The MCH stock closed at VND 207,800/share on September 19, setting the dividend yield at around 8.1% based on the announced dividend of VND 16,800/share.

Previously, MCH shareholders received dividends for the fiscal year 2023 in two installments, at a rate of 45% on August 14, 2023, and 55% on July 12, 2024, respectively. With this 100% total dividend payout ratio, MCH distributed approximately VND 7.2 trillion to its shareholders.

|

MCH’s Dividend History

Source: VietstockFinance

|

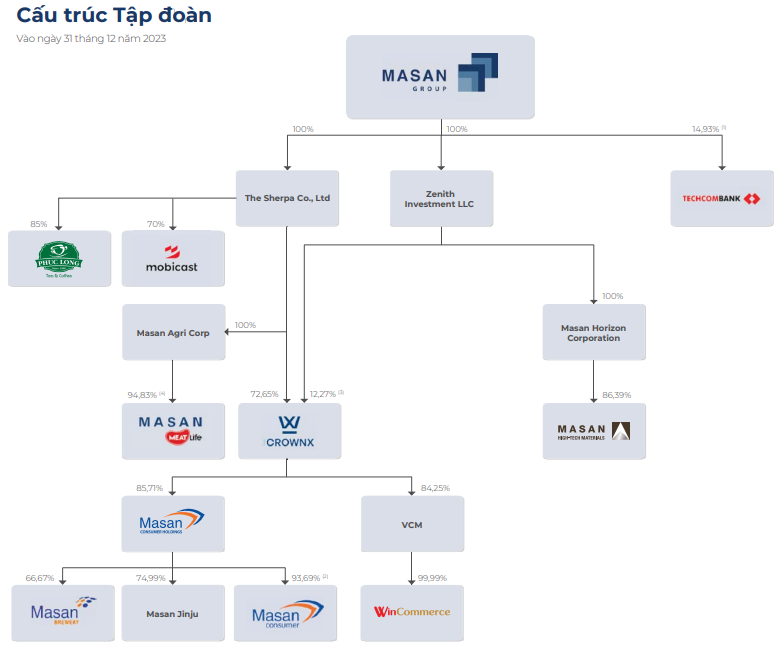

MCH is an integral part of the Masan ecosystem. Specifically, MasanConsumerHoldings LLC, the direct parent company of MCH, holds approximately 94% of MCH’s capital and is thus the primary beneficiary of MCH’s dividends.

Furthermore, MasanConsumerHoldings is a subsidiary of Masan Group Joint Stock Company (HOSE: MSN), which operates primarily in the investment fund management industry. The companies under MasanConsumerHoldings’ portfolio include Masan Consumer, Masan Brewery, and Masan Jinju.

Source: MSN’s 2023 Financial Statements

|

In addition to the parent company, MasanConsumerHoldings, other notable institutional shareholders of MCH include Albizia ASEAN Tenggara Fund, Bill & Melinda Gates Foundation Trust, and Vietcap Securities (VCI). Bill & Melinda Gates Foundation Trust is a financial trustee of Bill & Melinda Gates Foundation, established by Bill Gates, the founder and former chairman of Microsoft Corporation, and his former wife, Melinda. The foundation has also been indirectly investing in Vietnam for a long time through VEIL, the largest fund under Dragon Capital in the Vietnamese market.

MCH has also set September 25 as the ex-dividend date and plans to collect shareholders’ opinions in writing in October-November 2024. This move aims to approve matters within the competence of the General Meeting of Shareholders, including but not limited to the 2024 interim dividend payment and other issues within the competence of the General Meeting of Shareholders.

Regarding MCH’s business performance in the first half of 2024, the company reported net revenue of nearly VND 13,968 billion, a 12% increase compared to the same period last year. Ultimately, MCH recorded a net profit of nearly VND 3,402 billion, an increase of 13%. Overall, MCH continues to maintain its growth trajectory in business results over the years.

| MCH’s Sustained Growth in Business Results |

Huy Khai

“The Novaland Chairman, Bui Thanh Nhon: Treasuring What Matters Most.”

Novaland has submitted a document to the State Securities Commission of Vietnam (SSC), the Ho Chi Minh City Stock Exchange (HoSE), and the Hanoi Stock Exchange (HNX) providing clarification on its efforts to address and rectify the issues that led to the warning.