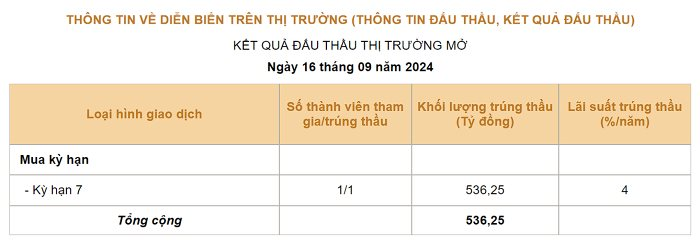

The trading session on September 16 witnessed notable developments in the foreign exchange market as the State Bank of Vietnam (SBV) reduced the lending rate for repo transactions to 4% per annum from 4.25% maintained since early August.

However, the amount of repo bids in today’s auction only reached slightly over VND 536 billion, a slight increase compared to the previous week’s session.

Source: SBV

This is the second time the SBV has cut the repo rate in just over a month. Previously, the regulator also lowered this interest rate from 4.5% per annum to 4.25% in the auction held on August 5.

This rate cut reverses the trend of rate hikes in the first half of 2024, as the SBV had adjusted this rate twice in mid-April and May 2024, from 4% to 4.25% and then from 4.25% to 4.5%.

The reduction in the repo rate indicates the SBV’s orientation to support the liquidity of the banking system, thereby establishing a lower interbank interest rate level in the future. Moreover, the SBV’s move is considered appropriate in the context of the exchange rate continuously plummeting in recent weeks.

In the interbank market, the USD exchange rate at the end of last week fell to VND 24,543/USD, down VND 47 from the previous week’s session. Compared to the end of July, the interbank USD exchange rate has decreased by about 2.8%.

The USD selling rate listed by domestic banks has also continuously dropped deeply. By the end of last week, the USD selling rate listed by banks ranged from VND 24,730 to VND 24,750, while the buying rate was at VND 24,360 to VND 24,400. Since the beginning of August, the USD rate at banks has decreased by about VND 700, equivalent to a decrease of 2.7%. This has narrowed the depreciation of the VND against the USD since the beginning of the year to 1.3%, down from the peak of 4.3% recorded in June and July.

In the free market, USD rates offered by foreign currency buyers have fallen below VND 25,000 for both buying and selling. Compared to the peak of nearly VND 26,000 at the end of June, the current free market USD rate is nearly VND 1,000 lower, equivalent to a decrease of 3.8%.

Thus, in the context of the cooling exchange rate, the SBV has implemented a series of accommodative policies. Specifically, the regulator announced that from August 28, credit institutions with a 2024 credit growth rate of 80% of the allocated quota at the beginning of the year would be allowed to proactively adjust their credit growth limit based on their ranking.

In the open market operations channel, the SBV also proactively stopped issuing bills and reduced the lending rate for repo transactions to 4.0% to support the liquidity of the banking system.

After a series of accommodative moves by the SBV and the sharp declines in the exchange rate, analysts do not rule out the possibility that the regulator will increase the USD buying rate at the Trading Center to replenish foreign exchange reserves (as in late 2022). Previously, in the second quarter and early third quarter, the SBV sold a large amount of foreign currency (estimated at about $6 billion, equivalent to the amount of foreign currency purchased in 2023) to cope with exchange rate pressure.

At the online seminar “Data Talk September 2024: Concerns about Recession, Fed, and investment strategies at the threshold of 1,300” held by VietnamBiz and Wigroup on September 13, Ms. Nguyen Thi My Lien, Head of Analysis Department, Phu Hung Securities Company, said that the market expects the SBV to resume buying foreign currency, thereby increasing VND liquidity in the market. Predicting the next moves, the expert said that the SBV would keep interest rates stable, especially in the context of Tropical Storm Yagi, which has just passed.

“In suitable conditions, the SBV may return to buying foreign currency, but the exchange rate needs to drop deep enough. In general, the decrease in the exchange rate and the possibility of the SBV buying foreign currency again are very positive factors, helping to increase market liquidity,” said the expert from Phu Hung Securities.

VnDirect Securities also believed that the regulator would have more policy space to support market liquidity through the open market operations channel and have conditions to supplement foreign exchange reserves in the last months of this year.

“Banking Sector Makes Sacrifices for the Greater Economic Good”

As of the State Bank of Vietnam’s regular press conference for August 2024, Deputy Governor Dao Minh Tu revealed that as of September 7th, credit growth had reached 7.15% compared to the end of 2023. This indicates a healthy and steady expansion of the country’s credit market, showcasing the resilience and potential of Vietnam’s economy.