According to the Draft Law on Amending and Supplementing a Number of Articles of the Securities Law being formulated by the Ministry of Finance, the standards for professional investors continue to be raised. Mr. Tran Le Minh – Director of Vietnam Investment and Rating Joint Stock Company (VIS Rating) shared his thoughts on these new regulations.

Mr. Tran Le Minh – Director of Vietnam Investment and Rating Joint Stock Company (VIS Rating)

Reporter: Sir, there is a fact in the private corporate bond market that the number of individual investors is very large, while in theory, this market is for professional securities investors, especially institutional investors. What are your thoughts on this?

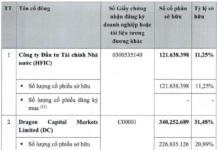

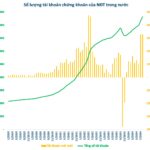

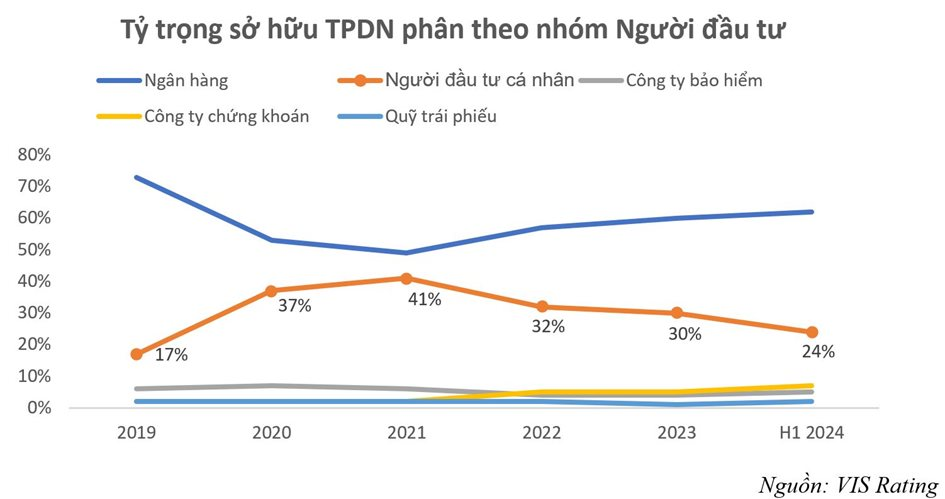

Mr. Tran Le Minh: That observation is accurate. Individual investors are the second largest group of corporate bondholders, just after banks, and significantly larger than other organized investor groups such as insurance companies or investment funds. In 2021, individual investors held the most corporate bonds, accounting for 41% of the total market size, while banks held 49%. After recent developments, this proportion has gradually decreased to 24% as of June 2024, but the second position remains unchanged.

It is important to note that many of these individual investors are not professional investors but small-scale individual investors. In many cases, they invest in corporate bonds as an alternative to savings deposits, believing that corporate bonds are a safer product. This is an unreasonable situation given the market’s development, and adjustments are needed.

Reporter: In addition to many other important contents, the Draft Amended Securities Law has supplemented provisions related to professional securities investors. Can you share your thoughts on the approach taken by the drafting committee?

Mr. Tran Le Minh: The Draft Amended Securities Law has attracted a lot of attention from market participants. Through studying the explanatory documents for the Law’s formulation, it is evident that the drafting committee has focused on addressing issues that are impractical and creating conditions for the safe, stable, and sustainable development of the private corporate bond market. Two key areas of focus are the regulations on professional securities investors (who are eligible to participate in the private corporate bond market) and the clarification of responsibilities to promote public corporate bond issuance.

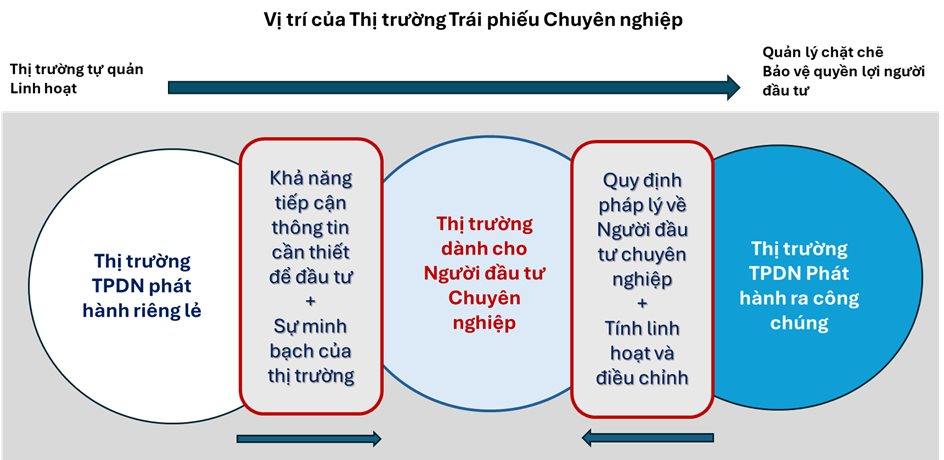

A notable point in the draft is the additional provision that professional securities investors participating in the purchase, trading, and transfer of private corporate bonds must be organizations as stipulated. This implies that private corporate bonds can only be issued and traded among professional institutional investors. The drafting committee has also provided detailed explanations for this opinion, based on market developments, market characteristics, and the practices and experiences of other countries in the region. I believe that market participants agree with the view that the private corporate bond market is intended for professional investors.

Given the nature of the private corporate bond market, there is significantly less information disclosure related to bonds and issuing organizations, reduced state management, and enhanced self-regulation in the market. On the other hand, the diversity in the agreement of bond terms and conditions has made this type of corporate bond a complex product that requires in-depth knowledge to invest and is not suitable for small- investors.

Along with this, regulations related to the market will always need to be updated and supplemented to ensure that privately placed corporate bonds are not sold to investors who lack the necessary knowledge and experience. This is a standard practice to ensure the legal framework’s protection of small-scale investors.

Reporter: From your perspective and research, what are the perspectives of other countries in building the target audience for the private corporate bond market?

Mr. Tran Le Minh: The markets in the region, specifically the ASEAN +3 group (China, South Korea, and Japan), have specific legal regulations for the private corporate bond market and regulations on investor eligibility. The general view is that private corporate bonds are not intended for the public. Investors participating in this market must meet certain conditions.

The ASEAN+3 Bond Market Forum, supported by the Asian Development Bank (ADB), has conducted studies on these issues and indicated that if individual investors are allowed to participate, they must have experience, knowledge, and expertise in the bond market, in addition to substantial assets. Currently, the regulations related to professional investors only stipulate requirements related to assets and transactions and do not quantify the necessary experience and knowledge. The regulations concerning individual professional investors in all the mentioned countries are stipulated in the highest legal documents, such as laws or decrees.

Source: ASEAN+3 Bond Market Forum

Reporter: As an expert with experience in researching financial markets, what are your suggestions for the development of the private corporate bond market to be in line with its nature, objectives, and practical development situation?

Mr. Tran Le Minh: It is also worth noting that in securities markets worldwide, private corporate bonds are considered “exempt securities” and are therefore not subject to the Securities Law. When issuing these bonds, the issuing organization does not have to register or be subject to the management of the Securities Commission of the respective countries.

In the past, the corporate bond market has revealed certain shortcomings in practice, which have been addressed through the issuance of Decree No. 65/2022/ND-CP.

The urgency of the issue is evident in the amendments to the points related to the public issuance of corporate bonds and the regulations on professional securities investors in the Draft Amended Securities Law with a streamlined process. Therefore, this Law amendment is very timely and further strengthens the adjustments needed for the private corporate bond market, initiated by the issuance of Decree 65/2022/ND-CP.

To achieve the goal of having the corporate bond market scale reach 25% of GDP by 2030, the market needs a quick recovery phase. Observable data to assess the market’s recovery includes the total value of circulating bonds in the entire market reaching the peak of 2022 again and the value of newly issued bonds exceeding the issuance value in 2021. While it is important to create a suitable legal framework to promote a rapid recovery, stability should not be compromised for the sake of growth speed.

Hence, I believe that the objective of the current Securities Law amendment is to create a stable and long-term development phase, aligning with market developments and laying the foundation for a more transparent market recovery without repeating the unreasonable situations and risks that occurred in the private corporate bond market in the past.

Reporter: Thank you, sir!

The Draft Amended Securities Law has revised and supplemented Article 11 (on professional securities investors) as follows:

For companies with a chartered capital of over VND 100 billion, a minimum operating period of 02 years is required.

For individuals, the following requirements are added: (i) must have invested in securities for a minimum of 02 years, with a minimum transaction frequency of 10 times per quarter in the last 04 quarters; (ii) must have an annual income of at least VND 01 billion in the last 02 years.

It is added that professional securities investors include foreign institutional and individual investors.

It is further added that professional securities investors participating in the purchase, trading, and transfer of private corporate bonds are organizations as stipulated in Clause 1, Article 11 of the 2019 Securities Law.

The Stock Market’s Elite: Unlocking the Power of High-Frequency Trading.

“The conditions, designed to mitigate investor risk, are perceived by some as stringent and potentially restrictive to market participation. While these regulations aim to protect, they may also inadvertently create a barrier for prospective investors, impacting the vibrancy of the stock market.”