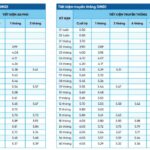

Deposit Interest Rates at ACB Counter – September 2024

This September, Asia Commercial Joint Stock Bank (ACB) offers its regular customers deposit interest rates ranging from 0.5% to 4.5% per annum for over-the-counter deposits with interest payable at maturity.

Specifically, the 0.5% per annum interest rate applies to tenors of 1-3 weeks; the 1-month tenor has an interest rate of 2.3% per annum; 2-month tenor is 2.5% per annum; 3-month tenor is 2.7% per annum; 4-month tenor is 2.9% per annum; 5-month tenor is 3.1% per annum; 6-month tenor is 3.5% per annum; 9-month tenor is 3.7% per annum; and the 12-month tenor stands at 4.4% per annum.

ACB offers a 4.5% per annum interest rate for long-term tenors ranging from 13 to 36 months. For the 13-month tenor, customers depositing 200 billion VND or more will enjoy a preferential interest rate of 5.9% per annum.

For non-term deposits, ACB applies an interest rate of 0.01% per annum.

Deposit Interest Rates at ACB Counter – September 2024

Source: ACB

This September, ACB also continues to offer flexible interest payment options: Quarterly interest: Interest rates range from 4.30% to 4.4% per annum; Monthly interest: Interest rates range from 2.45% to 4.35% per annum (For the 13-month tenor, a minimum deposit of 200 billion VND earns an interest rate of 5.7% per annum); Interest payable in advance: Interest rates range from 2.25% to 4.2% per annum.

Additionally, ACB introduces the Phúc An Lộc and Tích Lũy Tương Lai savings packages for customers to choose from, with the highest interest rate reaching 4.7% per annum.

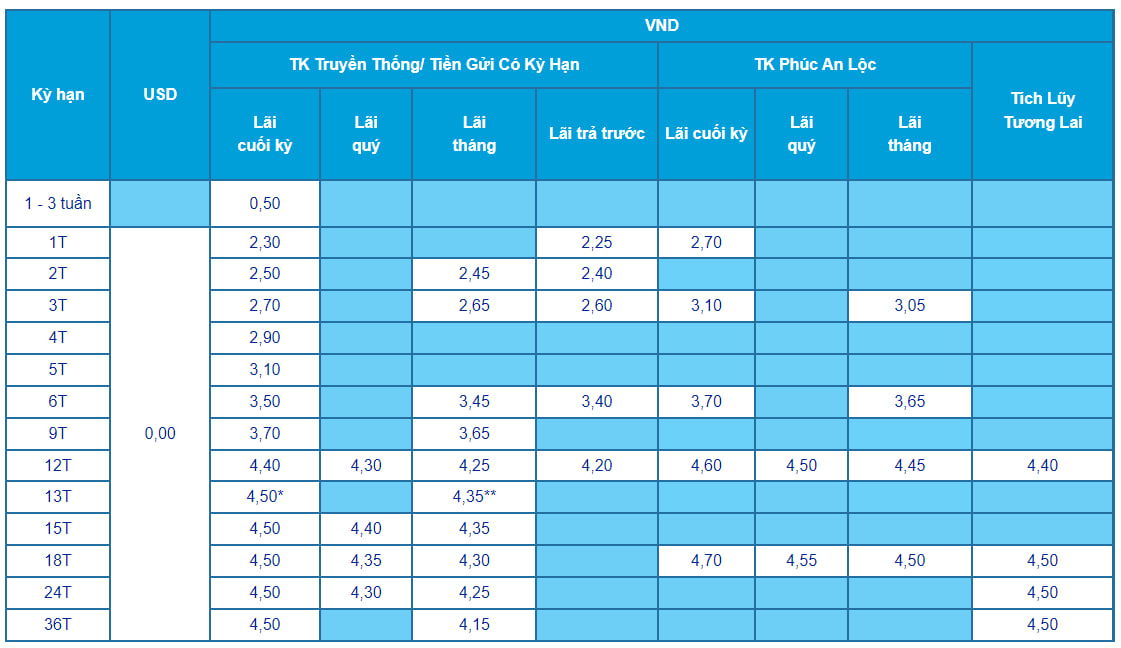

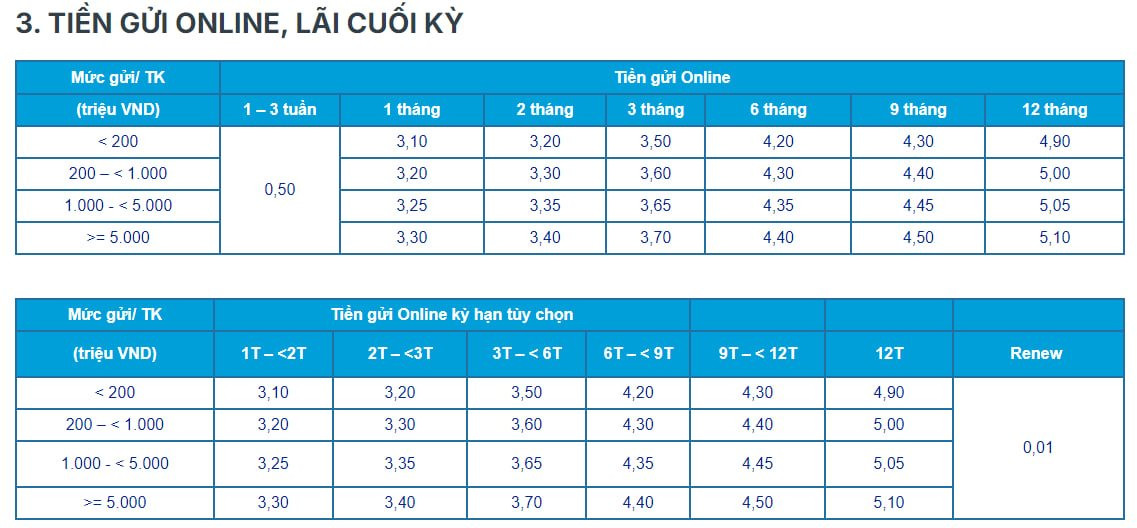

ACB Online Deposit Interest Rates – September 2024

For online deposits, ACB offers interest rates ranging from 0.5% to 5.0% per annum for customers who choose to receive interest at maturity.

Specifically, ACB sets a uniform interest rate of 0.5% per annum for tenors of 1-3 weeks

ACB offers the following interest rates for other tenors, depending on the deposit amount:

For deposits below 200 million VND: The interest rate for a 1-month tenor is 3.1% per annum, 2-month tenor is 3.2% per annum, 3-month tenor is 3.5% per annum, 6-month tenor is 4.2% per annum, 9-month tenor is 4.3% per annum, and 12-month tenor is 4.9% per annum.

For deposits from 200 million VND to less than 1 billion VND: The interest rate for a 1-month tenor is 3.2% per annum, 2-month tenor is 3.3% per annum, 3-month tenor is 3.6% per annum, 6-month tenor is 4.3% per annum, 9-month tenor is 4.4% per annum, and 12-month tenor is 5.0% per annum.

For deposits from 1 billion VND to less than 5 billion VND: The interest rate for a 1-month tenor is 3.25% per annum, 2-month tenor is 3.35% per annum, 3-month tenor is 3.65% per annum, 6-month tenor is 4.35% per annum, 9-month tenor is 4.45% per annum, and 12-month tenor is 5.05% per annum.

For deposits of 5 billion VND and above: The interest rate for a 1-month tenor is 3.3% per annum, 2-month tenor is 3.4% per annum, 3-month tenor is 3.7% per annum, 6-month tenor is 4.4% per annum, 9-month tenor is 4.5% per annum, and 12-month tenor is 5.1% per annum.

Thus, for online deposits, the 12-month tenor currently offers the highest interest rates across all deposit amounts, ranging from 4.9% to 5.1% per annum.

ACB Online Deposit Interest Rates – September 2024

Source: ACB

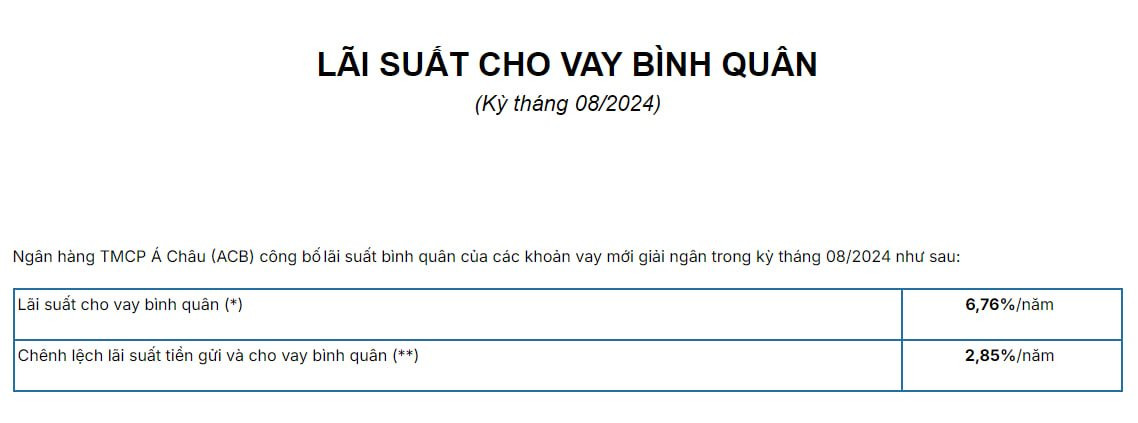

ACB Lending Rates

Recently, ACB announced the average lending rates for new loans disbursed in August 2024. Specifically, the average lending rate was 6.76% per annum, and the average interest rate spread between deposits and loans was 2.85% per annum.

ACB notes that this is the bank’s average lending rate and may not apply to specific loan products. Customers can visit the nearest ACB Branch or Transaction Office for consultation and detailed information about ACB’s credit programs and promotions.

Additionally, the interest rate spread does not include mandatory reserves, liquidity reserves, deposit insurance, operating expenses, and credit risk provisions.

Source: ACB

“Government-Backed 2000 Billion VND Loan Scheme to Aid Post-Disaster Reconstruction”

Military Commercial Joint Stock Bank (MB) is offering a special loan package of up to 2,000 billion VND with a 1% reduced interest rate for individuals and households to rebuild their lives after the storms and floods. This generous offer is available for a variety of reconstruction purposes, providing much-needed financial support to those affected by these natural disasters.

A Bank Increases Savings Rates Across All Terms Starting Today, September 12th.

With the recent rate adjustment, NCB now offers a maximum savings interest rate of 6.15% per annum. This is currently the highest interest rate in the market for regular deposits.