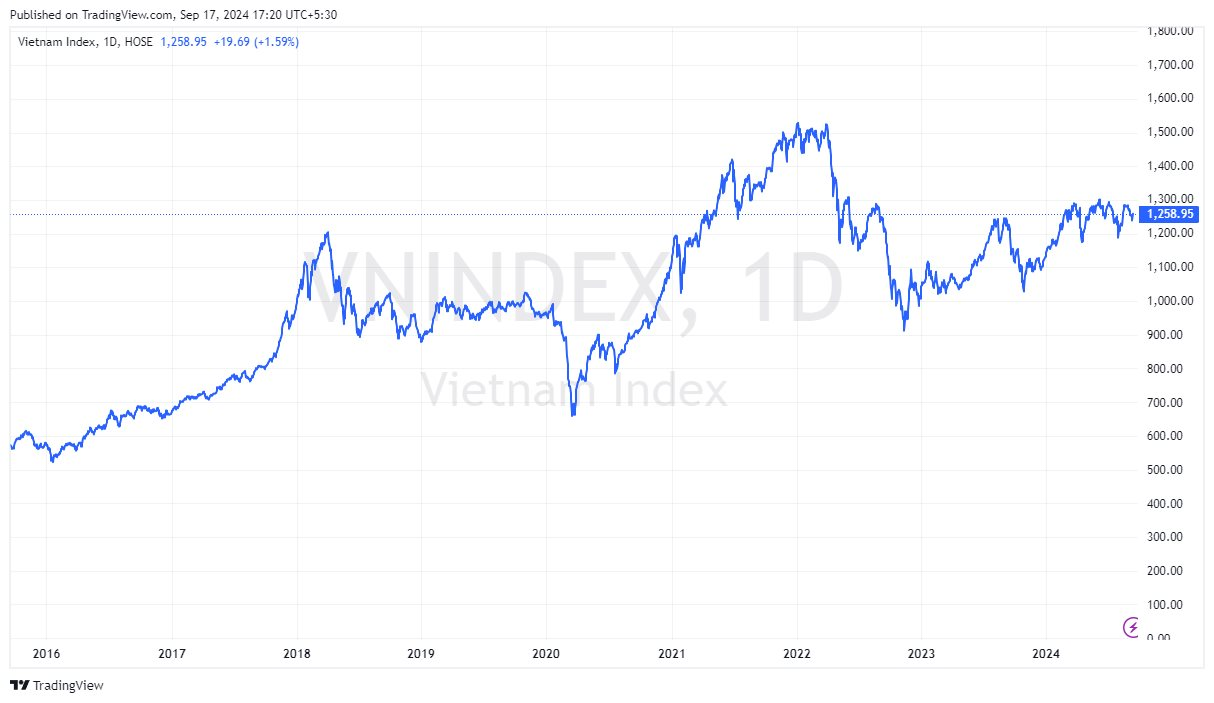

After a dull start to the week, the stock market on the 17th of September (Mid-Autumn Festival) witnessed a positive shift, reversing the short-term downward trend. The VN-Index made a slight adjustment early in the session but gradually gained momentum with improved buying interest. By the closing bell, the benchmark index had climbed 19.69 points (+1.59%) to 1,258.95. Foreign investors continued to boost sentiment with net buying of VND523 billion across all markets.

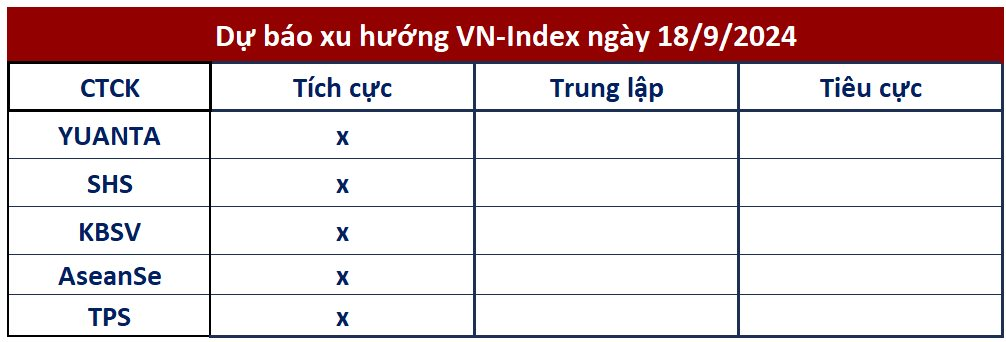

Brokerages unanimously agreed that the market could continue this upward trajectory after successfully retesting the support level, with short-term risks diminishing.

Yuanta Securities believed that the market would likely maintain its upward momentum, with the VN-Index potentially challenging the 1,270-1,275 range. While short-term risks appeared to be diminishing, the index might still experience continuous fluctuations upon entering the 1,260 range in the next session. Investors were advised to maintain their current equity allocation and refrain from selling at this point as short-term risks showed signs of abating.

Sharing a similar view, SHS Securities assessed that the short-term trend of the VN-Index was improving again as the index held a solid support area around 1,250 points. SHS anticipated that the VN-Index would continue upward to retest the 1,270 zone.

According to SHS, the current price range seemed reasonable concerning the market’s growth prospects. Therefore, investors could consider increasing and expanding their portfolios with a watchful eye on disbursement, expecting the VN-Index to firmly test the lower bound of 1,250 points in the medium-term accumulation channel.

KB Vietnam Securities also expected the market to sustain its short-term uptrend and conquer the nearby resistance area, despite the potential return of high-price supply during the ascent. In addition to holding long-term positions, KBSV recommended that investors dynamically sell a portion of their previously bought positions at the support level to balance their holdings.

From the perspective of Asean Securities, the slight increase in trading volume, coupled with foreign investors’ demand in recent sessions, supported optimism for a short-term recovery. In a positive scenario, if the market firmly holds this support area, the VN-Index’s next target would be the 1,265-1,270 zone. However, ASEANSe also cautioned about the risks stemming from negative news in the US stock market, underscoring the need to closely monitor global markets to determine how long the uptrend could persist.

For short-term trades, investors should exercise caution and prioritize balancing profits with risks. In the long term, investors should proactively manage their cash positions to seize opportunities when stocks become attractive.

Meanwhile, TPS Securities optimistically stated that today’s market performance had opened up bright prospects for investors who bought stocks around the 1,240 and 1,260 thresholds, with liquidity being the only missing piece.

TPS asserted that a session with increased liquidity would confirm the market’s new uptrend. Investors who had already deployed capital could maintain their positions, while those with a low-risk appetite should await confirmation of the uptrend (a session with higher liquidity) before initiating new positions.

The Big Reveal: Unveiling the Power Players Behind the $3 Billion Smart City Project in Dong Nai

The People’s Committee of Dong Nai Province has given the green light to a prestigious urban development project, the Hiep Hoa City project, located in Hiep Hoa Ward, Bien Hoa City. With a staggering total investment of over 72 trillion VND, this project promises to be a game-changer for the region.