Chairman of VIB, Dang Khac Vy, shared at the conference.

Speaking at the conference of the Government Office working with joint-stock commercial banks, VIB Chairman Dang Khac Vy said that, based on reduced deposit interest rates and efforts to cut operating costs, with a spirit of best supporting businesses and people, VIB has been lowering lending rates for all customer segments to boost both social supply and demand and promote economic growth.

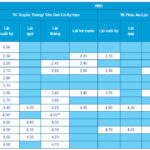

In the second quarter, VIB launched a VND30 trillion package for home purchases, with interest rates of only 5.9%-6.9%-7.9% for fixed-rate terms of up to 24 months, in parallel with other credit stimulus programs in apartment, business, and auto loan segments.

For corporate customers, VIB also maintained deep discounts, focusing on working capital and medium to long-term financing for businesses with interest rates starting at 2.9%.

“Although deep discounts will lead to short-term profit decline, this is a step to facilitate sustainable development for individuals, businesses, and the bank when production and business recover in the coming time,” shared VIB Chairman Dang Khac Vy.

At the conference, Chairman Dang Khac Vy also made several proposals and recommendations, such as the need to strongly promote solutions to boost the safe, healthy, and sustainable development of the real estate market.

According to Mr. Dang Khac Vy, the real estate market has seen positive changes recently, thanks to the efforts and high determination of the Government and ministries to remove obstacles and promote the real estate market.

As the banking industry increasingly focuses on retail credit in its credit portfolio, with real estate and apartments accounting for a significant proportion of total collateral, the recovery of the real estate market not only positively impacts the economy but also helps banks increase lending and handle bad debts.

“We hope that the Government and ministries will continue to implement synchronous solutions to promote the healthy and sustainable development of the real estate market, thereby helping banks increase credit safely and strongly. At the same time, continue to implement a policy of not loosening credit conditions to achieve credit growth at all costs to avoid subsequent adverse effects on the safe operation of banks and the stability of the banking industry when bad debts increase and profits decline,” said VIB Chairman Dang Khac Vy.

To ensure the healthy and sustainable development of the banking industry, VIB proposed that the State Bank of Vietnam (SBV) and the Ministry of Finance regularly refer to and compare with developed and regional countries to require all banks to strongly apply international standards. These include Basel standards (Basel II basic, Basel II advanced, and Basel III) in the fields of strategic risk management, credit risk, market risk, and operational risk; international financial reporting standards (IFRS); international credit ratings such as Moody’s, S&P, and Fitch; and advanced and transparent risk management and corporate governance standards.

“We also propose that the SBV evaluates and ranks banks based on highly transparent data and then supervises, supports, and manages credit room appropriately to promote healthy credit growth and ensure the credit quality of the banking system. It is necessary to ensure the proper recognition of problematic debts, restructured debts, revenue, and accrued income in a prudent manner according to accounting standards, thereby obtaining accurate data on profits, capital, non-performing loans, CAR ratio, ROE ratio, etc.,” said Mr. Dang Khac Vy.

Finally, the VIB leader proposed that the Government direct ministries and branches to issue regulations accepting the right of credit institutions to seize collateral to handle and recover bad debts in cases where the security contract is legally concluded, fully providing for the following three contents: stipulating one of the methods of handling collateral as the organization carrying out the seizure of collateral, stipulating the right of credit institutions to seize collateral, and stipulating the order and procedure for credit institutions to seize collateral.

Unlocking the Power of Fiscal Policy: A Proposal to Sustain Economic Growth

“Despite implementing a range of promotional tools and mechanisms, the credit growth of the entire industry, and Sacombank in particular, has not met expectations, according to Sacombank’s leaders.”

Sure, I can assist with that.

## Empowering Borrowers and Unraveling the Complexities of Collateral: A Lender’s Perspective

“In a proposal to the government, the Chairman of TPBank emphasized the need for enhanced public awareness and borrower accountability regarding loan debts. The bank seeks to address the challenging situation where lenders find themselves ‘standing when granting loans but kneeling when collecting debts.’ This metaphor highlights the urgent requirement for a cultural shift in borrowing behavior and a more responsible attitude toward financial obligations.”

“Afternoon Agenda: Government Meets with Major Shareholding Banks”

On the afternoon of September 21, at the Government Headquarters, Prime Minister Pham Minh Chinh chaired a meeting of the Government’s Permanent Members with the joint-stock commercial banks to discuss solutions to contribute to the country’s socio-economic development.