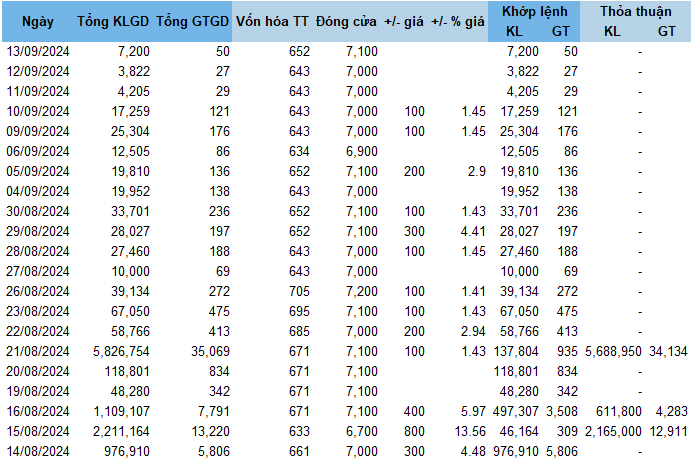

In particular, Mr. Dung only purchased over 8 million shares out of the registered 14 million CMM shares, citing that the stock price did not meet his expectations. Based on the average price during the transaction period of VND 7,033 per share, it is estimated that Mr. Dung spent approximately VND 56.5 billion.

During this period, nearly 8.5 million CMM shares were also traded via negotiation, valued at over VND 51.3 billion. It is possible that Mr. Dung contributed to this significant volume of negotiated shares.

Following the transaction, Mr. Dung’s ownership increased from 3.5% to 11.7%, equivalent to nearly 11.5 million shares, making him a major shareholder of CMM. He now holds a substantial influence in the company.

|

Details of CMM share transactions during the period of August 14 – September 13, 2024

KLGD: Shares, GTGD: Million VND

Source: VietstockFinance

|

Earlier, in early May 2024, Mr. Dung successfully purchased 3.4 million CMM shares. This transaction was made through a public offering by the Company, with National Securities Joint Stock Company (NSI) as the issuing agent. At a sale price of VND 10,000 per share, it is estimated that he spent VND 34 billion to complete the transaction, thereby increasing his ownership from 0.025% to 3.5%. These shares constitute the total amount offered by CMM during this issuance.

Mr. Bui Duc Dung (born in 1995) is the son of CMM’s Chairman of the Board of Directors, Bui Si Tuan, who directly holds nearly 1.5 million shares (a stake of 1.56%).

Mr. Dung joined CMM’s Board of Directors in 2022 and was re-elected for the 2024 – 2029 term. He also served as the Project Development Director of the parent company, Camimex Group (listed on HOSE: CMX), from 2018 to 2020, and has been the Vice President of Camimex Logistics since 2021. Currently, he chairs the Board of Directors of Thao Anh Fish JSC.

CMM shares have been traded on the UPCoM since November 2022. Recently, the Company’s shareholders approved the plan to shift to the Ho Chi Minh Stock Exchange (HOSE), expected to be carried out in 2024 or 2025. According to the Company, this move aims to enhance the liquidity of CMM shares, elevate the Company’s stature, and attract new investment opportunities, ultimately benefiting the shareholders.