Chairman of the International Bank (VIB), Dang Khac Vy, shared at the conference – Photo: VGP/Nhat Bac |

Speaking at the conference between the Government and joint-stock commercial banks, Chairman of the International Bank (VIB), Dang Khac Vy, stated that based on reduced deposit interest rates and efforts to cut operational costs, with a spirit of providing the best support for corporate clients, VIB has significantly lowered lending rates for all customer segments to stimulate both social supply and demand, thereby boosting economic growth.

In the second quarter of 2024, VIB launched a VND30,000 billion package for housing loans, with interest rates of only 5.9%-6.9%-7.9% for fixed-rate terms of up to 24 months, in conjunction with other credit stimulus programs in apartment, business, and auto loan segments.

For corporate clients, VIB has also maintained deeply discounted rates, focusing on working capital and medium to long-term financing for businesses, with interest rates starting from 2.9%.

According to Chairman Dang Khac Vy, despite the fact that deep discounts will lead to short-term profit decline, this move creates conditions for sustainable development for individuals, businesses, and the bank when production and business activities recover in the coming time.

Presenting to the Government leaders about the difficulties and obstacles, Mr. Dang Khac Vy said that the handling of secured assets to deal with bad debts is currently very challenging. One of the fundamental reasons is that Resolution 42 of the National Assembly has expired, and the new Law on Credit Institutions does not include provisions on the right of credit institutions to seize secured assets. Credit institutions are unable to seize and handle secured assets, even when there is an agreement with customers on the method of handling secured assets, and the right to seize secured assets is stipulated in the security contract, in accordance with the 2015 Civil Code and Decree 21 of 2021 guiding the implementation of the 2015 Civil Code.

This leads to the handling of secured assets being entirely dependent on litigation and the sale of secured assets during the enforcement process. Meanwhile, the process of initiating a lawsuit, participating in litigation, and carrying out enforcement for each case is often prolonged, while banks have to set aside risk provisions, stop collecting interest, and still have to pay daily capital mobilization costs.

This situation creates significant risks, especially for credit institutions with a high proportion of retail loans, focusing on stimulating demand, and having to deal with numerous small-value non-performing loans that are geographically dispersed, resulting in high operating costs in debt recovery and reduced ability to increase lending to customers.

At the conference, Chairman of VIB, Dang Khac Vy, made several proposals and recommendations, including the need to vigorously promote solutions to foster the safe, healthy, and sustainable development of the real estate market.

According to Mr. Dang Khac Vy, the recent changes in the real estate market have been quite positive, thanks to the efforts and strong determination of the Government and ministries to remove obstacles and boost the real estate market.

As the banking industry increasingly has a higher proportion of retail credit in its credit portfolio, with real estate and apartments accounting for a significant proportion of total secured assets, the recovery of the real estate market will not only positively impact the economy but also enable banks to increase lending and handle bad debts.

“We hope that the Government and ministries will continue to implement synchronous solutions to promote the healthy and sustainable development of the real estate market, thereby helping banks to safely and strongly increase credit. At the same time, continue to implement the policy of not loosening credit conditions to achieve credit growth at all costs to avoid subsequent adverse effects on the safe operation of banks and the stability of the banking industry when non-performing loans increase and profits decline,” said Chairman of VIB, Dang Khac Vy.

Mr. Vy also suggested the need to widely apply international standards and govern banks in a substantive manner as the Vietnamese banking industry is increasingly integrating into the global trend.

For healthy and sustainable development, VIB proposed that the State Bank of Vietnam (SBV) and the Ministry of Finance regularly refer to and compare with developed and regional countries to require all banks to strongly apply international standards. These include Basel standards (Basel II Basic, Basel II Advanced, and Basel III) in the fields of strategic risk management, credit risk, market risk, and operational risk; international financial reporting standards (IFRS); international credit ratings such as Moody’s, S&P, and Fitch; and advanced risk management and corporate governance standards that ensure transparency.

“We also propose that the SBV evaluate and rank banks based on highly transparent data, thereby providing appropriate solutions for supervision, support, and management of credit room to promote healthy credit growth and ensure the credit quality of the banking system. Especially, it is necessary to ensure the proper recognition of problematic debts, restructured debts, prudent recognition of revenue and accrued income in accordance with accounting standards, thereby obtaining accurate data on profits, capital, non-performing loans, CAR ratio, ROE ratio…,” said Dang Khac Vy.

Finally, the leader of VIB proposed that the Government direct ministries and branches to issue regulations accepting the right of credit institutions to seize secured assets to handle and recover bad debts in cases where the security contract is legally signed, fully stipulating three contents: stipulating one of the methods of handling secured assets as the organization proceeds to seize secured assets, stipulating the right of credit institutions to seize secured assets, and stipulating the order and procedure for credit institutions to seize secured assets.

When the legitimate rights of creditors are fully protected, including the right of credit institutions to seize and handle secured assets, it will increase the access to credit for businesses and individuals, reduce borrowing costs for borrowers, ensure that good customers are not affected by customers who do not fulfill their repayment obligations and do not comply with the agreement in the credit contract and security contract, and make credit institutions more confident in increasing lending and applying suitable interest rates when the risks related to the rights of creditors are reduced.

Khang Di

“Caution Advised: VIB Chairman Đặng Khắc Vỹ Cautions Against Loosening Credit Conditions for Short-Term Growth”

“VIB’s Board Chairman, Dang Khac Vy, cautioned against pursuing credit growth at all costs by relaxing lending conditions. He emphasized the potential adverse consequences on the safety and stability of the banking sector, citing increased non-performing loans and diminished profits as key concerns.”

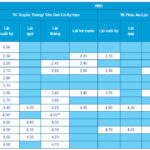

Latest ACB Bank Interest Rates for September 2024: Maximize Your Returns with Online Deposits, Offering the Highest Interest Rates for 12-Month Terms. Competitive Lending Rates at 6.76% p.a. for New Loans.

In September, ACB offered its highest interest rates on term deposits to individual customers who made online deposits of 12 months or more. The average lending rate for new loans at ACB was 6.87% per annum.