The topic that has been buzzing on social media and stock investment forums lately is the Draft Law amending and supplementing a number of articles of the Securities Law recently announced by the Ministry of Finance.

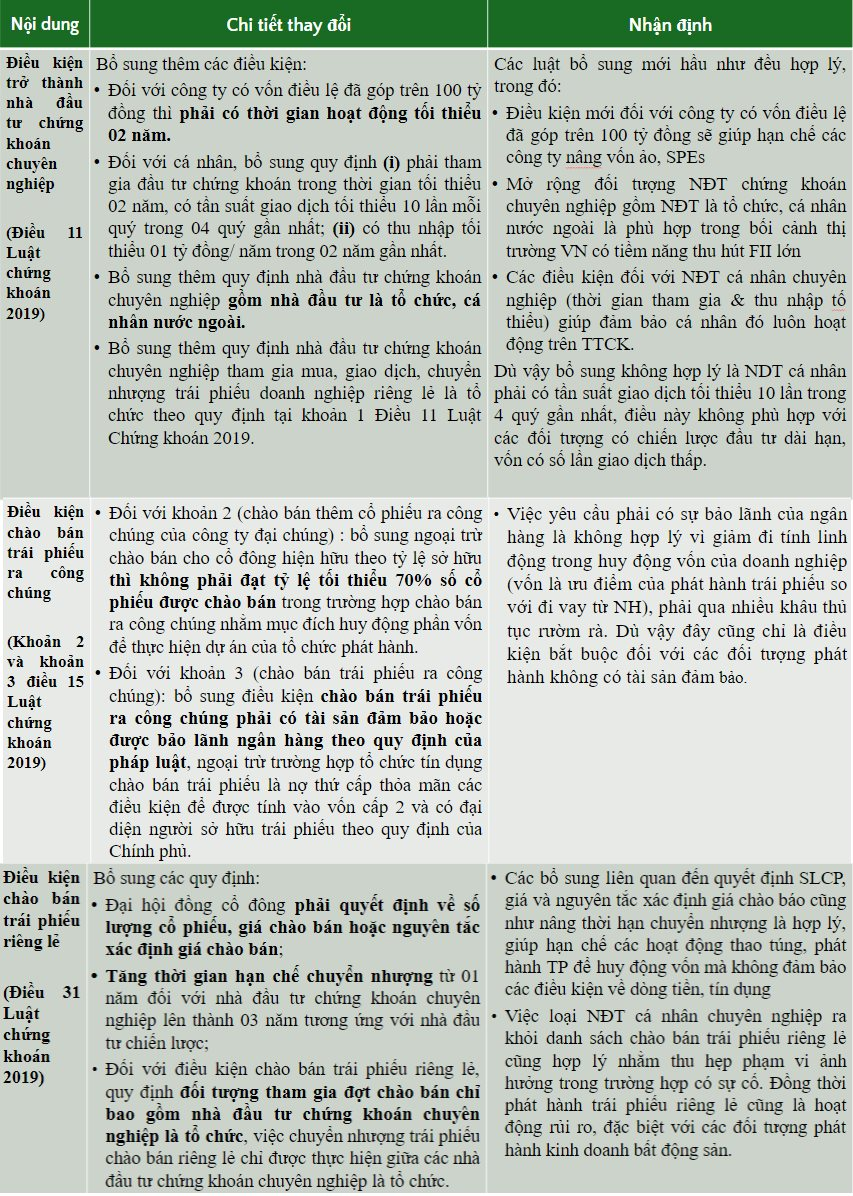

Accordingly, one of the most notable proposals is the Ministry of Finance’s raising of the standards for professional securities investors. For individuals, the following requirements are added: (i) must have participated in securities investment for a minimum of 02 years, with a minimum trading frequency of 10 times per quarter in the last 04 quarters; (ii) have a minimum income of VND 01 billion/year in the last 02 years.

Many reactions state that the above conditions may reduce risks for investors, but most show that the new regulations are stringent and could easily become barriers, thereby narrowing the scope of participation in the market.

According to Bui Van Huy, Ho Chi Minh City Branch Director, DSC Securities Joint Stock Company, it is normal to have opposing viewpoints that either support or argue against policy changes.

Firstly, there is a clear direction to build a more transparent and safer bond market.

Raising the bar for market entry and directing the buying and selling of privately placed bonds towards the primary issuance stage is a playground for organizations, funds, and securities companies’ proprietary trading, while professional individual investors can buy listed bonds on a centralized exchange—a clear and sustainable orientation after the initial building of a private bond exchange in 2023.

However, Mr. Huy assessed that the supplementary provisions on the conditions for professional investors are unreasonable, especially the requirement that individual investors must have a minimum trading frequency of 10 times per quarter in the last 4 quarters.

“This is totally inappropriate for investors with a long-term investment strategy and a low number of transactions. In reality, the current regulations on professional individual investors are already stringent after several amendments. In addition, investor education should be strengthened,” said Bui Van Huy.

Some other opinions also stated that this is a relatively high trading frequency, especially for long-term investors. The “professional” standard forces investors to engage in short-term trading.

A leader of a large securities company once shared that “90% of the transactions in the market are losing trades.” This shows the high level of risk in the stock market, especially for investors with a high trading frequency. Therefore, the condition of trading frequency can affect the performance of investors, especially in an unfavorable market environment.

On the other hand, regarding the conditions for public offering of bonds, it is proposed to add the condition that the issuer must have collateral or a bank guarantee in accordance with the law.

Mr. Huy opined that requiring a bank guarantee is unreasonable as it reduces the flexibility of enterprises in capital mobilization (which is an advantage of bond issuance compared to borrowing from banks). The bond market is built on trust, and many large enterprises are fully capable of issuing bonds without collateral.

Once again, the DSC expert stated that it is reasonable to have strict regulations in both issuance and investor eligibility. However, what is truly important is whether these regulations are practical and applicable in reality.

Comparison of the Securities Law before and after amendment

“Individual Investors Speak Out on Corporate Bond Trading Restrictions”

“There is a growing concern among individual investors that they will be left behind in the corporate bond market if and when new regulations are implemented. This fear is understandable, as regulatory changes can significantly impact investment strategies and opportunities.”