“Hanging” Individual Investors

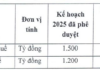

According to statistics from the Vietnam Bond Association, in the first eight months of this year, the total corporate bond issuance reached nearly VND 215 trillion, equivalent to 30% compared to 2020 and 2021. Corporate bond outstanding debts amounted to approximately VND 1.1 quadrillion, equivalent to 10% of GDP in 2023, much lower than the government’s target of 20% of GDP by 2025 and 25% by 2030.

The draft by the Ministry of Finance has caused concerns among investors about potential difficulties in this market.

Meanwhile, the Ministry of Finance is developing a project to amend and supplement a number of articles of the Securities Law. The draft supplementing provisions on private placement of corporate bonds has raised concerns among investors about potential challenges in this market. Especially for individual investors – an essential component in the market, some conditions may create barriers to participation.

One of the most controversial points is the restriction on transactions with individual investors. Clause 2 of Article 1 of the draft law amendment stipulates that professional individual investors are not allowed to invest in privately issued bonds if they do not meet certain conditions, including a minimum of two years of securities investment experience, a minimum transaction frequency of 10 times per quarter in the last four quarters, a securities portfolio of at least VND 2 billion, and an annual income of at least VND 1 billion in the last two years.

While these conditions aim to mitigate risks for investors, they are somewhat stringent and may reduce market participation. Simultaneously, they impact the investment needs of individuals in corporate bonds. Restricting the types of assets that can be invested contradicts market trends, investor demands, and the legitimate rights of investors.

Additionally, the draft requires organizations issuing public bonds to have collateral or a bank guarantee when applying for an issuance license, except for cases where the credit institution offers secondary debt bonds that meet the conditions to be counted as Tier 2 capital and have bondholder representatives as stipulated.

Hard to Fulfill

Mr. Hoang Kim Hoai, Director of Phuc Dien Land Company, opined that the corporate bond market is relatively small and somewhat stagnant, necessitating encouragement for investor participation.

Tightening rules for individual investors may hinder enterprises from successfully issuing bonds to raise capital.

“Simultaneously raising the standards for professional investors and imposing stricter conditions on issuing organizations may render the corporate bond market even more lackluster. Consequently, this hinders capital flow in the economy and diminishes enterprises’ capacity to raise capital,” stated Mr. Hoai.

According to experts, these regulations are overly stringent, making it challenging for many investors to meet the requirements to enter the market. Mr. Hoai believes that requiring bond investors to have an annual income of VND 1 billion is unrealistic when the average income of Vietnamese citizens in 2023 was USD 4,284 per person. This criterion prevents many people from accessing corporate bond investment opportunities and diminishes the appeal of the corporate bond market.

Economist Luong Duy Sinh shares a similar sentiment, suggesting that instead of imposing exceedingly high criteria, it is more advisable to require individual investors to undergo short-term training courses to obtain certificates.

Mr. Sinh also warns that if the regulations are too stringent, the market will lack individual investors, resulting in insufficient buyers. Consequently, enterprises may struggle to successfully issue bonds to raise capital.

Stringent Conditions for Bond Issuance

According to this regulation, to issue corporate bonds to the public, enterprises must complete the pledge and registration of security for the bonds before submitting their permit application. This process typically takes several months, incurring additional costs and manpower while prolonging the capital mobilization process for business development.

The requirement for a bank guarantee is also deemed inappropriate, as commercial banks are not permitted to guarantee corporate bonds intended for purchasing shares, capital contributions, or debt restructuring. Moreover, they may be restricted by the credit room for the year. In reality, corporate bonds serve as a form of capital mobilization. Mandating collateral for publicly offered corporate bonds that are not Tier 2 capital contradicts prevailing practices.

The Perplexing Puzzle of Corporate Bond Investment for Individual Investors

The proposed regulation by the Ministry of Finance has caused concern among investors, with requirements for professional individual investors to have a minimum of two years of securities investment experience, a portfolio of at least VND 2 billion, and an annual income of VND 1 billion in the last two years to be eligible for bond market participation.

Enterprise Private Bonds: Numerous Proposals to Remove Obstacles and Unblock the Impasse

As new regulations are introduced for privately placed corporate bond transactions, a myriad of solutions has been proposed to ease the process and foster market development.

Corporate Bonds: Back on the ‘Fast Track’

The corporate bond market is finding its feet again, with a surge in capital raising and much-needed debt restructuring from previous issuances. The market supply is heating up with a diverse range of issuances across different corporate structures. However, bond buyers, especially individual investors, still face significant risks.