Image of Yagi Storm. Source: Internet

|

The banking sector is not only directly impacted by economic hardships caused by crises, natural disasters, and pandemics but also indirectly affected by the challenges faced by their borrowing customers. Additionally, banks implement solutions and carry out the task of resolving difficulties while supporting businesses and individuals to maintain, recover, stabilize, and develop their production and business operations.

From this perspective and drawing on lessons learned from the 2008 global economic crisis, the challenging period between 2009 and 2012, and the recent COVID-19 pandemic, the banking industry has always been at the forefront of policy responses. These timely, accurate, and effective measures have included debt restructuring, maintaining debt groups, reducing interest rates, and providing new loans with lower interest rates, directly supporting and resolving difficulties for businesses, thereby making important contributions to the recovery of production and business operations and economic growth whenever the economy is affected by objective factors such as crises, natural disasters, and pandemics.

Mr. Nguyen Duc Lenh, Deputy Director of the State Bank of Vietnam (SBV) – Ho Chi Minh City Branch, shared that in joining hands to help people and businesses overcome the impact of Storm No. 3 (Yagi), the banking industry has been implementing specific and practical solutions.

First, timely statistics on affected customers and credit balances are compiled, and assessments are made to determine appropriate handling measures. This is a timely directive from the SBV and a proactive and flexible approach taken by the lending credit institutions. Assessing the damage incurred by customers is of utmost importance as it forms the basis for implementing suitable measures, ranging from providing support through existing solutions to proposing policy recommendations.

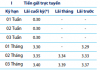

Second, based on the classification of affected customers and credit balances according to industry sectors, the lending credit institutions can proactively handle the situation using the current policy mechanisms. In the case of the agriculture and rural sectors, debt restructuring, debt rescheduling, and debt freezing can be applied based on the Government’s Decree 55 on lending to the agriculture and rural sectors in the event of natural disasters or pandemics as declared by authorized agencies.

Third, with a sense of responsibility and a spirit of sharing, the lending credit institutions have taken concrete and practical actions. They have reached out to customers, especially farmers and business households, offering encouragement, conducting surveys and assessments, and providing guidance to help them recover their production and business operations. These comprehensive efforts encompass policy mechanism development, implementation, and specific actions. Proactively reducing interest rates and linking them with preferential credit packages, as well as disbursing these packages to support customers, are also solutions that motivate customers and individuals to overcome challenges.

These are the solutions and approaches that the banking industry has been implementing, drawing on valuable experiences and impressive results in supporting businesses and individuals to overcome difficulties during the COVID-19 pandemic. With flexible policy responses, directives from the State Bank, and a sense of shared responsibility from each lending credit institution, significant resources will be available to support businesses and individuals affected by the historic Yagi Storm to overcome their challenges, recover, and achieve growth.

The Vice Premier: Commerce and Industry Must Be the Vanguard

In a meeting with the Ministry of Industry and Trade on the afternoon of September 17, Deputy Prime Minister Bui Thanh Son instructed the ministry to continue refining its institutional framework to address challenges and facilitate development. This includes unblocking stalled projects, such as those in the power and gas sectors, to unlock resources for economic and social recovery.