Oil Rises as Storm Francine Impacts Production

Oil prices climbed on Monday, as Storm Francine continued to affect production in the US Gulf of Mexico. The storm caused disruptions that led to a significant drop in both crude oil and natural gas output in the region.

Brent crude oil for November delivery settled at $72.75 per barrel, up $1.14 or 1.59%. WTI crude oil for October delivery closed at $70.09, gaining $1.44, or 2.1%.

More than 12% of crude oil production and 16% of natural gas output in the US Gulf of Mexico remained shut following the storm. This disruption caused a notable impact on the market, pushing prices upward.

However, the market remained cautious ahead of the Federal Reserve’s interest rate decision on Wednesday. Traders are increasingly betting on a 50-basis-point rate cut by the Fed instead of a 25-basis-point reduction, according to the CME FedWatch tool.

Gold Reaches All-Time High on Fed Rate Cut Expectations

Gold prices surged to a record high on Monday, buoyed by a weaker US dollar and expectations of a significant rate cut by the Federal Reserve at its policy meeting this week. The decline in the dollar made gold more attractive to buyers holding other currencies.

Spot gold finished the session up 0.2% at $2,581.37 an ounce, after earlier hitting an all-time high of $2,589.59. Gold futures for December delivery on the New York Mercantile Exchange fell 0.1% to $2,608.90 per ounce.

Speculators were eager to lock in profits, pushing gold bars to a new record. The $3,000 target is becoming increasingly visible, driven by the easy monetary policies of major central banks and the intense competition in the US presidential election.

Aluminum and Copper Rise on Lower Dollar and Fed Expectations

Aluminum prices surged past key resistance levels on Monday, supported by lower inventories, a weaker US dollar, and expectations of a significant rate cut by the Federal Reserve at its upcoming meeting. The price of aluminum broke above several critical averages, including the 100-day, 20-day, 50-day, and 200-day moving averages, indicating strong upward momentum.

Three-month aluminum on the London Metal Exchange (LME) ended the session up 2% at $2,518 a ton. During the session, it touched $2,545, its highest since August 28. Copper also saw gains, with three-month copper on the London market rising 0.9% to $9,388 a ton.

Weak economic data from China, including slower industrial output growth and softer retail sales and new home prices, contributed to the upward momentum in metal prices.

Rubber Prices Climb on Optimistic Demand Outlook

Rubber prices in Singapore rose on Monday, buoyed by expectations of increasing global demand and higher oil prices, despite weak economic data from China. October rubber on the Singapore exchange rose 1.8% to 188.6 US cents per kg.

The Osaka Futures Exchange was closed on September 16 for a national holiday in Japan but will resume trading on September 17. Similarly, the Shanghai Futures Exchange was closed on September 16 and 17 for the Mid-Autumn Festival in China.

Cocoa Prices Climb While Coffee Prices Dip

Cocoa futures for December delivery on the New York exchange rose 0.9% to $7,767 a ton on Monday. In London, cocoa for December rose 0.6% to £5,396 a ton. The upward movement in cocoa prices comes amid a global cocoa deficit and declining stock-to-grind ratios, which have reached their lowest levels in nearly 50 years.

Ghana, the second-largest cocoa producer, lost 160,000 tons of cocoa, or over a third of its 2023/24 crop, due to smuggling, according to Cocobod. This loss was attributed to low local cocoa prices and delayed payments, which pushed some farmers to sell to smugglers.

Coffee prices, on the other hand, dipped as investors took profits following a multi-year high last week. Arabica coffee for December fell 0.3% to $2,5855 per lb, while robusta coffee for November declined 0.4% to $5,246 a ton after touching a 16-year peak earlier.

Wheat, Corn, and Soybean Prices Ease

Wheat futures in Chicago eased from a three-month high on Monday due to profit-taking after last week’s rally, which was fueled by concerns about crops in Europe and escalating tensions between Russia and Ukraine. Corn and soybean prices also declined due to supply pressure during the harvest season.

The most active wheat futures on the Chicago Board of Trade (CBOT) ended down 16-1/4 cents at $5.78-1/2 per bushel. Corn futures fell 2-1/2 cents to $4.10-3/4 a bushel, while soybeans lost 1-3/4 cents to $10.04-1/2 a bushel.

Goldman Sachs Cuts Iron Ore Price Forecast

Goldman Sachs lowered its forecast for iron ore prices in the fourth quarter of 2024 to $85 per ton, a reduction of $15 from its previous estimate. The bank cited a supply surplus despite stable demand from top consumer China.

Chinese iron ore futures had risen last week on expectations of stimulus measures and a recovery in steel demand. However, the Chinese market was closed on Monday for the Mid-Autumn Festival holiday.

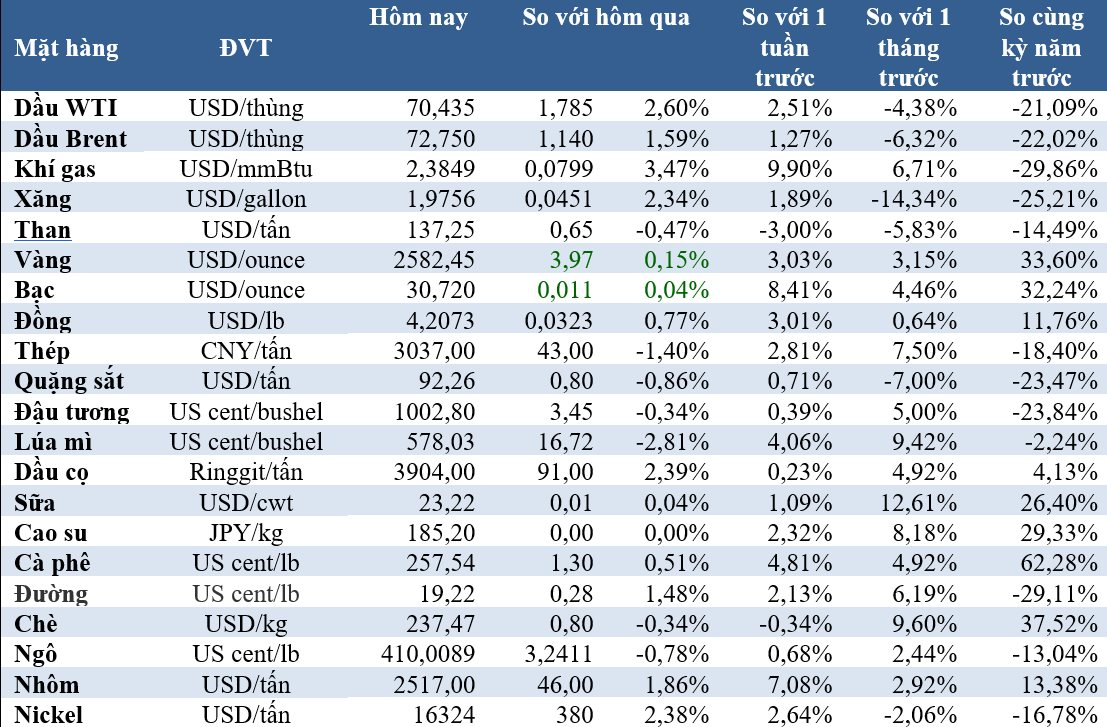

Prices of Key Commodities on September 17:

The Energy and Commodity Markets Surge: US Crude Oil Climbs Over $2 a Barrel, Robusta Coffee at a Near 16-Year High

As of the market close on September 11th, crude oil prices surged by over $2 a barrel, with natural gas, nickel, copper, steel, and sugar also seeing notable gains. Robusta coffee prices hit a near 16-year high, while gold and rubber prices retreated.