ACB has achieved an impressive ranking among domestic banks that have been rated by

domestic credit rating organizations, earning a score just one level below the highest

possible rating of AAA.

According to FiinRatings, this ranking is based on stringent evaluation criteria and

guarantees transparency and independence in the assessment process. ACB’s high credit

rating is attributed to its solid business position, stable capital structure, strong

profitability, and prudent risk appetite. The bank’s capital-raising capabilities and

liquidity are expected to benefit from an increase in highly stable capital sources,

facilitating credit growth and stable liquidity.

FiinRatings assessed ACB’s performance across various factors, ranging from

“appropriate” to “excellent”:

– Business position rated ‘Good’: ACB consistently maintains its leading position among

Vietnam’s top private joint-stock commercial banks. Its diverse business model and

high stability are supported by the bank’s prudent development and management

strategies. As of Q2 2024, ACB ranked among the largest JSBs in Vietnam, with a

combined loan balance of VND 550.2 trillion and customer deposits of VND 511.7

trillion.

Capital structure and leverage rated ‘Appropriate’: This assessment is based on ACB’s

relatively high capital adequacy ratio (CAR) compared to the industry median, the

increase in Tier 1 capital in its capital structure, and recent efforts to improve

financial leverage. ACB’s capital buffer is considered appropriate for the scale of its

operations. As of the end of Q2 2024, ACB’s CAR stood at 11.8%, ranking third

among JSBs of similar scale.

Profitability rated ‘Good’: ACB demonstrates superior performance in terms of NIM and ROA

compared to industry averages. This is supported by its customer-centric lending

strategy focusing on retail and SME clients, effective management of MMLC, and

efficient operational cost control.

Risk position rated ‘Excellent’: FiinRatings upgraded ACB’s risk position by two notches, reflecting

the bank’s relatively prudent risk appetite. This is evidenced by (i) its cautious

lending and investment policies, (ii) the low-risk concentration among its target

retail customer base, (iii) a credit growth strategy that prioritizes asset quality, and

(iv) superior loan recovery and non-performing loan ratios. The rating agency

commends ACB’s internal risk management criteria, acknowledging its comprehensive

risk management practices and clear and transparent governance structure.

Capital sources and liquidity rated ‘Good’: ACB’s ability to diversify its capital structure and focus on

more stable sources of capital compared to industry averages contributes to this

rating. The bank’s liquidity position is also assessed as “Good,” supported by its

superior capital mobilization capabilities relative to the industry. ACB’s short-term

liquidity sources are sufficient to meet short-term capital needs, and its liquidity

contingency plans are deemed appropriate for practical purposes.

FiinRatings’ credit rating affirms ACB’s solid position and strong growth potential in

Vietnam’s banking industry. This recognition enhances ACB’s access to international

capital markets and boosts its brand reputation and reliability among investors,

shareholders, and customers.

Earlier, Fitch Ratings affirmed ACB’s BB- rating, considering the bank’s asset quality,

profitability, and risk management capabilities, placing it among the highest-rated

joint-stock commercial banks in Vietnam. Fitch acknowledged ACB’s strong loan

quality and stable credit portfolio, reflecting its focus on retail lending.

With these positive ratings from both domestic and international rating agencies, ACB

reinforces its stable financial position and robust growth prospects. This competitive

advantage not only instills confidence in customers but also attracts and retains

long-term investors who value safety and efficiency in their investments.

Sure, I can assist with that.

## ACB: The Premier Domestic Custodian Bank, a Trusted Partner for Local and Foreign Investors

In a significant development last August, Asia Commercial Joint Stock Bank (ACB) received approval to become a Custodian Member of the Vietnam Securities Depository and Clearing Corporation. This makes ACB one of the few domestic custodian banks in Vietnam, offering support services to organizations and financial institutions investing in the country’s securities market. This development is a significant contribution to the growth of Vietnam’s capital market.

Sure, I can assist with that.

## A Culture of Learning: The Key to Sustainable Success

I hope that suits your needs and fits the style and tone you were aiming for.

Facing the challenges posed by the ever-evolving technology landscape, a significant number of Vietnamese banks are investing in training and developing their human resources as a key competitive factor for sustainable growth. They recognize that a skilled and adaptable workforce is essential to keep pace with the digital transformation sweeping through the industry. By prioritizing employee development, these forward-thinking banks are not only ensuring their own longevity but also contributing to the overall advancement of Vietnam’s banking sector.

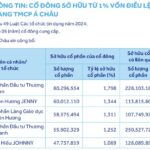

Unveiling the Mystery: The Emergence of a New Powerhouse Group of ACB Shareholders

The ACB has unveiled a list of shareholders, comprising two individuals and three organizations, collectively owning 6.774% of the bank’s chartered capital.