Sustainable Digital Finance Trends in Vietnam: Embracing Innovation for a Greener Future

Vietnam is witnessing a significant shift towards sustainable digital finance, as outlined in recent reports. This transition is driven by the need to optimize financial services, reduce negative environmental and social impacts, and foster a more equitable financial system. Vietnamese banks have been investing in technology and innovating digital financial services to meet market demands and international sustainable development standards.

The digital transformation trend presents countless opportunities for banks to develop and enhance their products and services.

The evolution of sustainable digital finance demands constant innovation. Banks must seek new approaches, from developing new products to optimizing operational processes and understanding customer behavioral psychology. These insights are highlighted in a recently released report for September 2024, offering specific recommendations for Vietnam’s banking and finance industry to accelerate its journey towards sustainable digital finance. The report was advised and executed by two leading experts: strategist and communications expert Nguyen Thanh Son and Dr. Nguyen Nhat Minh, a lecturer in the Business sector at RMIT University Vietnam.

Solutions for a Sustainable Digital Finance Future

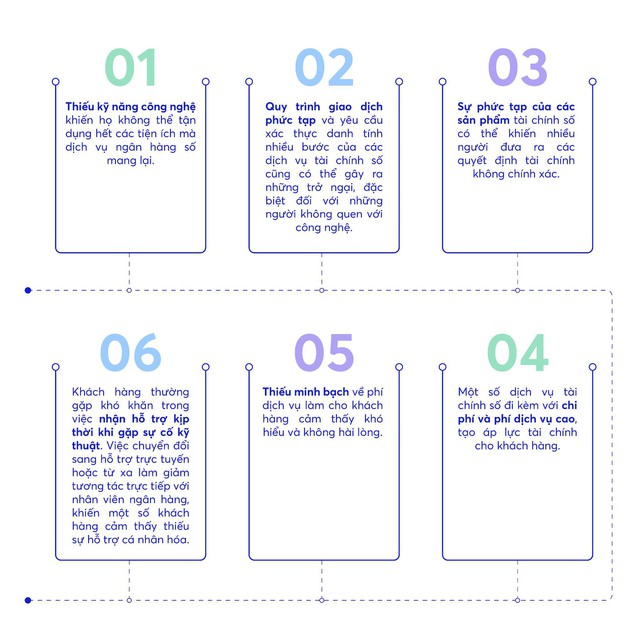

The report not only outlines the current state and trends of digital transformation but also proposes a series of concrete solutions to foster sustainable digital finance. Notable strategies include:

Investing in Information Technology Infrastructure

According to the report, building a modern and secure digital financial ecosystem is the most critical step towards sustainability. Investing in technology infrastructure, such as communication networks, data centers, and security systems, improves operational efficiency and safeguards customer data.

The adoption of advanced technologies like blockchain, artificial intelligence (AI), and machine learning is also emphasized. These technologies automate complex processes, enhance transaction speed, and provide smoother user experiences. Banks are encouraged to continue their digital transformation journey, encompassing both customer-facing services and internal processes, to stay competitive.

Encouraging Innovation and Creativity

To maintain competitiveness, the banking industry must constantly innovate and create. Investment in research and development (R&D) is vital to producing digital financial products and services that meet market demands. Additionally, fostering a creative work environment that encourages new ideas is essential.

The implementation of new technologies should be flexible to adapt quickly to market changes. Encouraging innovation not only improves services but also opens up more opportunities for sustainable development in the future.

Ensuring Security and Data Protection

In the digital age, cybersecurity and risk management are indispensable. The report emphasizes the need for banks to develop advanced security systems and comprehensive risk management processes. This safeguards customer data from cyber-attacks and ensures the safe conduct of banking operations, even in unforeseen circumstances.

Solutions to promote digital transformation and sustainable development in the banking industry – Extracted from the report “The Shift to Sustainable Digital Finance of the Banking and Finance Industry in Vietnam” published by MB.

Developing Digital Talent

Digital talent is crucial to the banking industry’s digital transformation. To succeed in sustainable digital finance, banks must invest in training and developing digital skills for their employees. The report suggests that combining training programs with practical experience and encouraging a culture of innovation will enable banks to quickly adapt to market changes. Additionally, offering technology and digital finance courses in universities will create a high-quality future workforce, ensuring long-term sustainable development.

Collaboration and Data Sharing

A critical driver of sustainable digital finance is collaboration between banks, technology companies, and other financial institutions. This enables the sharing of expertise, technology, and the development of new products and services. Building strategic alliances and seeking partnerships will enhance banks’ competitiveness in the international market.

Promoting Sustainable Development

Lastly, the report underscores the importance of developing green financial products, including green bonds and green credit. These products not only reduce environmental impacts but also contribute to the sustainable development of Vietnam’s economy. Banks should also focus on expanding digital financial services to reach a wider range of customers, especially in rural and remote areas, promoting financial inclusion and equity.

The report, “The Shift to Sustainable Digital Finance of the Banking and Finance Industry in Vietnam,” serves as a valuable reference for bank managers, policymakers, and anyone interested in the development of Vietnam’s financial sector in the digital era.

To delve deeper into sustainable digital finance, access the full report, “The Shift to Sustainable Digital Finance of the Banking and Finance Industry in Vietnam,” published by MB, at: https://bit.ly/mb-bao-cao-nganh-09-2024

The Industrial Revolution: Unveiling a Mega Factory and a District-Sized Construction Site with a $1.3 Billion Vision

The VSIP 3 Industrial Park, spanning an impressive 10 square kilometers (that’s one and a half times the size of District 1 in Ho Chi Minh City), is a burgeoning hub of economic activity. Even before its completion, the park has already attracted eight significant projects, boasting a total investment of 1.6 billion USD. The star attraction is undoubtedly the world’s largest mega-factory by the renowned LEGO Group.

Soaring for Over a Decade: Championing the Dreams of Millions in Vietnam and Beyond

Vietjet, the forward-thinking and innovative airline, is thrilled to celebrate a remarkable milestone: welcoming its 200 millionth passenger. This achievement is a testament to the airline’s incredible growth and success over the past decade, solidifying its position as a pioneer in the industry.