The Prime Minister and representatives of several banks on the sidelines of the Conference of the Government’s Standing Committee working with joint-stock commercial banks on solutions to contribute to the socio-economic development of the country – Photo: VGP/Nhat Bac

Chairman of MB requests additional solutions to unblock capital flow in the corporate bond market

At the conference, Mr. Luu Trung Thai – Chairman of the Board of MB, shared that following the Government’s and SBV’s directions, MB maintained its sustainable growth momentum until the end of August 2024.

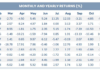

Its credit balance reached approximately VND 685 trillion (an increase of 11.15% compared to 2024; compared to the industry average of approximately 7.15%). Loans to priority sectors as directed by the Government accounted for approximately 65%, with new disbursements of approximately VND 74 trillion for SMEs.

MB manages interest rates in accordance with the Government’s and SBV’s directions, supports customers in accessing loans, and accompanies them in overcoming difficulties and resuming production and business activities, thereby contributing to economic growth.

In the fourth quarter of 2024, MB will continue to implement preferential interest rate credit programs for customers with viable production and business plans. It will also focus on closely controlling credit quality and complying with safety limits and ratios, liquidity management, etc.

The Chairman of MB also pointed out difficulties and limitations, especially regarding safe and healthy credit growth. He also conveyed MB’s recommendations and suggestions to the Government and SBV.

MB agrees with the solution of firmly maintaining macroeconomic stability targets, controlling inflation, and stabilizing lending rates. However, additional solutions are needed to stabilize and unblock the capital flow in the corporate bond market to reduce the pressure on medium and long-term credit capital in the banking system. Effective information dissemination is also crucial to maintaining market and investor confidence.

“There is a need to expedite the unification of electricity pricing mechanisms, especially for transitional and new projects. EVN should be directed to prioritize and ensure timely payment to green power and renewable energy producers. Furthermore, the banking sector should be further facilitated and provided access to the national database to develop technology and ensure safe and secure payments for customers,” MB’s representative requested.

Chairman of VPBank: Legal support is needed for real estate companies to implement projects and generate cash flow to repay debts to banks

Mr. Nguyen Duc Vinh, CEO of Vietnam Prosperity Joint-Stock Commercial Bank (VPBank), shared that the bank is actively promoting disbursement to meet capital demands, boost production and business activities, and push back black credit. This orientation of VPBank is in line with the SBV’s requirements and legal framework to support enterprises in accessing capital to expand their production and business activities.

Following the Government’s and SBV’s directions, VPBank has planned and implemented solutions to support its customers in overcoming difficulties, resuming production and business activities, and overcoming the aftermath of Storm No. 3 (YAGI) as guided by the SBV.

VPBank has also promptly directed its branches and transaction offices to proactively review and summarize the damage of borrowing customers to provide timely support.

Regarding the social housing lending program, in accordance with the Government’s Resolution 33/NQ-CP dated March 11, 2023, VPBank has registered to participate in the lending program for social housing, worker housing, and renovation and reconstruction of old apartment buildings. The disbursement volume of this program is expected to reach VND 5,000 billion by the end of 2030.

Mr. Nguyen Duc Vinh, CEO of VPBank, proposed several specific recommendations and suggestions to relevant ministries, branches, and sectors. He emphasized the need for a program to support enterprises and people affected by floods and storms, including tax breaks to help customers recover their lives and resume their businesses.

Legal support is crucial for real estate companies to implement projects, generate cash flow, and create surplus value for society, ensuring their ability to repay debts to banks. The public security, court, and enforcement agencies should assist in debt recovery, seizure, and handling of secured assets, giving priority to credit institutions to ensure credit safety for banks and generate cash flow for reproduction and funding of general activities.

“It is recommended to consider extending the validity of Circular No. 06/2024/TT-NHNN dated June 18, 2024, to June 30, 2025, and provide additional guidance on the allocation of receivable and retractable interest by credit institutions. A roadmap for point b, Clause 5, Article 4 on the specific provision rate should also be established…”, VPBank’s representative proposed.

Prime Minister Postpones Meeting with Chairmen and CEOs of Vingroup, Sungroup, Masan Group, FPT, Hoa Phat, THACO, and T&T on September 12th.

The Prime Minister is keen to host a conference focused on collaborating with private corporations to address challenges in business operations and stimulate economic growth. The aim is to create a platform to discuss strategies for unblocking major projects, fostering a stable macroeconomic environment, and promoting a thriving business landscape.