In 2017, I purchased my first home, a four-story house located in a small alley in Hoang Mai district for 2.5 billion VND. The house was fully functional for a young family, close to the market, schools, and both my wife’s and my workplace.

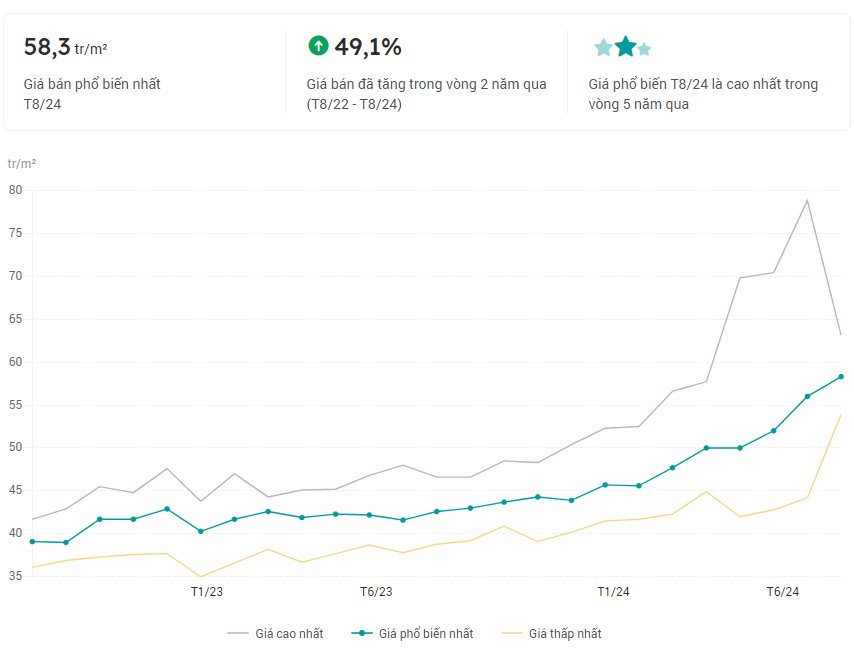

However, after living in this alley house for five years, my wife and I desired the convenience of an apartment. Especially with plans to expand our family, we wanted to explore other living options. In 2022, we jointly scouted apartment options in a building on Kim Giang street in Thanh Xuan district. At that time, the asking price for apartments in this area ranged from 40 to 45 million VND per square meter. We were shown a two-bedroom apartment measuring 71 square meters, priced at 3.1 billion VND (equivalent to 43.6 million VND per square meter), including fees. There was also a three-bedroom unit measuring 84 square meters on offer for 3.65 billion VND (approximately 43.4 million VND per square meter), which included fees and furnishings.

The real estate market was experiencing a stagnation, with high-interest rates and real estate price cuts in many provinces. I anticipated that apartment prices would decrease, so I decided to postpone our move, expecting a better opportunity soon.

Contrary to the overall real estate market trend, apartment prices in Hanoi began to rise. By the end of 2023, the price of the 84-square-meter, three-bedroom apartment in the Kim Giang building had increased to 3.95 billion VND (equivalent to 47 million VND per square meter), an increase of nearly 300 million VND from the previous year.

This marked the beginning of a rapid escalation in apartment prices. By March 2024, the price of the 84-square-meter unit had soared to around 4.6 billion VND (approximately 55 million VND per square meter), reflecting an increase of over 600 million VND in less than four months.

By July, the asking price for apartments in this complex had reached nearly 60 million VND per square meter. The 84-square-meter unit now totaled more than 5 billion VND, an additional increase of over 400 million VND from April.

Asking prices for apartments in the Kim Giang, Thanh Xuan building. (Source: Batdongsan.com.vn)

Faced with the staggering increase in apartment prices, my wife and I decided to halt our search for an apartment and shifted our focus to finding a house with the criterion of having a car accessible location. While alley houses have also experienced price increases over time, the rise has been stable and not as shocking as the apartment prices.

Specifically, we purchased a house near the previous apartment project for 8 billion VND. The property had a land area of 40 square meters and was built over five floors, providing a total usable area of 200 square meters. This translates to approximately 40 million VND per square meter of usable space, which is more affordable compared to the asking price of 60 million VND per square meter for apartments.

Moreover, houses with car-accessible locations hold potential for sustainable price increases in the future. On the other hand, apartments that have been in use for 5-7 years and have just gone through a rapid price increase since the end of 2023 are likely to stabilize in price and may face potential degradation in quality over the coming years. Therefore, with our comfortable financial situation, I decided to choose a house in a wider road location with car accessibility over an apartment.

The Urban Exodus: Sky-High Prices for Out-of-Reach Apartments

Once upon a time, suburban apartments were few and far between, yet still affordable. Now, while there are more developments in the suburbs, the prices have skyrocketed and are almost on par with the city’s inner urban areas.