The government issues six key tasks and solutions to recover from Storm No. 3 and boost production and business activities

|

Losses exceed VND 50,000 billion, GDP declines by 0.15%

The resolution estimates the total property damage caused by Storm No. 3 to be over VND 50,000 billion. It is predicted that the storm could reduce the GDP growth rate for the whole year by about 0.15% compared to the growth scenario of 6.8-7%. The economic growth rate of many localities such as Hai Phong, Quang Ninh, Thai Nguyen, and Lao Cai may decline by over 0.5%.

Therefore, in addition to solutions to overcome the consequences of storms and floods, the resolution also sets out reconstruction solutions to support production facilities, business households, cooperatives, and enterprises in quickly restoring production chains, supply, labor, and promoting the recovery and development of production, business, and economic growth.

Specifically, the Government requests the Ministry of Finance to promptly and effectively implement policies on exemption, reduction, extension, and deferral of taxes, fees, charges, land rents, and water surface rents for subjects affected and damaged by storms, floods, and landslides according to legal regulations.

The Ministry of Finance is requested to direct insurance companies to promptly inspect and pay insurance benefits to affected customers according to regulations. For now, immediately implement the advance compensation payment for customers as prescribed.

Developing credit packages with preferential interest rates

The State Bank of Vietnam, based on Clause 4, Article 147 of the Law on Credit Institutions 2024, reports to the Prime Minister within September 2024 on the classification of assets, provisions for risk provisions, methods of risk provision, and the use of risk provisions to support customers affected and damaged by Storm No. 3.

The State Bank directs credit institutions to proactively calculate support plans, restructure the deadline, keep the debt group unchanged, consider exempting and reducing interest rates for affected customers; develop new credit programs with appropriate preferential interest rates, and continue new loans to customers to restore production and business after the storm according to the current legal regulations.

The Ministry of Planning and Investment shall coordinate with the Ministry of Finance to study and advise, reporting to the Government and the Prime Minister within October 2024 to supplement resources for the Social Policy Bank to lend to existing credit programs at the Social Policy Bank, especially for lending to poor households and other policy beneficiaries in the Northern Midland and Mountainous region.

The Ministry of Industry and Trade shall study and propose policies to support the rapid restoration of damaged logistics facilities and warehouses to ensure uninterrupted supply chains. Research on applying electricity prices for tourist accommodation establishments equal to production electricity prices.

Vietnam Social Security shall study the extension of the deadline for payment of social insurance for tourism enterprises damaged by Storm No. 3.

An Enigmatic Forest Transformation Project: Unraveling the 900-Hectare Mystery in Gia Lai

After 11 years of leasing forest land to plant rubber trees, Duc Long Gia Lai Joint Stock Group failed to implement the project and fell into tax debt.

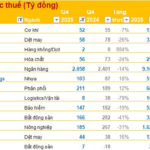

Fiscal Policy: To Loosen or Tighten?

From 2020 onwards, Vietnam has implemented an expansionary fiscal policy, providing relief to businesses and citizens through tax breaks, waivers, and deferrals amounting to nearly VND 200,000 billion per year. This has resulted in an estimated 17.8% year-on-year increase in state budget revenue for the first eight months of this year, indicating a robust economic growth trajectory. With predictions of reaching 6.5% growth in 2025-2026, the question arises: What should Vietnam’s fiscal policy look like going forward?

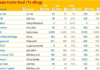

“VAT on Fertilizers: A Fair Proposal or an Unnecessary Burden on Farmers?”

There are differing views on the proposal to impose a 5% VAT rate on fertilizers and agricultural machinery, which were previously tax-exempt.