Riding on the recovery momentum of the general market, the shares of CTR of Total JSC Viettel Construction (Viettel Construction) also witnessed a vibrant uptrend.

The CTR stock price surged to the ceiling, with a ‘white sale’ of 133,300 VND/share in the morning session, reaching its highest level in two months. Trading volume also spiked with nearly one million shares changing hands.

Since the beginning of the year, this stock has skyrocketed by 48% in value, pushing its capitalization above 15,200 billion VND.

This ceiling trend followed the news that CTR finalized its list of shareholders to pay a record-high dividend on September 30. Accordingly, Viettel Construction will distribute 2023 dividends in cash at a rate of 27.2% (each share will receive 2,720 VND). The expected payment date is October 18, 2024.

With over 114 million shares in circulation, Viettel Construction will dish out more than 310 billion VND for this dividend payout. The Military Industry and Telecoms Group (Viettel), the parent company that holds a 65.66% stake in Viettel Construction, will pocket over 204 billion VND from this dividend event.

Meanwhile, Mr. Doan Hong Viet – Chairman of the Board of Directors of Digiworld JSC (Digiworld – code DGW) and related organizations, currently holding 5.08% of CTR’s capital, is expected to earn about 16 billion VND.

Accomplished 63% of the 2024 profit plan after eight months

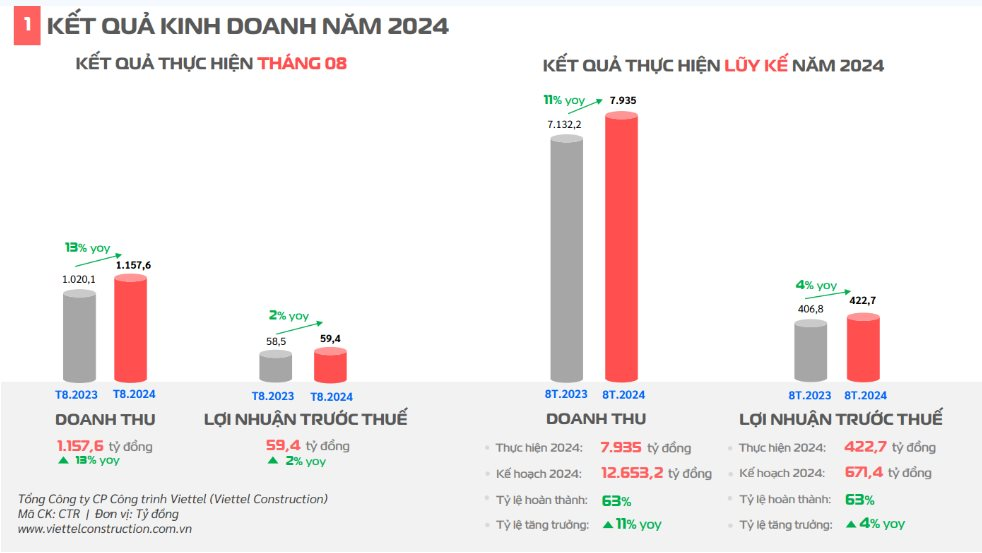

In a related development, CTR recently published its August 2024 business report. Specifically, the company recorded nearly VND 1,158 billion in revenue, up 13% over the same period. Pre-tax profit exceeded VND 59 billion, up 2% compared to August 2023.

For the first eight months of the year, Viettel Construction’s revenue reached VND 7,935 billion, and pre-tax profit was estimated at nearly VND 423 billion, increasing by 11% and 4%, respectively, compared to the same period.

With these results, the company has accomplished 63% of its revenue and profit plans for 2024.

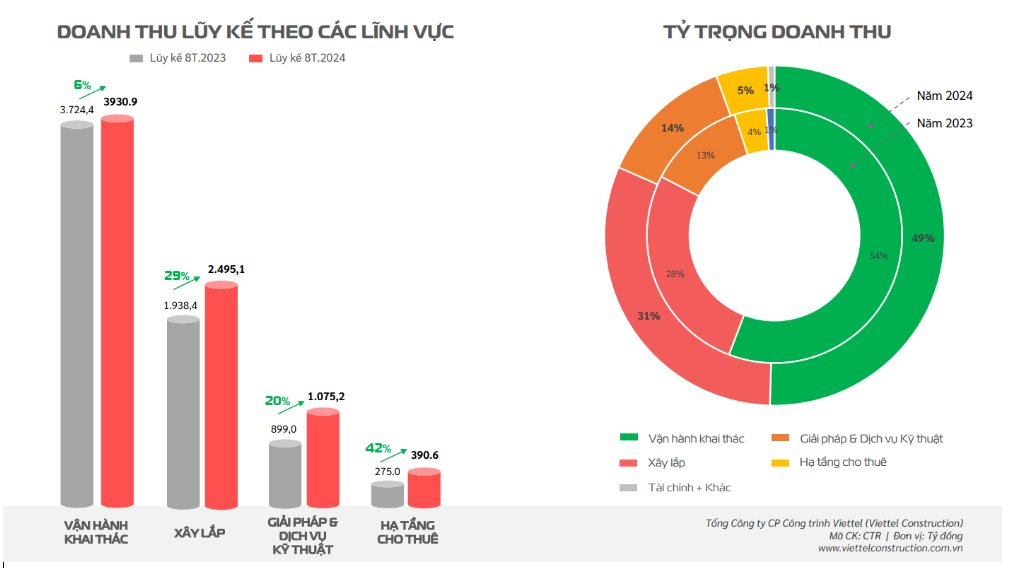

Regarding specific business areas, the revenue from the operation and exploitation sector in the first eight months of the year witnessed a 6% increase over the same period, with nearly VND 3,931 billion, still accounting for the largest proportion (50%).

Ranked next is the construction sector, which contributed 31% of total revenue, with more than VND 2,495 billion in the first eight months of the year, up 29% from the same period last year. During this period, the company signed B2B contracts worth VND 1,665 billion and B2C & SME contracts worth VND 1,279 billion.

Additionally, other segments, such as technical solutions and services, and infrastructure leasing, generated revenues of VND 1,075 billion and VND 390 billion, respectively, for the company in the first eight months of 2024. As of August 31, Viettel Construction owned 8,447 BTS stations, maintaining its position as Vietnam’s leading TowerCo. The sharing rate reached 1.03.