I. FUTURE CONTRACTS OF STOCK MARKET INDICES

I.1. Market Movements

Futures contracts witnessed a surge during the trading session on 20/09/2024. Specifically, VN30F2410 (F2410) rose by 0.45% to reach 1,330 points; VN30F2411 (F2411) climbed 0.87%, settling at 1,331.5 points; VN30F2412 (F2412) increased by 0.57%, ending at 1,329.7 points; and VN30F2503 (F2503) gained 0.71%, closing at 1,330.4 points. The underlying VN30-Index ended the session at 1,326 points.

Throughout the trading week of 16-20/09/2024, the VN30F2410 contract experienced a tug-of-war from the beginning, with short sellers gaining the upper hand by the end of the next session. However, buyers aggressively increased their demand, propelling F2410 upward during the mid-week period. The week concluded with a sideways trend as supply and demand forces balanced out, allowing the futures contract to retain its gains and close at the 1,330-point level.

Intraday Chart of VN30F2410 for the Period of 16-20/09/2024

Source: https://stockchart.vietstock.vn/

At the end of the session, the basis of the VN30F2410 contract narrowed compared to the previous session, reaching a value of 4 points. This indicates a slight shift in investor sentiment, moving away from excessive optimism.

Movement of VN30F2410 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated using the formula: Basis = Futures Price – VN30-Index

Trading volume and value in the derivatives market rose by 14% and 15.38%, respectively, compared to the session on 19/09/2024. On a weekly basis, trading volume and value increased by 2.25% and 3.04%, respectively, compared to the previous week.

Foreign investors continued net buying in the final session, with a trading volume of 8,139 contracts. For the entire week, they were net buyers, accumulating a total of 13,100 contracts.

Weekly Trading Volume Movement in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

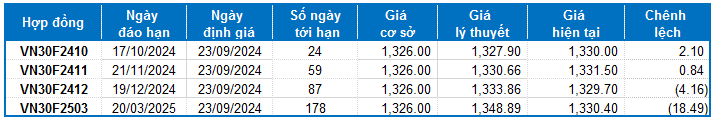

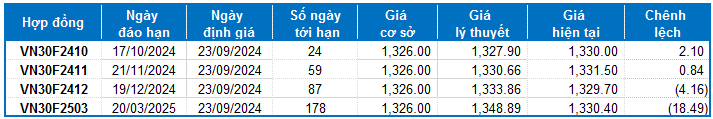

I.2. Futures Contract Pricing

Based on the fair value pricing method as of 23/09/2024, the reasonable price range for the futures contracts currently traded in the market is presented as follows:

Source: VietstockFinance

Note: The opportunity cost in the pricing model has been adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government bonds) is replaced by the average deposit interest rate of large banks, with appropriate term adjustments for each type of futures contract.

I.3. Technical Analysis of VN30-Index

On 20/09/2024, the VN30-Index advanced, accompanied by trading volume surpassing the 20-session average, reflecting a positive investor sentiment.

Additionally, the VN30-Index continued its upward trajectory after breaking above the Middle line of the Bollinger Bands. This upward momentum is further reinforced by the MACD indicator, which signaled a buy opportunity, bolstering the short-term bullish trend of the index.

Source: VietstockUpdater

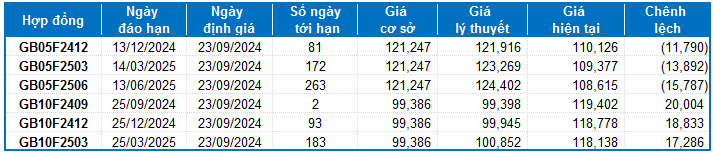

II. FUTURE CONTRACTS OF THE BOND MARKET

Based on the fair value pricing method as of 23/09/2024, the reasonable price range for the futures contracts currently traded in the market is presented as follows:

Source: VietstockFinance

Note: The opportunity cost in the pricing model has been adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government bonds) is replaced by the average deposit interest rate of large banks, with appropriate term adjustments for each type of futures contract.

According to this valuation, the GB05F2412, GB05F2503, and GB05F2506 contracts are currently undervalued and present attractive investment opportunities. Investors may consider focusing on these futures contracts and taking long positions in the upcoming period.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department