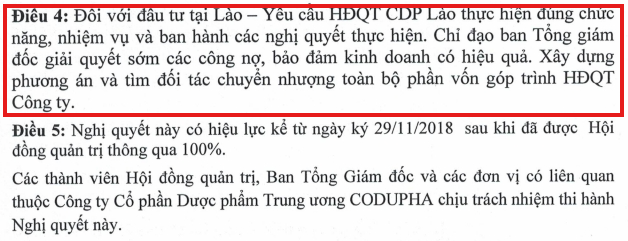

The capital divestment from Codupha Laos has been a topic of discussion for CDP for several years, even dating back to 2018. The minutes of the 2023 Annual General Meeting of Shareholders indicated that the leadership had proposed the dissolution of the subsidiary as the optimal solution to recover debts and investments made by the company. In 2024, the auction of the capital contribution was approved by the shareholders, and the transfer is expected to be completed within this year.

A resolution by CDP’s Board of Directors in November 2018 regarding the consideration of capital divestment from Codupha Laos. Source: CDP

|

According to CDP, their subsidiary did not generate any revenue in the first half of 2024 as it had ceased production since the end of 2023 due to the expiration of the factory land lease. However, they continued to incur costs, including paying 50% of the salaries of employees whose contracts had not yet been terminated, security guards, office rent to store machinery and documents, and other expenses, which increased management expenses. This had an impact on CDP’s profit, despite an increase in revenue compared to the previous year. The company has signed a land lease extension to facilitate the legal procedures for this investment.

In 2023, Codupha Laos recorded revenue of 34 billion VND, a small fraction of CDP’s revenue of over 3,000 billion VND. Despite a 50% increase in revenue compared to the previous year, this subsidiary still incurred a post-tax loss of over 1.8 billion VND. CDP attributed this to additional provisions for overdue receivables and investments in Laos, which affected their profits. By the end of 2023, Codupha Laos’ total assets amounted to over 7.7 billion VND, only one-third of the figure from the previous year. Owners’ equity stood at 7.7 billion VND, a decrease of nearly 3 billion VND from the beginning of the year.

According to CDP’s annual reports over the years, Codupha Laos’ highest post-tax profit was 228 million VND in 2020 and 224 million VND in 2017. Its peak revenue was nearly 34 billion VND in 2023 and over 33 billion VND in 2018. Total assets reached a high of over 60 billion VND in 2017, maintained until 2021, and then decreased to 7.7 billion VND at the end of 2023.

At the 2019 Annual General Meeting of Shareholders, some shareholders expressed their concerns about the low profitability and inefficient operations of the subsidiary and requested the leadership to “reconsider” and “review the capital divestment from Codupha Laos.”

Codupha – Laos joint venture’s factory in Laos. Source: FB Codupha-Lao Pharma Co., Ltd

|

Tu Kinh

“Record-Breaking Prices: Đan Phượng’s Upcoming Land Auction Starts at VND 14 Million per Square Meter”

On September 30, 26 land lots located in the Dong Say – Trem Sau area (phase 2), Phung Town, Dan Phuong District, Hanoi, will be up for auction with a starting price of VND 14 million per square meter.