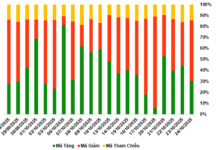

A slight profit-taking pullback occurred this afternoon as bottom-fishing stocks saw decent gains. This is a normal development and hasn’t caused any apparent harm, just a slight downward pressure on prices within the uptrend. Stronger buying momentum is boosting the market’s ability to absorb such intraday fluctuations.

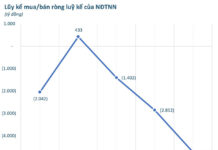

Today’s matched order liquidity on the HSX and HNX reached nearly VND 15,800 billion, the highest in 13 sessions and back to the average level. It’s evident that a portion of the money has decided to participate in buying despite the rapid price increase. The market has also gone through 2/3 of September, and newer supportive information is forthcoming. As worrying factors become less relevant, sentiment will shift towards the future. Therefore, the likelihood of a deeper decline is now lower than the chances of an advance.

The most important factor remains the inflow of new money. When expectations change, investors tend to sell less, so new money will alter the supply-demand dynamics and create opportunities for prices to rise. If you miss the chance to buy on dips, those holding cash will have to decide when to enter, whether to wait for a retest or buy immediately. Hence, crucial signals include decreasing liquidity during intraday declines and increasing liquidity during advances, along with narrower intraday loss margins.

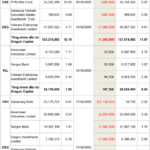

Currently, most stocks have a reference bottom, while others have a well-defined bottom. Due to varying strengths of supply and demand, each stock’s performance is unique, but historical price zones and accumulated liquidity within those ranges remain essential references. Trading decisions often refer back to past emotions and choices, and the feeling of “missing out” on past opportunities can reinforce determination in the present.

Short-term profit-taking pressure is emerging, so if you want to buy, there’s no need to chase high prices. I still believe it’s best to maintain a high stock proportion at this point, without the need for frequent trading. Opportunities to reduce capital costs through derivatives trading should be seized.

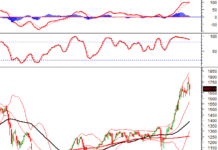

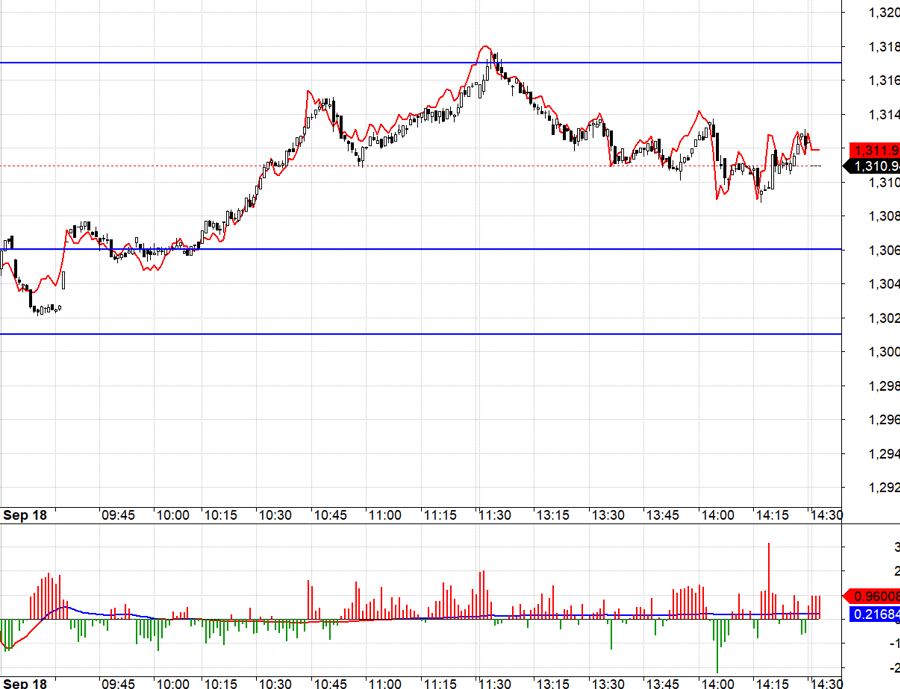

Yesterday’s projection for derivatives today was an expectation of limited fluctuations and a narrow trading range between 1301.xx and 1306.xx due to expected profit-taking pressure. For more than half of the morning session, the VN30 index traded as anticipated but then started to strengthen. With F1 futures approaching expiration, basis is no longer a concern. The range from 1306.xx to 1317.xx opened the upside, offering a good opportunity for the Long side with a standard stop loss. This was also the most profitable upward move of the day, as VN30 precisely reached 1317.xx before reversing. The afternoon decline was challenging to trade, even with a stop loss, as the adjustment range was difficult to predict due to stable buying support and mild selling pressure.

The afternoon pullback indicates that sellers are selective about their prices, and buyers are willing to pay slightly above reference prices. Overall, today’s session was open for two-way trading, reflecting a positive psychological state. A liberal decision-making mindset often signifies a willingness to accept higher risk, characteristic of a robust market. Tomorrow, the market will react to the Fed’s decision and futures expiration. The strategy remains flexible, favoring both Long and Short positions.

VN30 closed today at 1310.94. Tomorrow’s resistances are 1318; 1325; 1335; 1340; 1346; 1351. Supports are 1305; 1298; 1290; 1285; 1280.

“Stock Market Blog” reflects the personal views of the author and does not represent the opinions of VnEconomy. The views, assessments, and investment advice expressed herein are solely those of the author, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the published assessments, views, or investment advice.