McDonald’s is an iconic fast-food brand with a global presence, and its journey to success is an intriguing tale. With a footprint in over 118 countries and a staggering 35,000 restaurants, McDonald’s serves more than 70 million consumers worldwide every day.

The Plan for 100 McDonald’s Restaurants in Vietnam

Mr. Nguyen Bao Hoang, the man who brought McDonald’s to Vietnam, expressed optimism about the brand’s prospects in the country. In an interview with Bloomberg, he shared the ambitious goal of having 100 McDonald’s restaurants in Vietnam within the next decade, acknowledging the challenge but believing it to be achievable.

Mr. Ralf Matthaes, an expert from TNS Vietnam, concurred with this assessment at the time. He stated that with Vietnam’s rapidly rising income levels, targeting the middle class with a monthly household income of $500 to $1,000 would be a winning strategy.

Facing Reality

However, more than a decade since McDonald’s first entered Vietnam, the journey has proven more challenging than anticipated. The brand has only managed to achieve a third of its initial goal. Currently, there are 36 McDonald’s restaurants located in major provinces and cities such as Ho Chi Minh City, Hanoi, Binh Duong, Khanh Hoa, and Hai Phong, among others.

Instead of expanding, the brand recently announced the closure of one of its oldest branches, effective September 19. In a statement on their fan page, McDonald’s shared the news, expressing their emotions about the end of a decade-long journey.

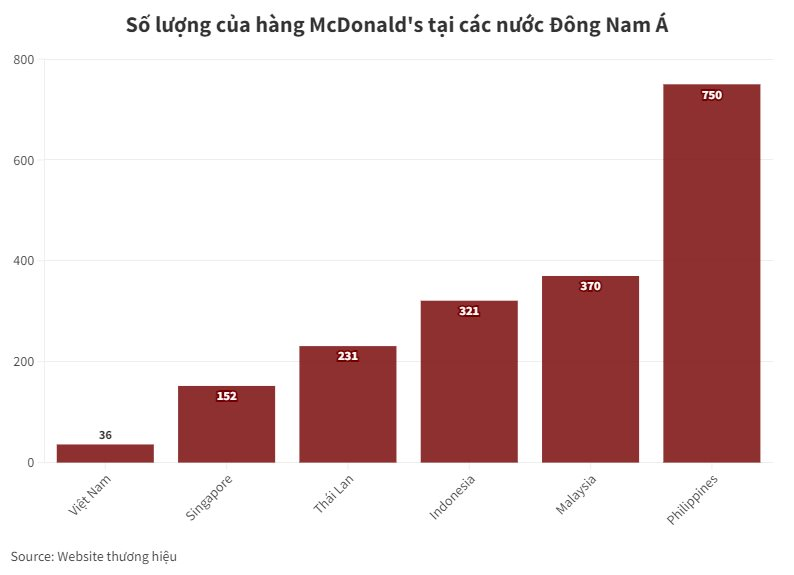

In comparison to other countries in the region, Vietnam has one of the lowest numbers of McDonald’s restaurants. The Philippines boasts over 750 outlets, more than 20 times the number in Vietnam. Similarly, Malaysia has 370, Indonesia 321, Thailand 231, and Singapore over 152, more than tripling Vietnam’s count.

According to WorldPopulationReview, the number of McDonald’s restaurants in Vietnam is on par with countries like Jordan, Uruguay, and Oman.

Global Distribution of McDonald’s Restaurants. Image: WorldPopulationReview

CNBC, a prominent news source, previously reported on the challenges faced by American fast-food chains in Vietnam, citing the country’s diverse and vibrant culinary scene as a competitive hurdle. While the opening of the first McDonald’s in Vietnam in 2014 garnered much excitement, with locals queuing for hours to try the Big Mac, this initial curiosity did not sustain long-term growth. It took four years for the chain to open 17 branches and a full decade to reach 36 outlets.

Experts attribute McDonald’s struggles in Vietnam to various factors, including pricing and cultural dining preferences. McDonald’s and Burger King are among the most expensive fast-food options, while competitors like KFC, Lotteria, and Jolibee offer more affordable menus that cater to local tastes. McDonald’s attempt to introduce a “pho-flavored” burger in 2020 fell flat, and they quickly discontinued it.

Price, however, is not the only obstacle. American dining culture typically involves individual meals, whereas Vietnamese culture favors sharing. The iconic McDonald’s Big Mac, for instance, is not easily shared, making it less appealing to Vietnamese diners.

Mr. Thue Thomasen, founder of Decision Lab, commented that perhaps fast food is not as alluring to Vietnamese consumers as it is in other markets.

Additionally, according to Statista, a German data analytics company, foreign fast-food brands entering the Vietnamese market must compete with the country’s robust “street food” sector. In 2023, Grab reported that the top 10 most popular orders on their platform were predominantly Vietnamese dishes, with the exception of a single fast-food item: a shrimp burger.

McDonald’s and Burger King faced competition not only from local brands but also from established foreign names like KFC, Lotteria, and Pizza Hut. In 2018, CNBC reported that McDonald’s and Burger King held only a 2.8% market share in Vietnam’s fast-food industry, while KFC claimed 11.4% and Pizza Hut a substantial 21.3%.

Without a well-executed strategy, the goal of reaching 100 restaurants in Vietnam may remain elusive for McDonald’s.